REITs vs Stocks daily update – Oct 11, 2021

The US stock market fell this Monday, the start of the new week with continued worries on the Economy, not so great 3rd quarter results, and rising oil prices (article). Despite today’s loss, October is still higher than Septembers 4.8% losses.

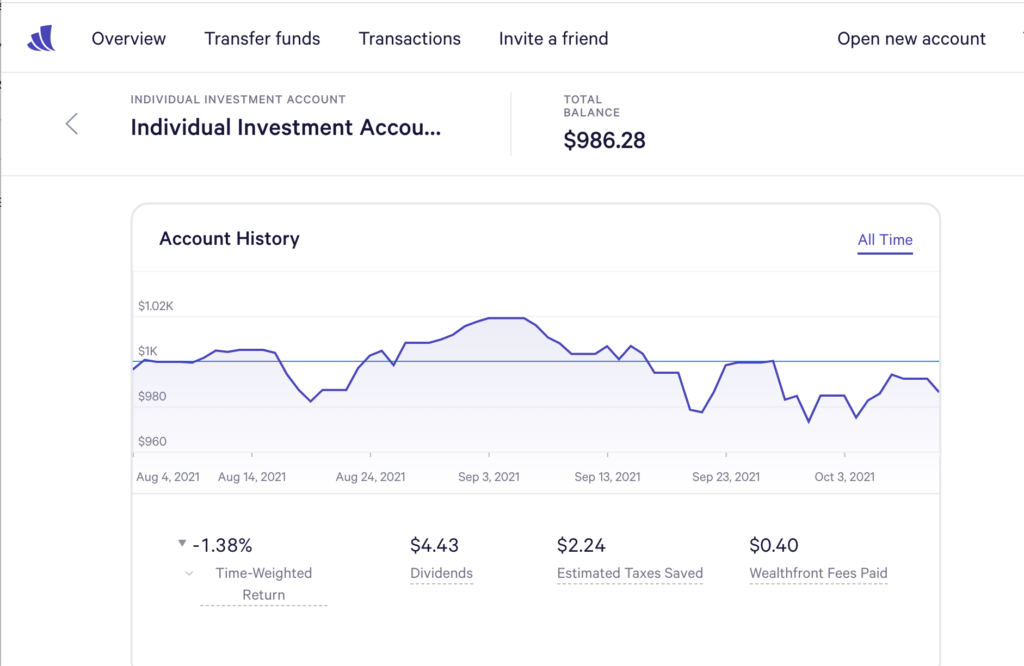

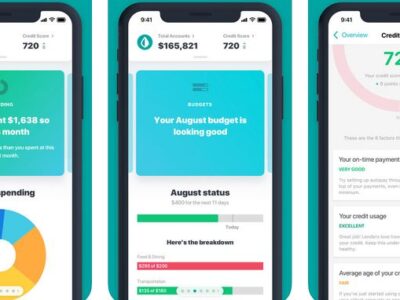

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks dropped a bit today and continues to be below our initial investment of 1000, currently at $986.28.

