REITs vs Stocks daily update – August 17, 2021

This is one of the worst investment days in the last month of investing. The US stock market declined, S&P 500 in reaction to number events, increasing delta variant, retail sales have declined, and finally the news about the Afghan government collapse, US pulling put and Taliban taking over. It’s one of those areas where even though the day before created a rise in stocks – the stock market is highly influenced by the external events in the world, not just the collection of individual companies. Why am I saying all this in an update about REITS vs Stocks, mostly because it’s had an effect on our bottom line.

Today’s update is that REITs win over Stocks – and here are the daily numbers.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

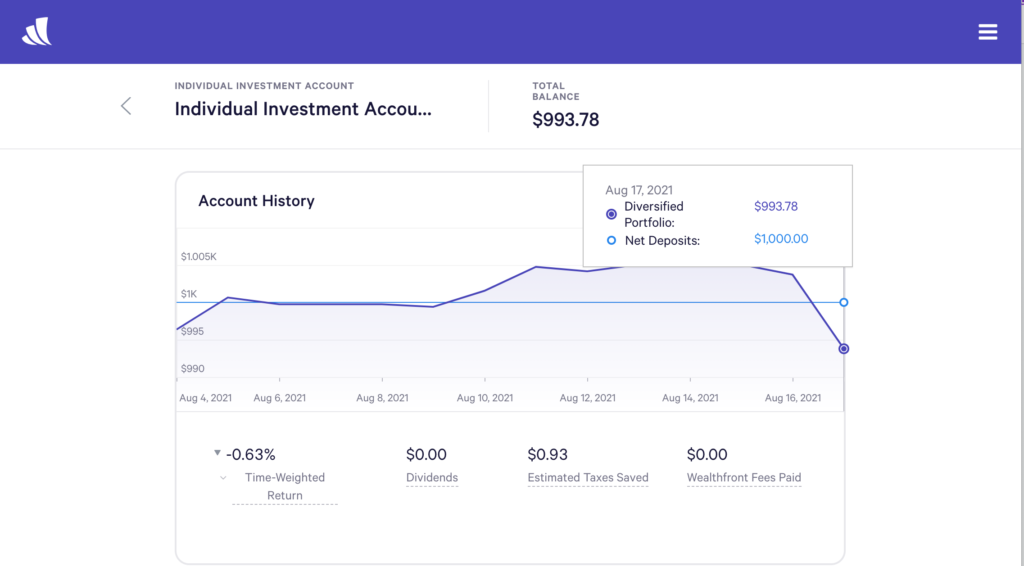

Stock Investment – Wealthfront

Today’s balance: $993.78 (Net returns to date: $6.22 loss)

Day change: $9.48 decrease since yesterday – $1,003.26

Historical info: Invested $1000 on August 2, 2021

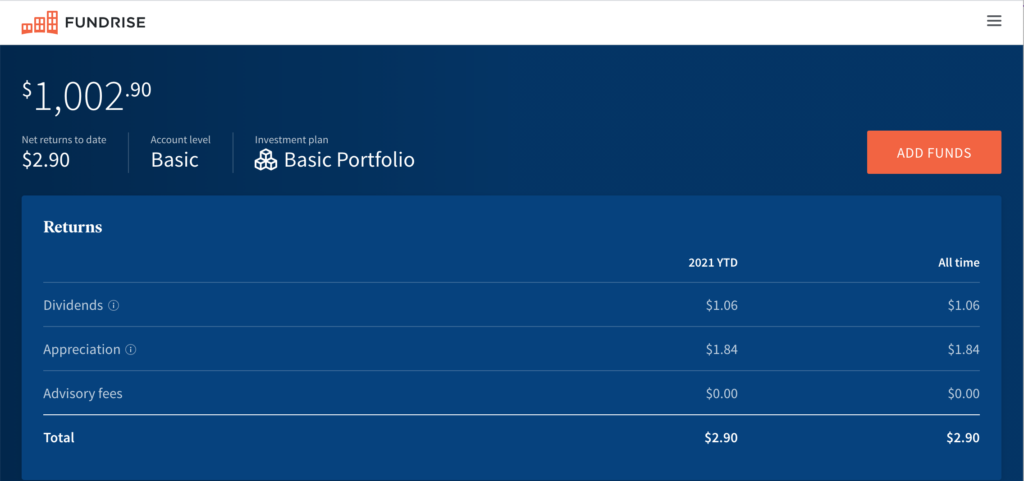

REITs – Fundrise

Today’s balance: $1002.90 (Net returns to date: $2.90 gain)

