REITs vs Stocks daily update – Oct 13, 2021

Today, Fed Chair Jerome Powell mentioned the central bank was likely to announce the reduction of its bond buying at its November meeting. Beginning in December and finish during mid-2022. Overall, the stock market was up today across all 3 indexes (article).

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks dropped a bit more today and continues to be below our initial investment of 1000, currently at $984.34.

Today’s outcome is Stocks win over REITs, a negative growth of 1 cent in Fundrise compared to a daily decrease of $3.36 from Wealthfront. Still, the running total balance of REITs is $1,123.08, which is a a substantial gap over stock market, $987.30.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

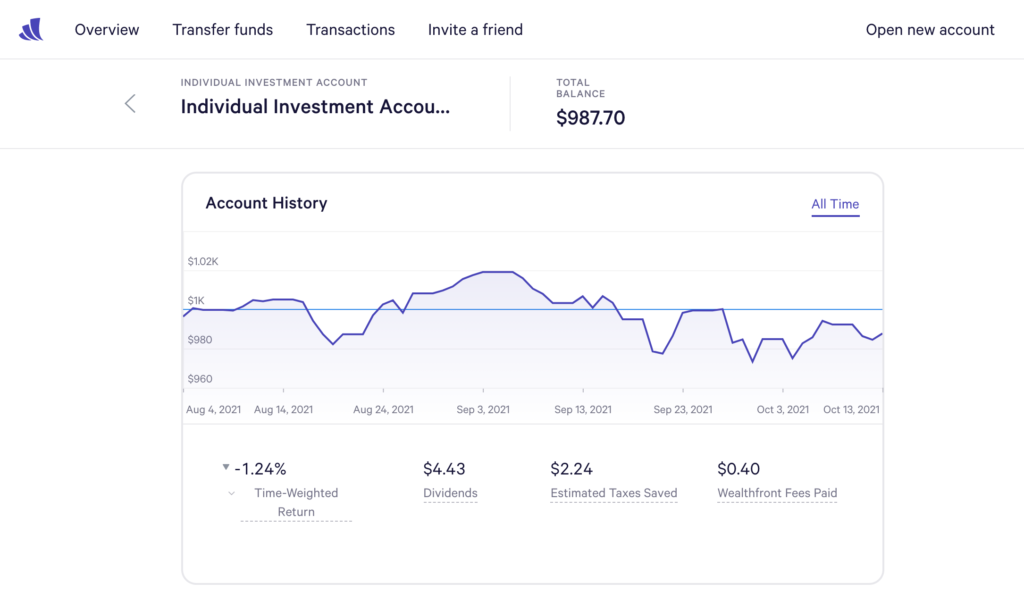

Stock Investment – Wealthfront

Today’s balance: $987.70 (Net returns to date: $12.30 losses)

Day change: $3.36 increase since yesterday (Oct 11, 2021) – $984.34

Historical info: Invested $1000 on August 2, 2021

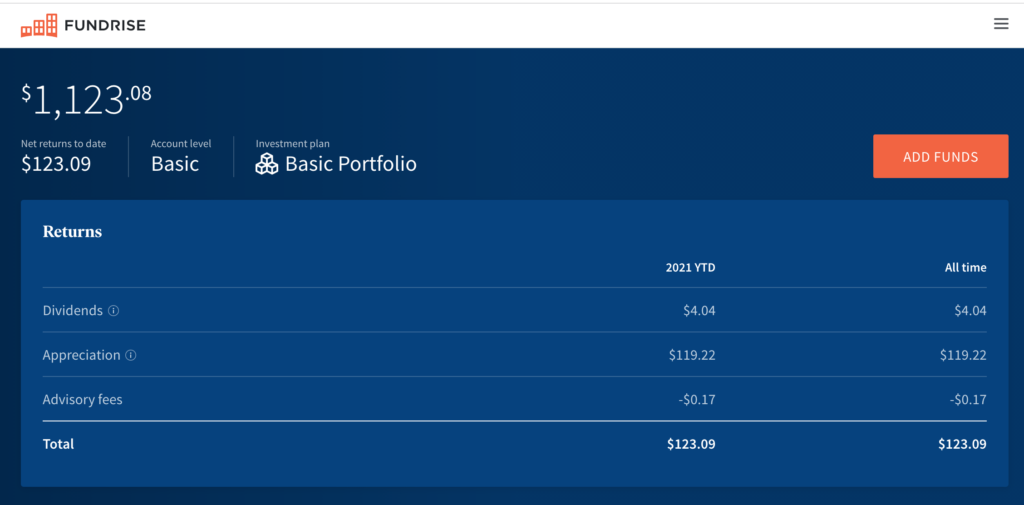

REITs – Fundrise

Today’s balance: $1,123.09 (Net returns to date: $123.08 gain)

