REITs vs Stocks daily update – Oct 6, 2021

The stock market was positive today with all three indexes pushing higher in the afternoon. There’s worry that the market is very volatile as many people following the conversations in Washington about the debate on the debt ceiling (article).

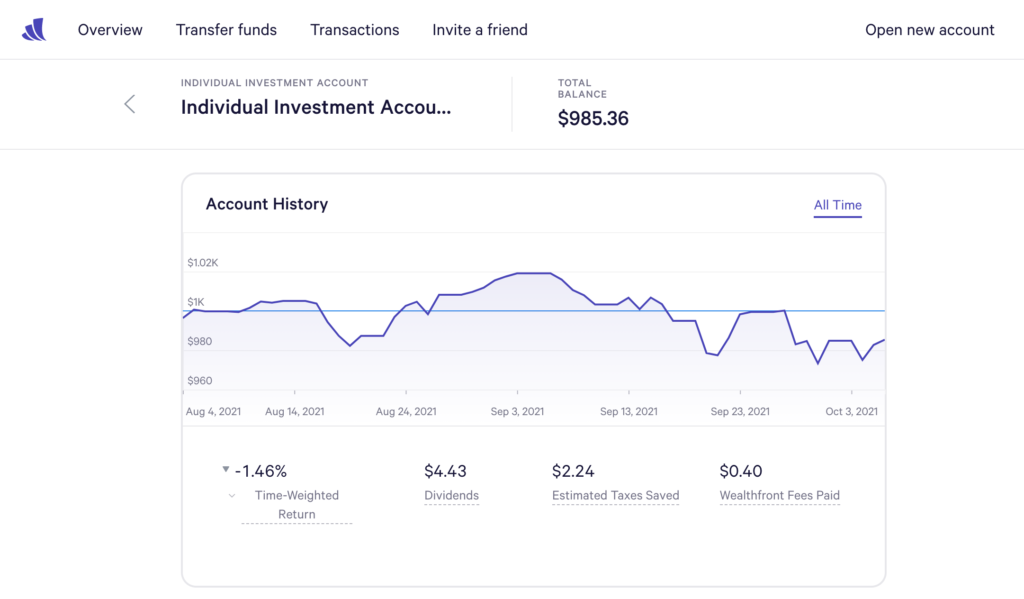

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks are still below our initial investment of 1000, currently at $985.36. Although it improved a few dollars from yesterday, it’s still down from the bad month in September.

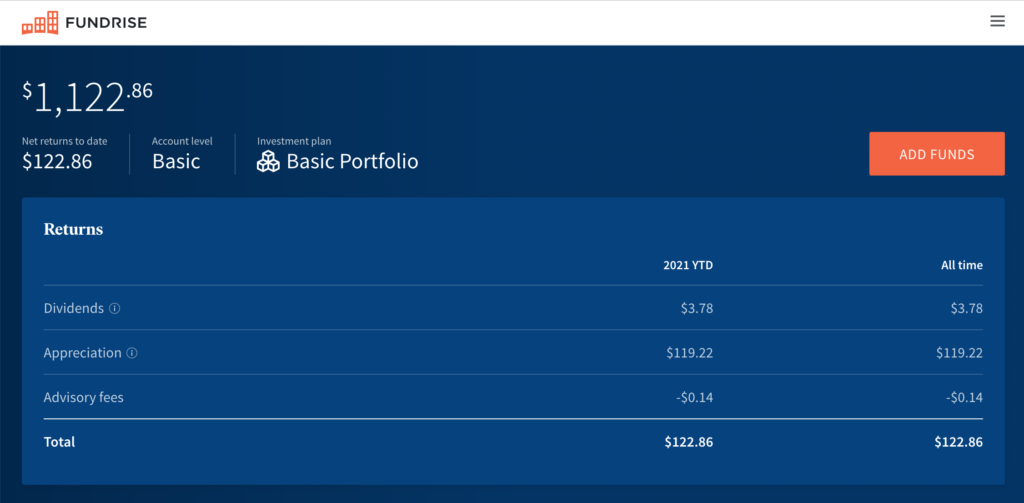

Today’s outcome is Stocks have it over REITs today, with no growth in Fundrise, but a 2.60 increase The running total balance of REITs is $1,122.86, which is a a substantial gap over stock market, $985.36. September and October losses really hit a toll on our stock investments.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $985.36 (Net returns to date: $14.64 losses)

