Why Mortgage Rates all-time lows are starting to rise?

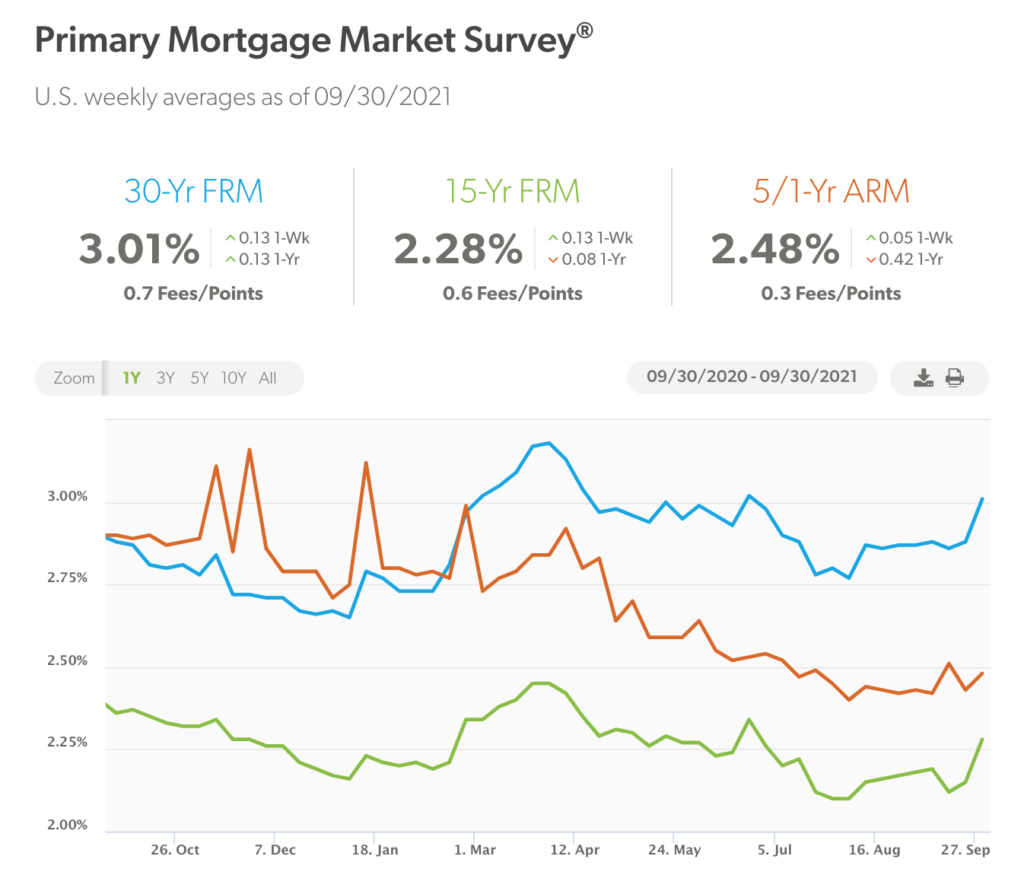

The all-time lows Mortgage rates being below 3% is starting to come to an end. According to Freddie Mac on Sept 30, 2021, Mortgage rates rose across all loans types.

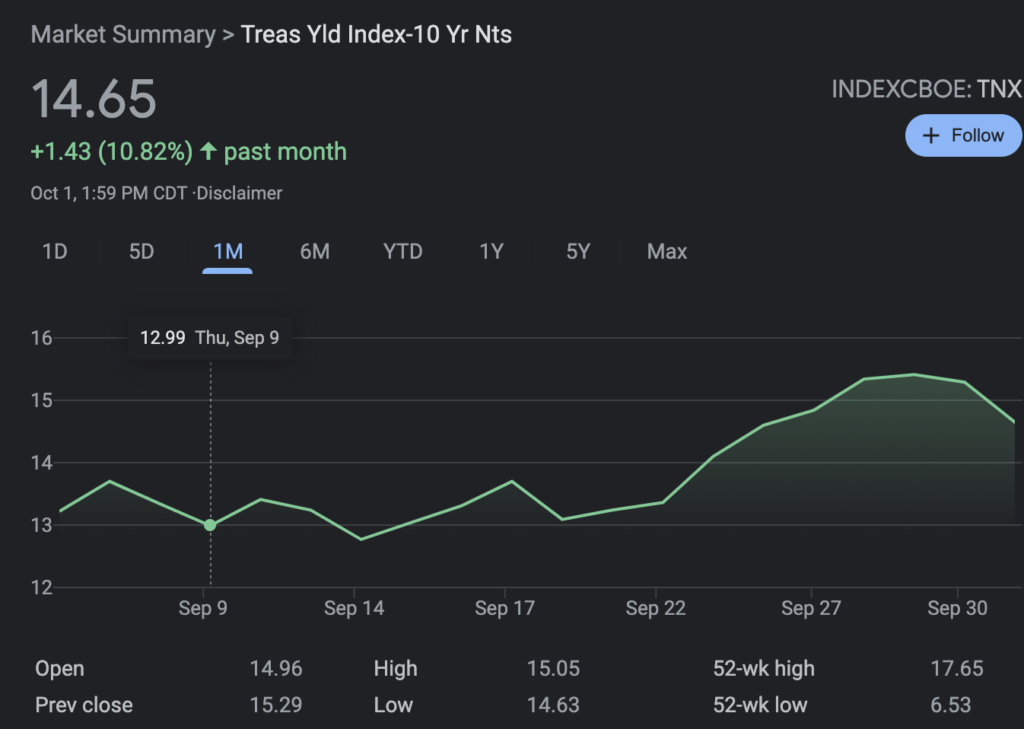

After the Federal Reserve Bank met mid September to discuss the plan to reduce buy-backs of bonds, which they’ve been doing for the large part of the pandemic to help keep borrowing costs low as emergency aid to recover the US Economy – that is starting to come to an end. As they begin tapering starting end of this year and into 2024, you’ll start to see several things happen. This is expected to be formally announced the next time the treasury bank meet.

The 10-year U.S treasury yield reaching it’s highest point since June and it triggered a few things: 1) It weakened tech stocks mid week as those saw a downturn, 2) It influenced Mortgage rates as those increased.

Mortgage rates affect home prices

Low mortgage rates allow home buyers to afford homes as you’ll pay less interest over the lifetime of the loan. The catch is that it also leads to higher home prices as it has an inverse relationship to home prices.

We’ve been in a sellers market for several years now and if you had the opportunity to buy a home during the Great Recession, with all time lows in 2012, you got the benefit of getting a home at a bargain being in a buyers market.

Now with the low rates, some homeowners are refinancing their rates during this time, as well it’s also the one thing making it good for new home buyers to get their hands on a house as the lower rates makes the monthly more affordable. That’s all soon to come to an end.

What it means for home buyers?

Mortgage rates are expected to continue to rise modestly which will likely have an impact on home prices. They’ve increase substantially over the last year from 2020-2021 as people wanted larger homes to live through the pandemic. You might see more stagnant prices with these higher mortgage rates now above 3% and increasing over time. (Reference)