Day change: $0.01 decrease (1 cent decline for REITs) since last yesterday (Oct 11, 2021) – $1,123.02

Historical info: $1000 on July 27, 2021 (initial investment)

I’ve actually never seen decline in REITs yet and this might be the first one. Although I’m not sure if its an error or discrepancy as net returns still show 123.09. That’s a flaw in

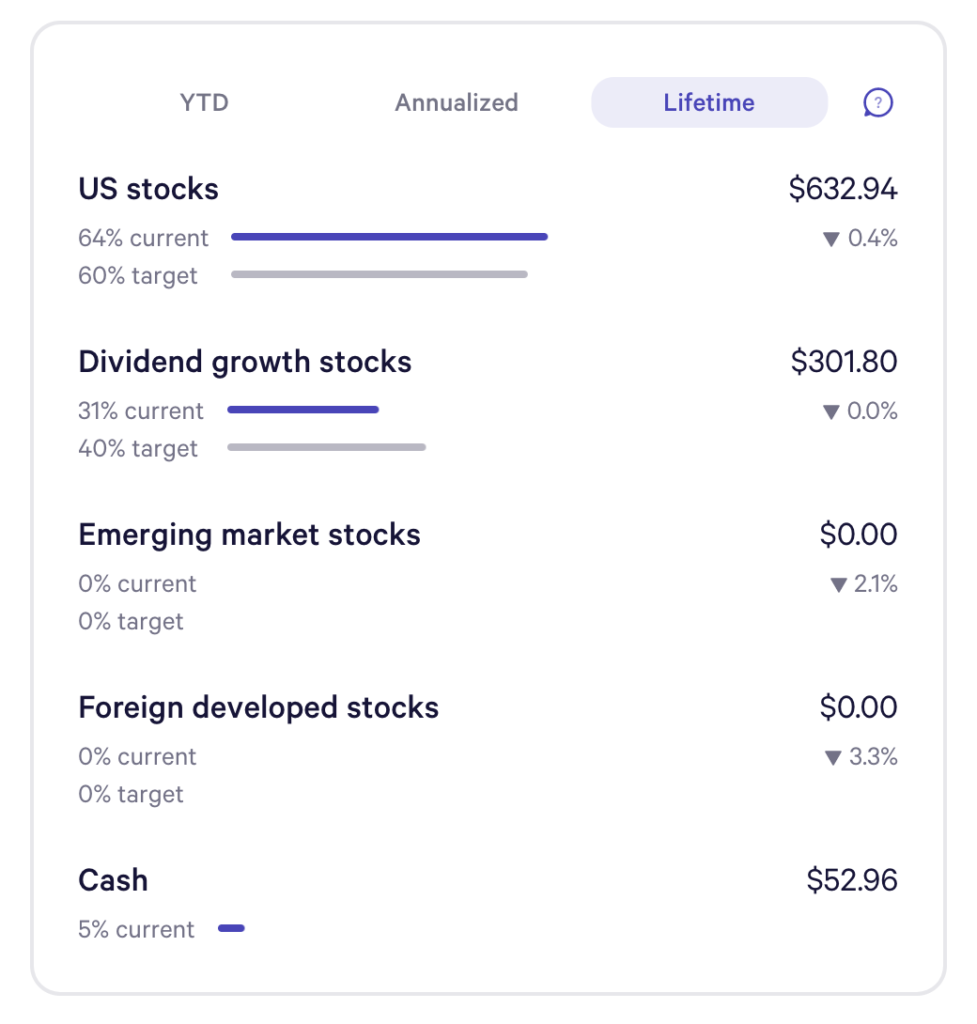

Wealthfront Funds snapshot:

Lifetime earnings are still negative growth for Wealthfront stocks for US stocks @ 0.4%. Dividend growth remains at 0%, while Foreign developed stock as poorest performer at 3.3%.