REITs vs Stocks daily update – Oct 4, 2021

The stock market opens the week with another dip. Nasdaq falls 2% while S&P 500 falls by 1%. The biggest fall is Tech, where all tech stocks have seen more than 2.5% drop with Facebook leading more than 5% of losses due to the whistleblower and the services being down due to an unknown server error (article). The economy is still concerned the national debt ceiling limit that still hasn’t been resolved.

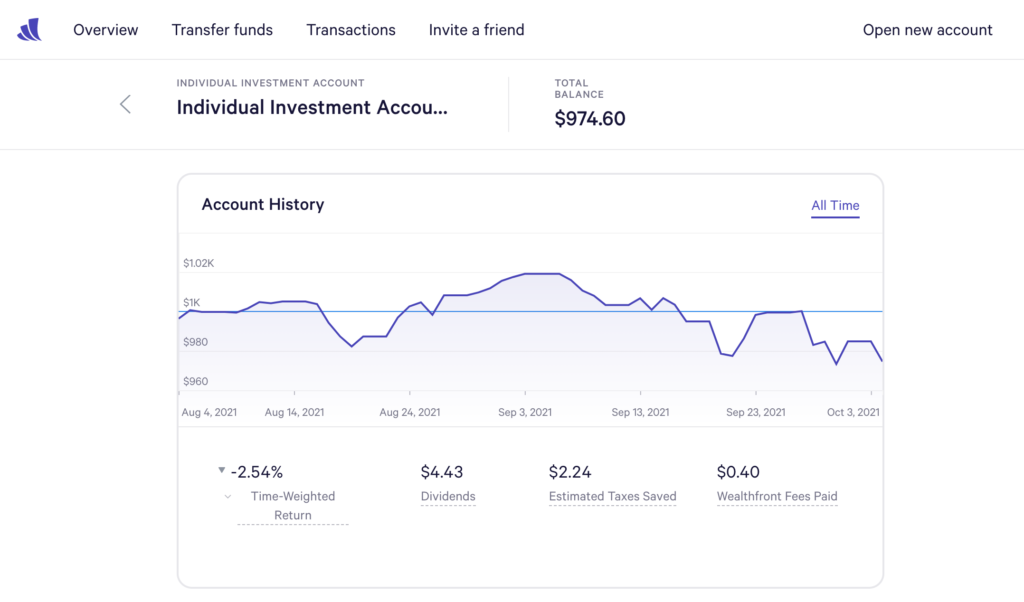

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks are still below our initial investment of 1000, currently at $974.60. This is down from Friday of last week, and now still far below REITs.

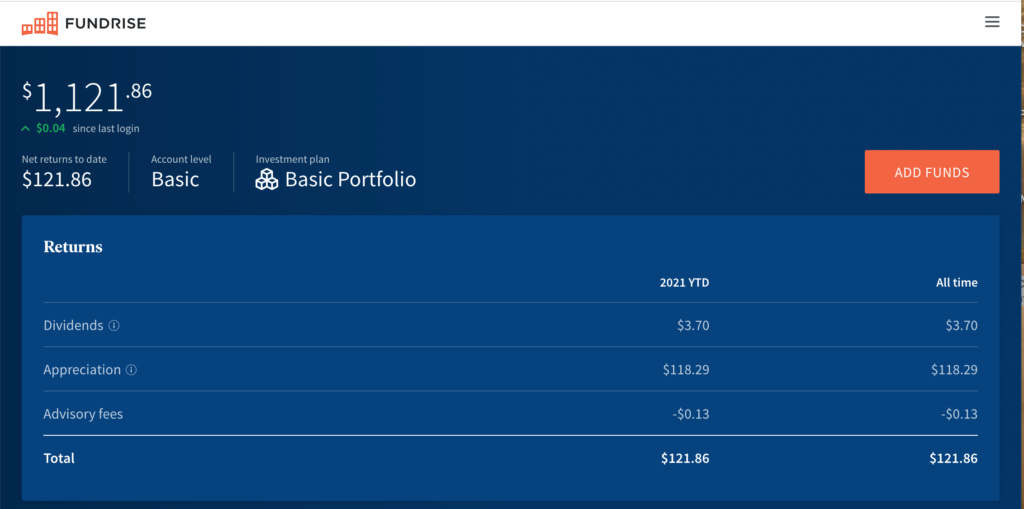

REITs win over Stocks, there was small growth of 6 cents, but the running total balance of REITs is $1,121.86, which is a a substantial gap over stock market, $974.60. Earlier last week, there was a large growth is due to appreciation of property in these real estate investments.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $974.60 (Net returns to date: $25.40 losses)

