REITs vs Stocks daily update – August 25, 2021

The stock market gains yet again – Nasdaq and S&P500 hit record highs. According to multiple articles, we are seeing strong signs of economy activity and corporate profits are healthy (article).

This is great for our investment as we’ve now seen a recovery and more significant growth from our initial $1000 stock investment in Wealthfront. For this edition of REITS vs Stocks as of August 25, 2021 – Stocks win over REITs. See more info below…

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

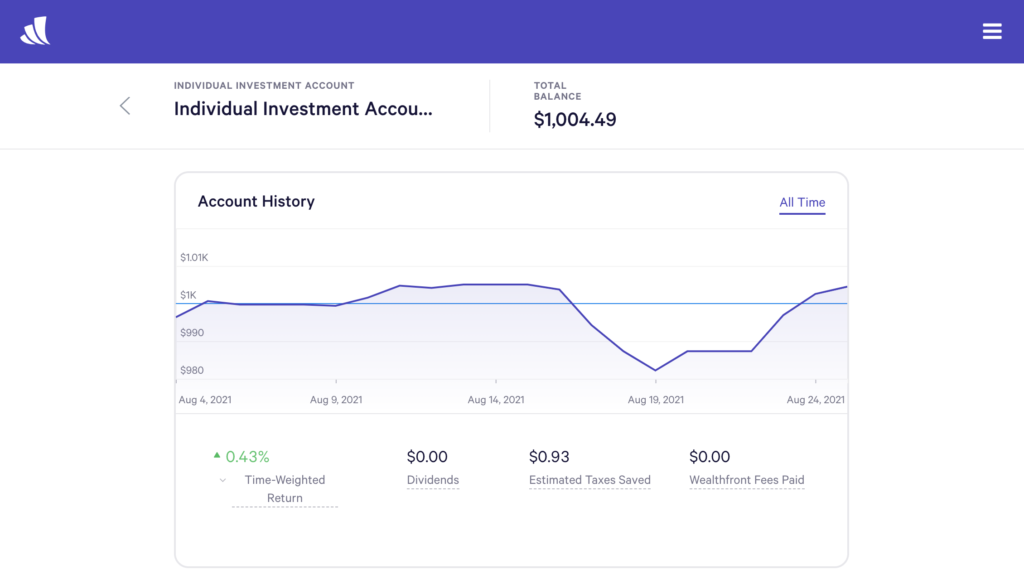

Stock Investment – Wealthfront

Today’s balance: $1,004.49 (Net returns to date: $4.49 gains)

Day change: $2.01 increase since yesterday – $1,002.48. This was the 3rd strong day for the stock market, although yesterday had higher gains.

