REITs vs Stocks daily update – August 18, 2021

This is the second day of hard declines for the stock market. Reports says it took a larger dip mid day, and this was in result of the Fed. The Federal Reserve met and decided that they will put the breaks on their buy backs and quantitative easing. What that means is they’ve been buying assets to easy the economy – but they’re planning on reducing this – which had a hit in the stock because much of the gains was probably due to Fed helping. How does that affect us – well…in another post about REITS vs Stocks – REITs win over Stocks – and here are the daily numbers.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

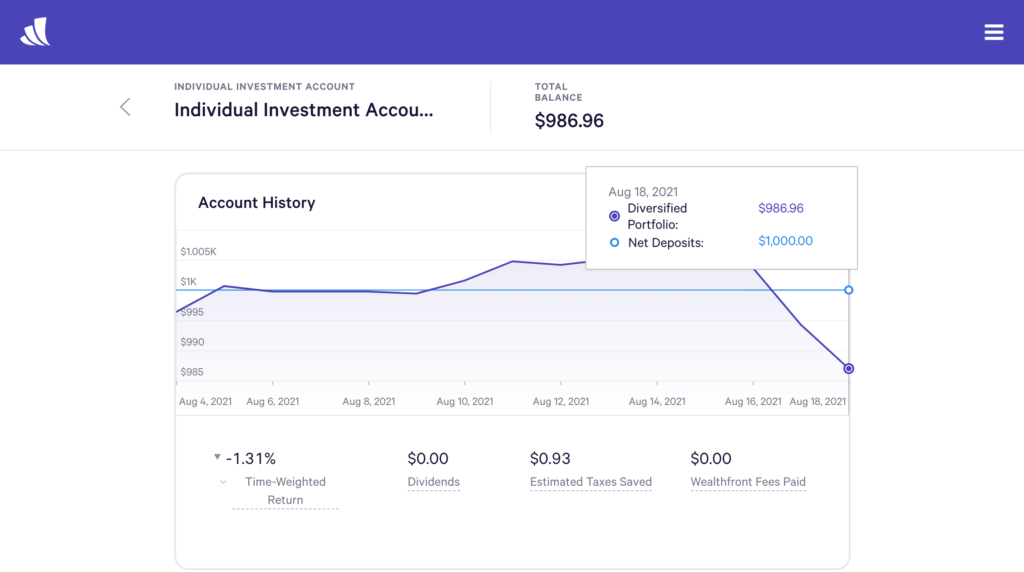

Stock Investment – Wealthfront

Today’s balance: $986.96 (Net returns to date: $13.04 loss)

Day change: $6.82 decrease since yesterday – $993.78

Historical info: Invested $1000 on August 2, 2021

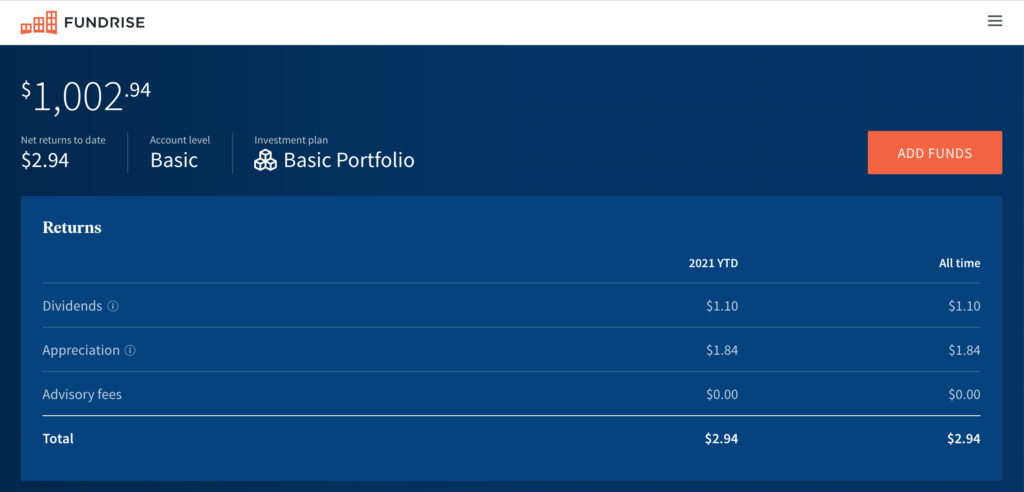

REITs – Fundrise

Today’s balance: $1002.94 (Net returns to date: $2.94 gain)

Day change: $0.04 (Small growth) since yesterday ($1002.90)

Historical info: $1000 on July 27, 2021 (initial investment)

A 4 cent growth in REITS vs a yet another huge loss in stocks, we lost $6.82 in one day bring us a net loss of $13.04. That’s well below our $1000 investment. These last few days, there’s been so many economic events from Fed easing policies, Delta Variant, and other foreign related issues that are effecting not just US stock market, but global market.

