REITs vs Stocks daily update – Oct 1, 2021

Stock market begins the month of October fairly positive, recovering a bit from the worst month of the year, September which had closed in the red, a 4.8% monthly decline. The increase in October could be from a few reasons. A company, MERCK has developed an antiviral pill that has proved effective against COVID (article). This is said to bring confidence in the market due to the economic outlook of the world reopening. People are expecting the US economy to fully reopen in coming months and interest rates to increase as a result of that (article).

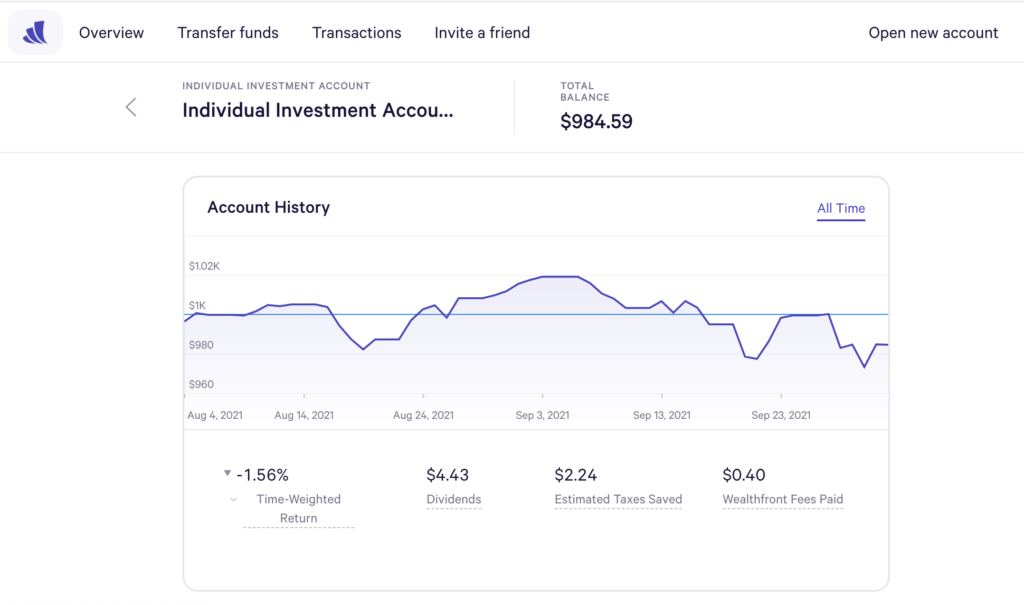

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks are still below our initial investment of 1000, currently at $984.59. This is up from yesterday, but still far below REITs.

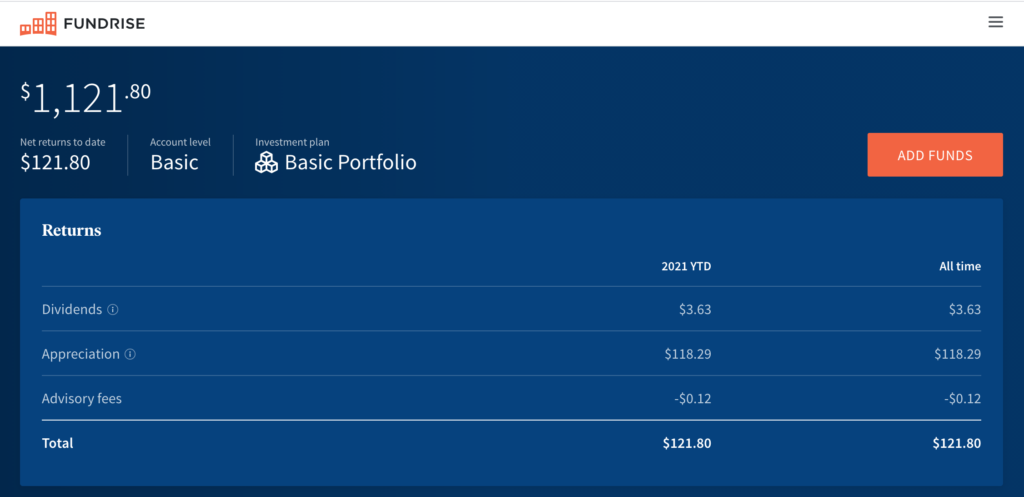

REITs win over Stocks, there was a huge daily growth today of $113.77. The running total balance of REITs is $1,121.80, which is a a substantial gap over stock market. This is significantly higher than the usual increase by a few cents. The large growth is due to appreciation of property in these real estate investments.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $984.59 (Net returns to date: $15.41 losses)