Day change: $9.99 decrease since last week (Oct 1, 2021) – $984.59

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,121.86 (Net returns to date: $121.86 gain)

Day change: $0.06 (6 cent increase for REITs) since last week (Oct 1, 2021) – $1,121.80

Historical info: $1000 on July 27, 2021 (initial investment)

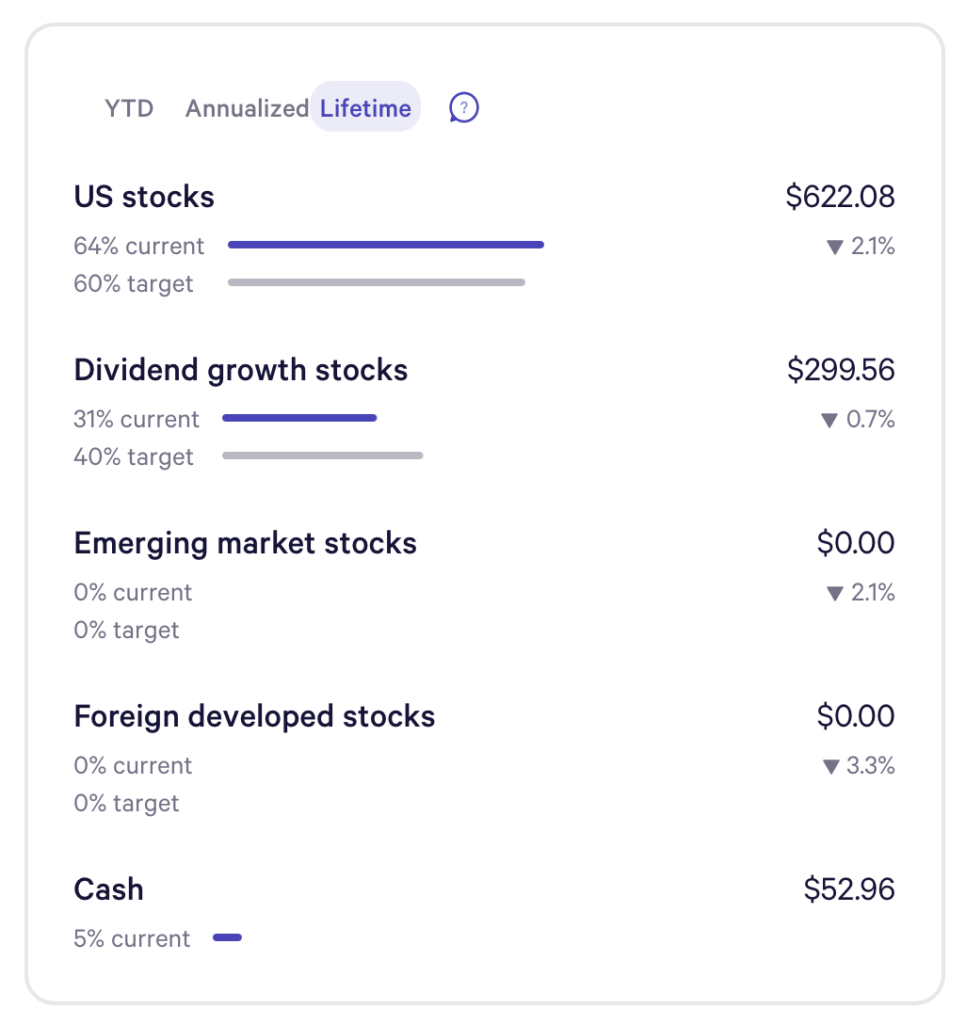

Wealthfront Funds snapshot:

Our lifetime earnings are still in the negative for Wealthfront stocks with Foreign developed stock as poorest performer. US stocks going even lower down 2.1%.