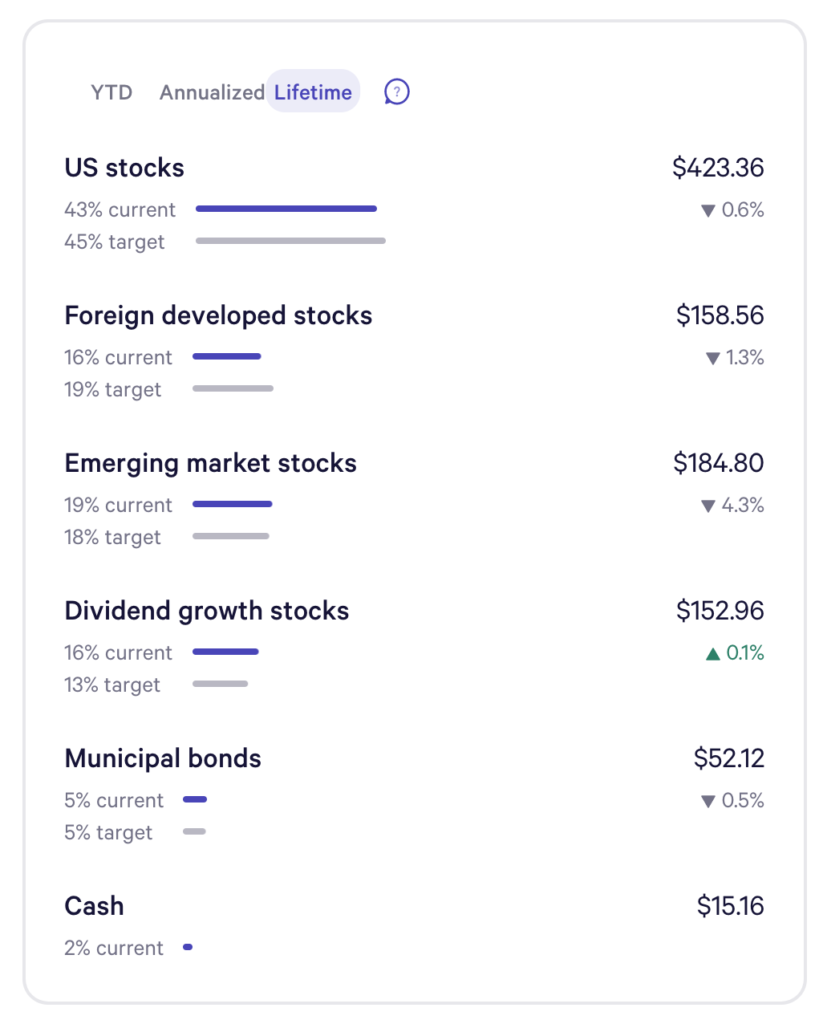

When you get huge losses like this, it’s important to take a closer look at where investments are being put and where those are showing declines.

Across the board in the screenshot below – we are seeing losses, besides dividend growth stocks. In other days, some funds pick up and some decrease, but today is probably one of the worst losses since I invested $1000 to see how it performs against Real Estate Investment Trust funds.

Few things I’m noticing in the screenshot below. First, although all funds are declining – the significant decreases come from Emerging market stocks and Foreign developed stocks. Those are down at larger percentage points. US stocks and Dividend growth stocks – really seem to be performing better.

I’m tempted in pulling my assets all into US stocks and Dividend growth stocks as I feeling is that those will always out perform the others. But that’s a hypothesis. If you were in this situation, what would you do?

Would you sell? Would you buy more? Would you shift assets around to the ones that are gaining or decreasing less? Let me know in the comments below and thanks for reading this edition of REITs vs Stocks.