REITs vs Stocks daily update – Oct 7, 2021

The stock market was positive today, ended higher due to the Debt Limit extension that has caused much worry across the nation about government shutdown and its overall effect on the economy (article). The original concern was the government would default by middle of this month, which was Oct 18, but the extension has been pushed to December. This is good as it brought confidence for today, but one can expect the market to be volatile til end of year. Why? Because since this is only a temporary patch, we’re really waiting for the final resolution of what Congress and Senate will do about the debt ceiling that’s more than a temporary solution of a month. Secondly, the next macro event that we know of which will influence the market is the November Federal Reserve meeting to continue the discussion of interest rate increases (article).

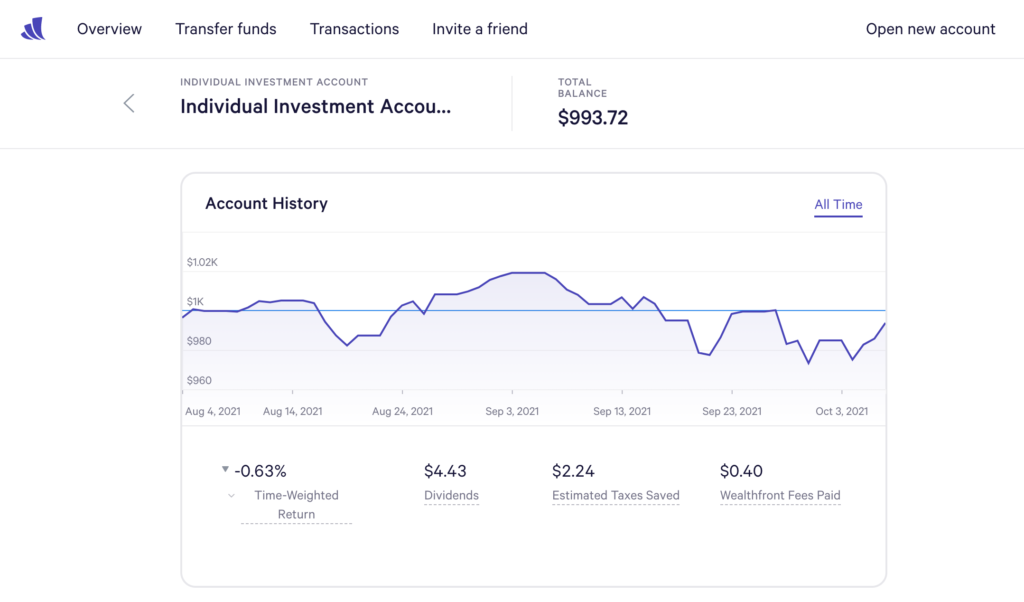

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks are starting to recover, but still below our initial investment of 1000, currently at $993.72. Although it improved a few dollars from yesterday, it’s still down from the bad month in September.

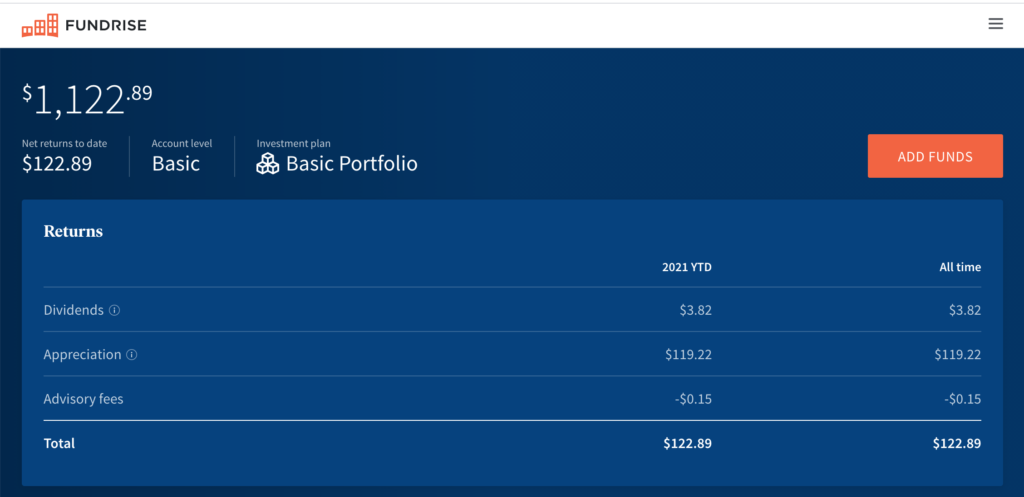

Today’s outcome is Stocks have it over REITs today, with a small 3 cent growth in Fundrise, but a 8.36 increase. That said, the running total balance of REITs is $1,122.89, which is a a substantial gap over stock market, $993.72.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $993.72 (Net returns to date: $6.28 losses)

