There are many money management apps available that can help you track your spending, create a budget, and manage your finances. Here are some popular options and their features, pros, and cons:

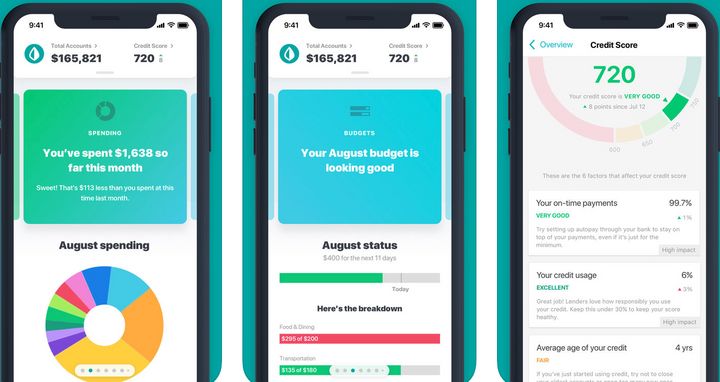

- Mint: Mint is a free app that allows you to track your spending, create a budget, and monitor your credit score. The app links to your bank accounts and credit cards to automatically categorize your transactions and give you a clear picture of where your money is going. Pros of Mint include its ease of use, automated tracking of spending, and the ability to set up alerts for unusual spending activity. Some cons include the app’s reliance on ads for revenue and occasional issues with syncing to certain financial institutions.

- Personal Capital: Personal Capital is a comprehensive financial planning tool that offers investment management, retirement planning, and budgeting tools. The app links to your accounts to track your net worth and investments, and provides personalized investment advice. Pros of Personal Capital include its comprehensive financial planning tools and investment management features. Some cons include its focus on wealth management and investment advice, which may not be useful for those just looking to manage their day-to-day finances.

- YNAB (You Need a Budget): YNAB is a budgeting app that helps you create a personalized budget and track your expenses. The app emphasizes a “zero-based” budgeting approach, where you allocate every dollar of your income to a specific category. Pros of YNAB include its emphasis on budgeting and the ability to see exactly where your money is going. Some cons include the app’s cost ($11.99/month or $84/year), and the manual entry required for transactions, which can be time-consuming.

- Acorns: Acorns is an app that rounds up your purchases to the nearest dollar and invests the spare change in a portfolio of ETFs. The app also offers a retirement account option and the ability to set up recurring investments. Pros of Acorns include its ease of use and the ability to start investing with small amounts of money. Some cons include the app’s fees ($1/month for basic service, $3/month for retirement account), and the limited investment options available.

- Robinhood: Robinhood is an investment app that offers commission-free trading of stocks, ETFs, and cryptocurrencies. The app also provides real-time market data and news updates. Pros of Robinhood include its commission-free trading and user-friendly interface. Some cons include the app’s limited investment options and the potential risks associated with investing in individual stocks and cryptocurrencies.

Overall, the best money management app for you will depend on your individual financial goals and preferences. It’s important to carefully consider the features, fees, and potential risks associated with each app before choosing one to use.

What's your reaction?

Excited

0

Happy

0

In Love

0

Not Sure

0

Silly

0