Day change: $11.50 increase since yesterday (Sept 30, 2021) – $973.09

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,121.80 (Net returns to date: $121.80 gain)

Day change: $113.77 increase for REITs since yesterday (Sept 30, 2021) – $1008.03

Historical info: $1000 on July 27, 2021 (initial investment)

Below is a snapshot of net returns for Fundrise REITs. Although we’ve seen small increases daily by a few cents, today we saw a large jump in appreciate returns. Still unclear why it jumped today, but so far, we haven’t seen any declines in our Real Estate Trust Investments. The one thing about Fundrise is the reporting tool doesn’t provide as much detail on how and why these funds are influenced that I can see. More to come on reporting on REITs.

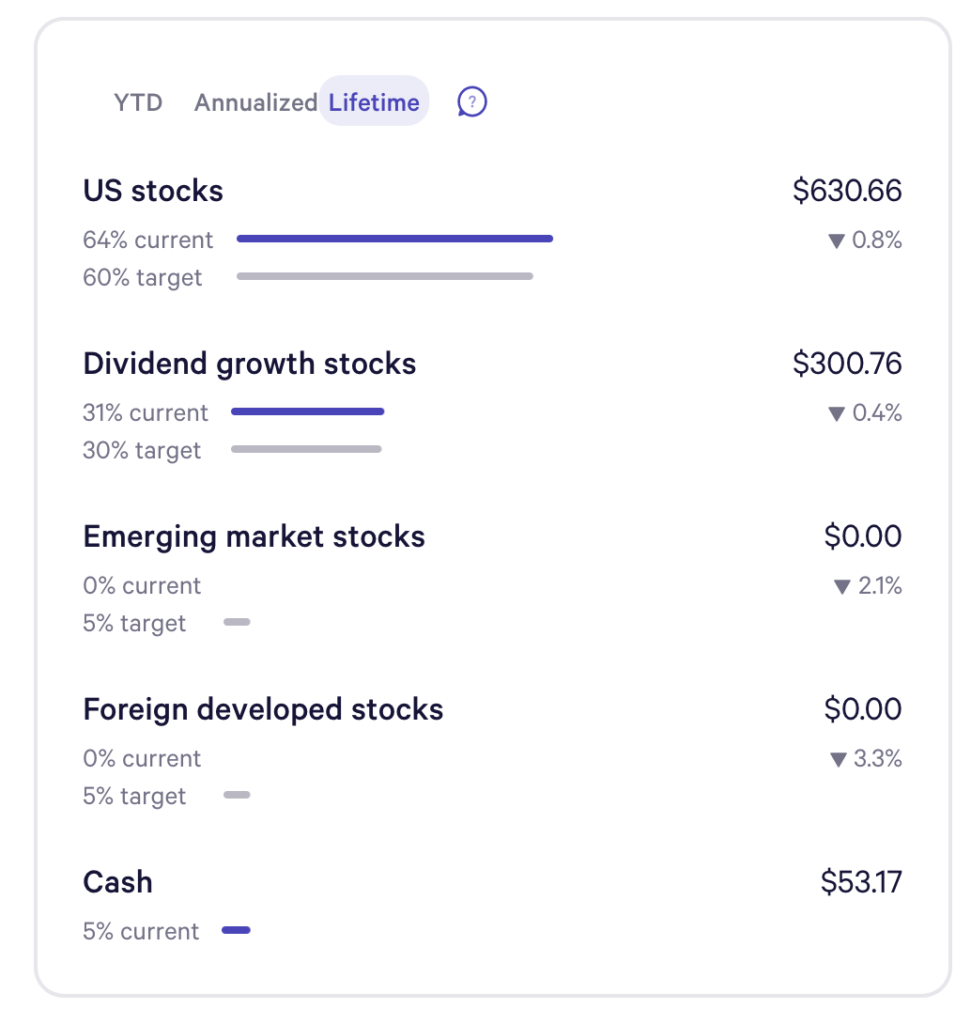

Wealthfront Funds snapshot:

Our lifetime earnings are still in the negative for Wealthfront stocks with Foreign developed stock as poorest performer. Overall, our stock funds trail way behind REITs. It’s definitely more stable at the moment due to the uncertainty in the economic climate and the stock market.