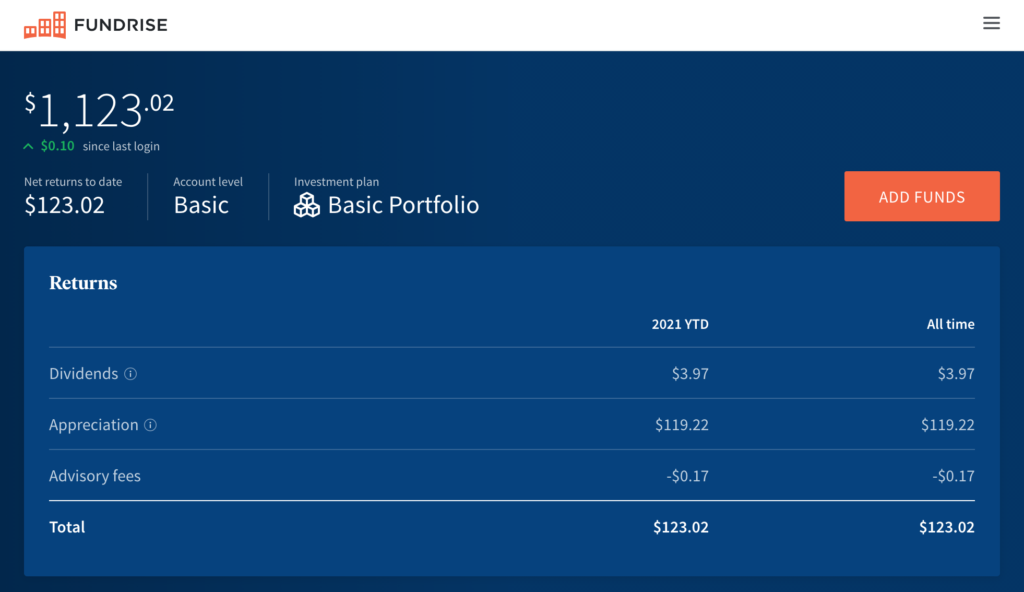

Today’s outcome is REITs win over Stocks today, with a small 10 cent growth in Fundrise compared to a daily decrease of $5.78 from Wealthfront. Still, the running total balance of REITs is $1,123.02, which is a a substantial gap over stock market, $986.28.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $986.28 (Net returns to date: $13.72 losses)

Day change: $5.78 decrease since last week (Oct 8, 2021) – $992.06

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,123.02 (Net returns to date: $123.02 gain)

Day change: $0.10 increase (10 cent growth for REITs) since last week (Oct 11, 2021) – $1,122.92

Historical info: $1000 on July 27, 2021 (initial investment)

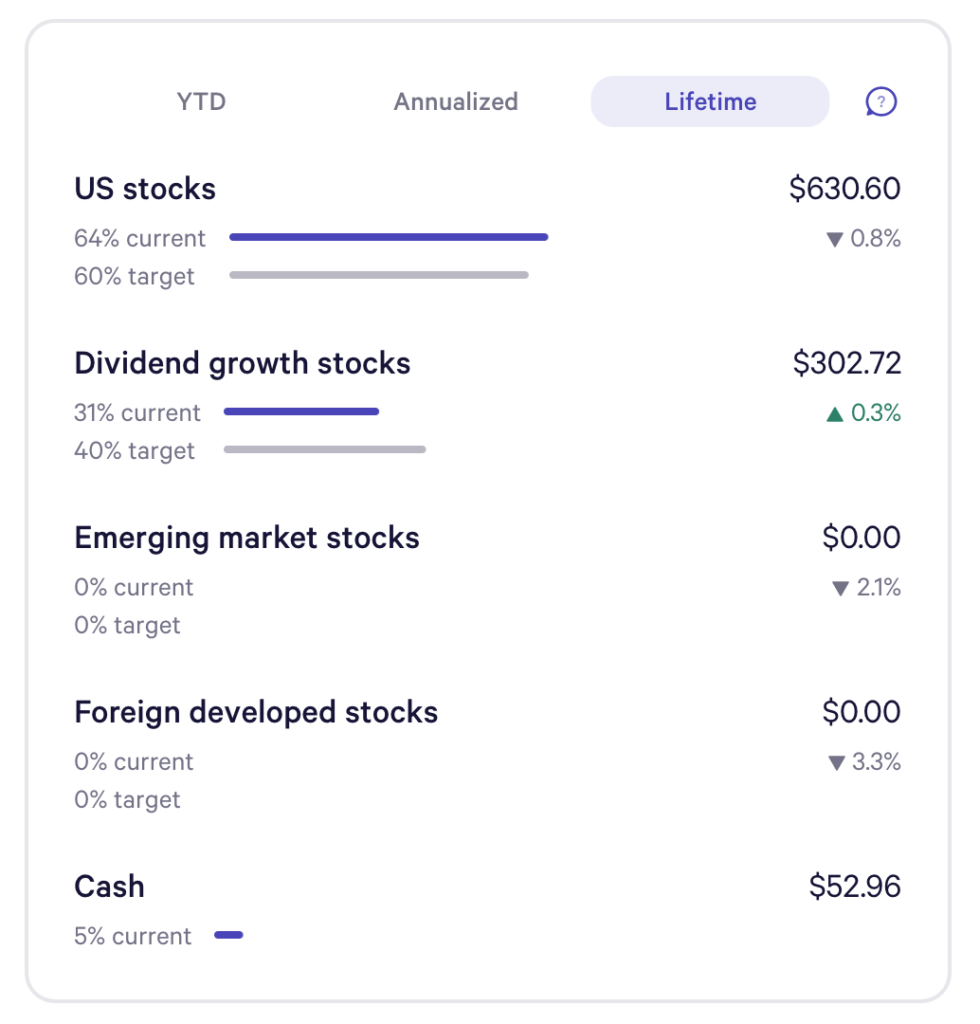

Wealthfront Funds snapshot:

Lifetime earnings are still slightly negative growth for Wealthfront stocks for US stocks. Dividend growth stocks seems to be positive at 0.3%. Foreign developed stock as poorest performer at 3.3%.