REITs vs Stocks daily update – September 10, 2021

The stock market closed the week with another day of losses, a fifth straight day of losses. Analyst worry about economic uncertainly, both in reaction to the job report from August delivered last Friday. The same concerns and themes loom from COVID increases and Federal Reserve talking about taking away the quantitate easing and buy back polices that are currently in place. (article).

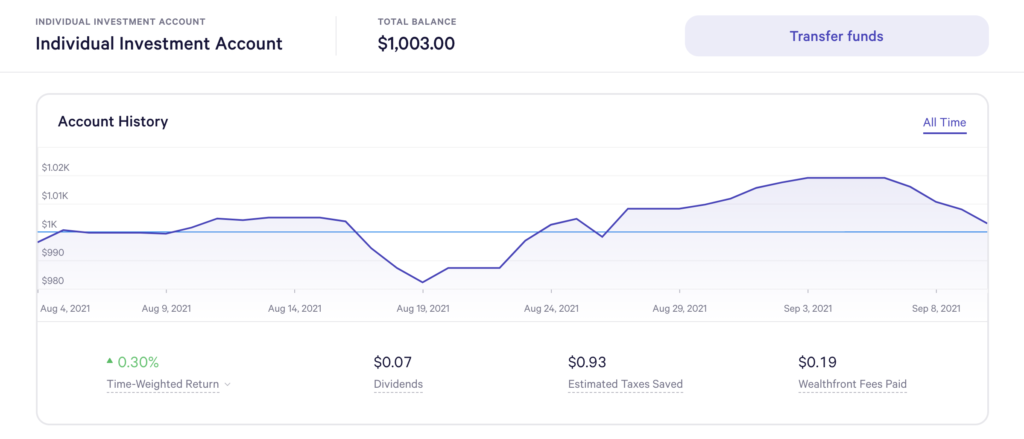

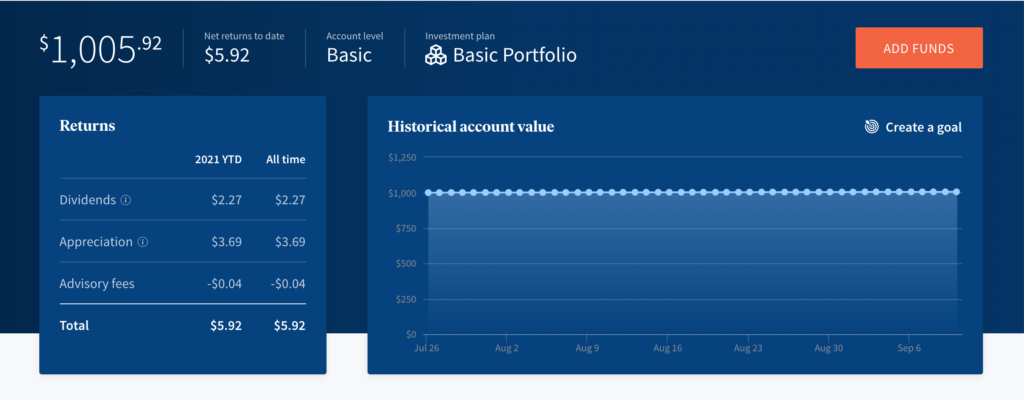

How this affects our $1000 investment in Wealthfront –today’s loss at $4.66, while REITs had a small growth of 6 cents. Fortunately, we’re still above our $1000 dollar investment from early August at $1,003.00. REITs win over stocks – both today and in total as Wealthfront is now $1003.00 vs Fundrise at $1005.92.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $1,003.00 (Net returns to date: $3.00 gains)

Day change: $4.66 decrease since yesterday – $1,007.66

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1005.92 (Net returns to date: $5.92 gain)

Day change: $0.06 (small 6 cent growth for REITs yet) since yesterday – $1005.86

Historical info: $1000 on July 27, 2021 (initial investment)

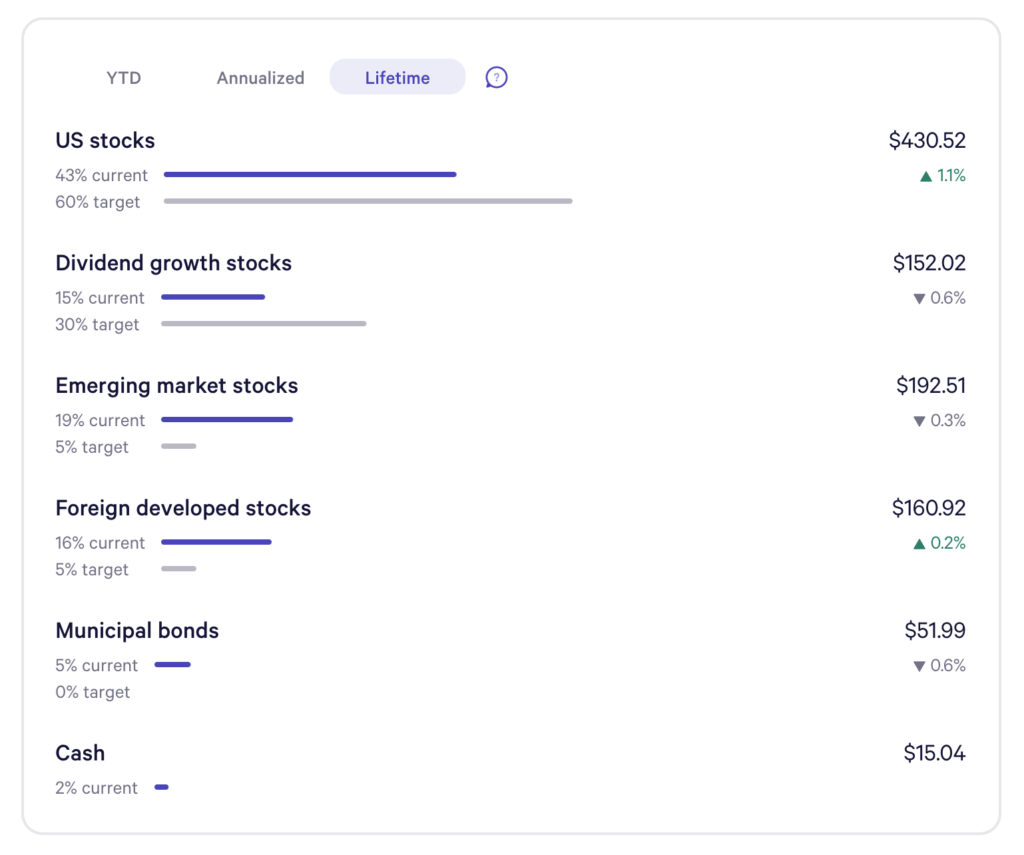

Wealthfront Funds snapshot:

US stocks positive lifetime growth is dwindling yet again as it has dropped by 0.8% to now at 1.1% from 2.9%. Now every other fund now in negative growth besides Foreign developed stocks rising at 0.2%. Let’s hope next week has better results for the stock market.

I’m actually really surprised at Real Estate Investment Trust (REITs). Although the gains are small, I haven’t seen any declines. Still to come though as I haven’t seen dividend payouts, the fact that REITs rising faster than a traditional savings rate, but more stable than the stock market funds from Wealthfront – it’s really great to see.