Day change: $0.09 (Small growth) since yesterday ($1002.81)

Historical info: $1000 on July 27, 2021 (initial investment)

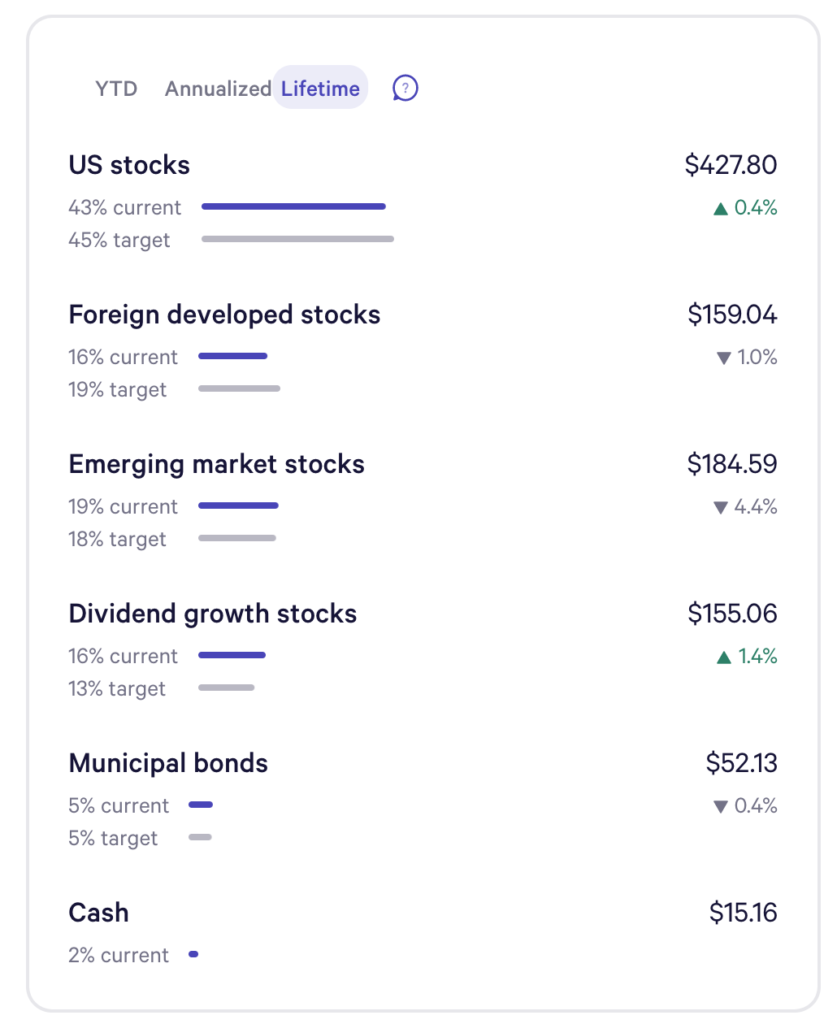

Another consistent 9 cent growth in REITS vs a huge loss in stocks bringing us under $1000, we lost $9.48 in one day bring us a net loss of $6.22. It’s been less than a month since we’ve put our 1000 in both stocks and real estates so it’s still very young. A detailed snapshot of our stocks shows huge percentage declines in some of our main assets including Foreign develop stocks and Emerging market stocks. I would say there’s a tiny increase in US stocks, but small gains not enough to balance the losses across the board. This is one of those lessons, one of those days that generally scares first time investors as people try to reclaim or sell their stock back. But since we’re in it for the long-term, we’re gonna hold and see.

Some more bolder investors would double down and put money into it. Something also good if you have extra disposable income, but only if it’s extra, not money you depend on a daily basis. Let’s wait and see what tomorrow has in store for us.