Day change: $2.60 increase since yesterday (Oct 5, 2021) – $982.76

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,122.86 (Net returns to date: $122.86 gain)

Day change: No increase for REITs since yesterday (Oct 5, 2021) – $1,121.86

Historical info: $1000 on July 27, 2021 (initial investment)

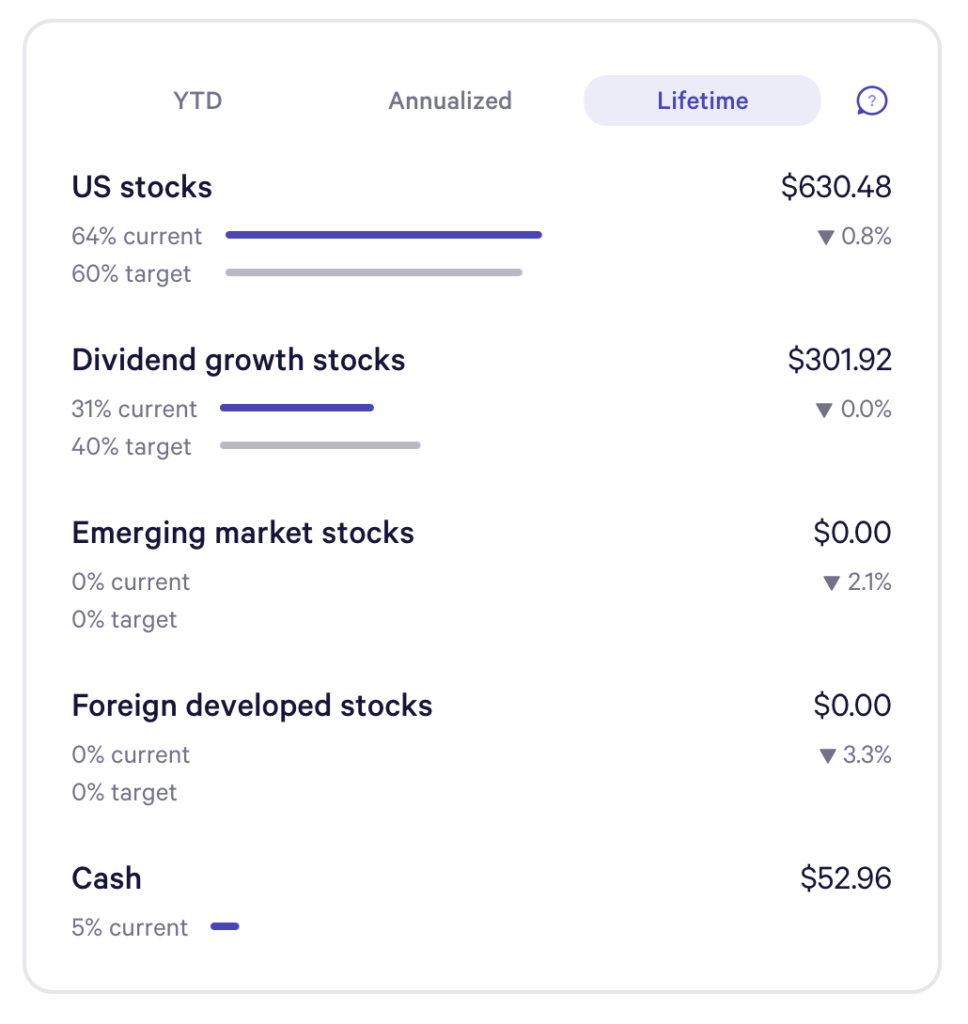

Wealthfront Funds snapshot:

Unfortunately, lifetime earnings are still in the negative for Wealthfront stocks with Foreign developed stock as poorest performer at 3.3%. US stocks inch in a better direction, going from 1.2% to now 0.8%. Luckily 64% of our funds are in US stocks.