Historical info: Invested $1000 on August 2, 2021

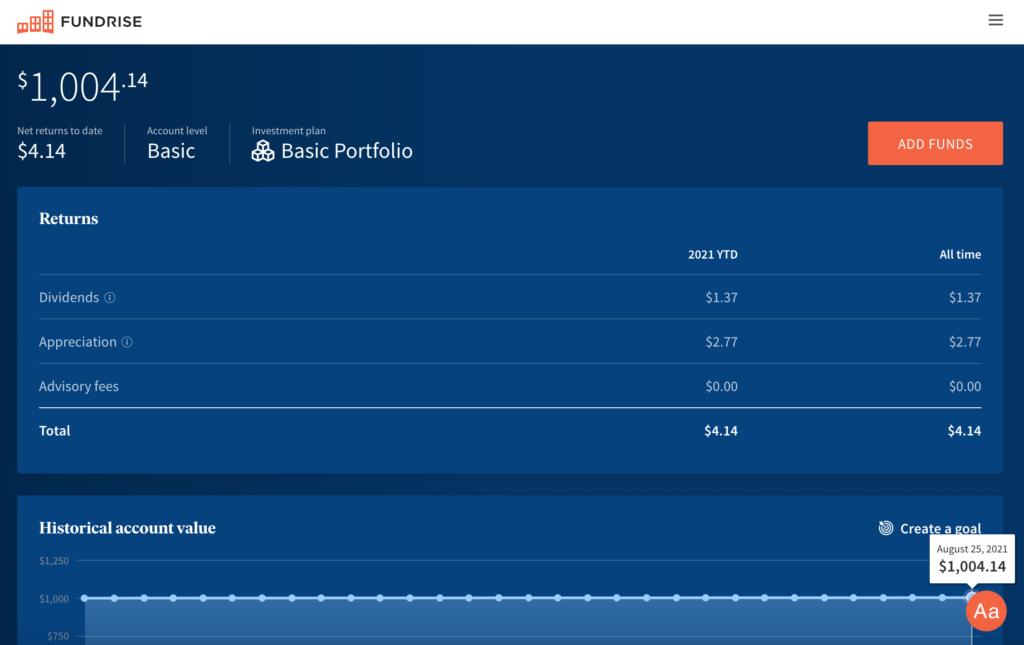

REITs – Fundrise

Today’s balance: $1004.14 (Net returns to date: $4.14 gain)

Day change: $0.00 (No growth today) since yesterday ($1004.14)

Historical info: $1000 on July 27, 2021 (initial investment)

Stocks increased $2.01 since yesterday, while REITs had no growth. But with the stock market gains, our Wealthfront Stock is just a tad bit higher, $1004.49 vs $1004.14

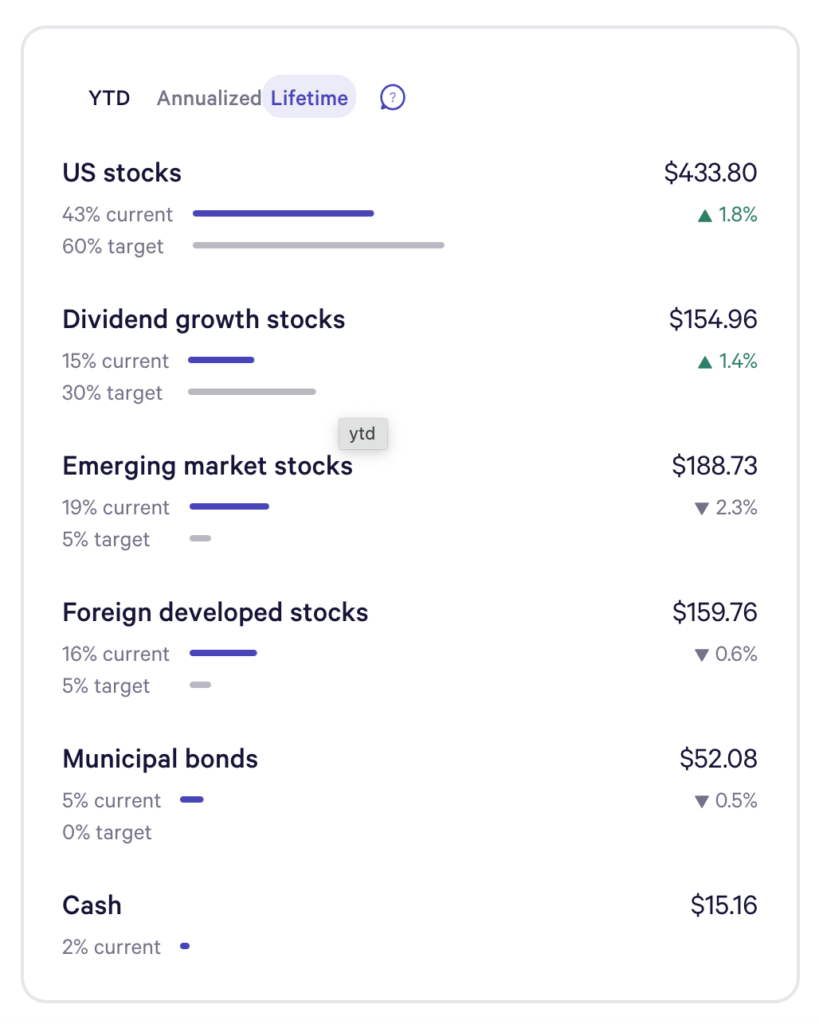

Another snapshot below of our specific Wealthfront funds – US stocks and Dividend growth are high performers with 1.8% daily increase for US stocks.

I’m concerned about Emerging market stocks as it keeps declining at 2.3%. We have adjusted its current allocation of 19% of my $1000 to 5%, but this change hasn’t been in affect yet.