Day change: $8.36 increase since yesterday (Oct 6, 2021) – $985.36

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,122.89 (Net returns to date: $122.89 gain)

Day change: $0.03 increase (3 cent growth for REITs) since yesterday (Oct 6, 2021) – $1,121.86

Historical info: $1000 on July 27, 2021 (initial investment)

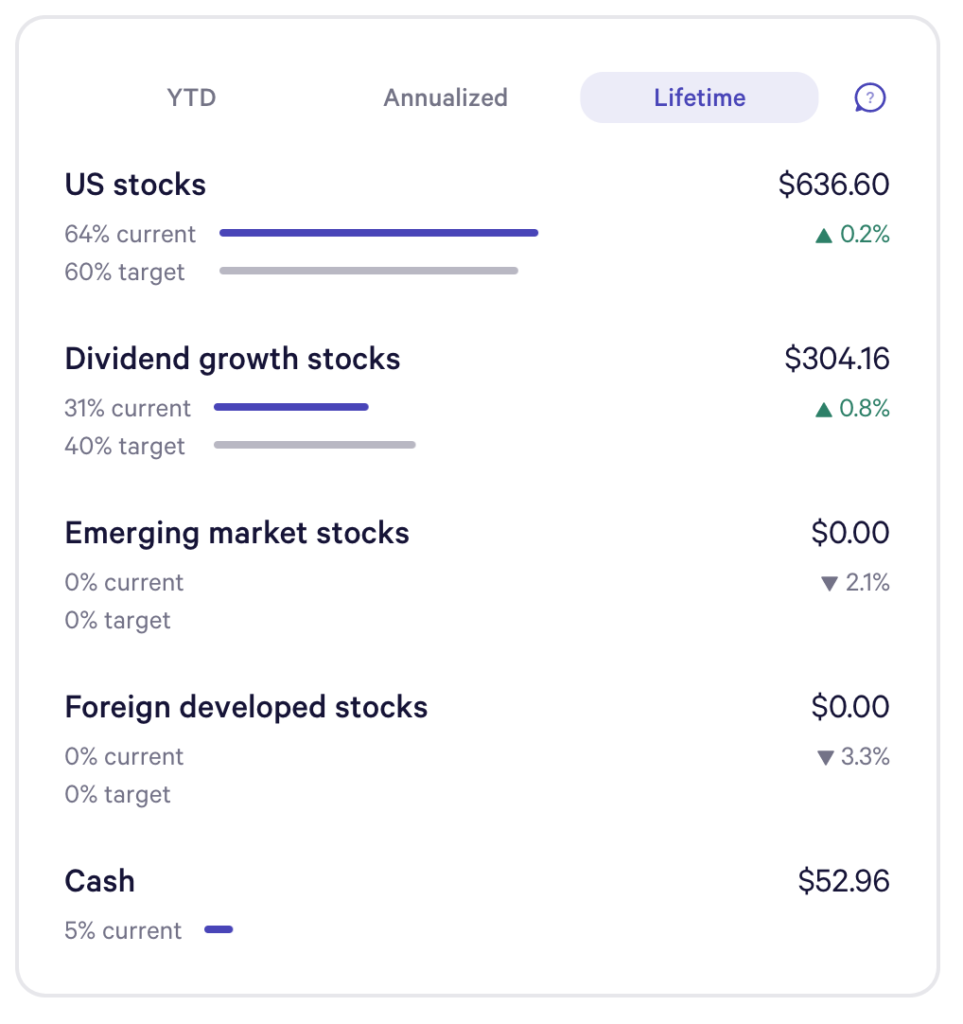

Wealthfront Funds snapshot:

Unfortunately, lifetime earnings are showing signs of improvement, pulling out of negative growth for Wealthfront stocks for US stocks and Dividend growth stocks. Foreign developed stock as poorest performer at 3.3%. US stocks inch in a better direction, going from 0.8% decline to now 0.2%. increase.