The stock market ended with mixed results today, not a huge decline. Retail sales are up, but the S&P 500 dropped by 0.01% (article). There hasn’t been positive news for the world, and many are assuming a larger correction since this year hasn’t had any substantial drop. Tomorrow will be interesting as the world will hear about the Vaccine Booster meeting from the FDA (article.)

How this affects our $1000 investment in Wealthfront – yesterday, we had a hint of a recovery from the 6 day decline, but today, we are saw a $3.22 decrease from yesterday. That puts Wealthfront stocks at $1003.26. REITs win over stocks today and overall. REITs had an increase of 11 cents with a running total balance of $.1006.33

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

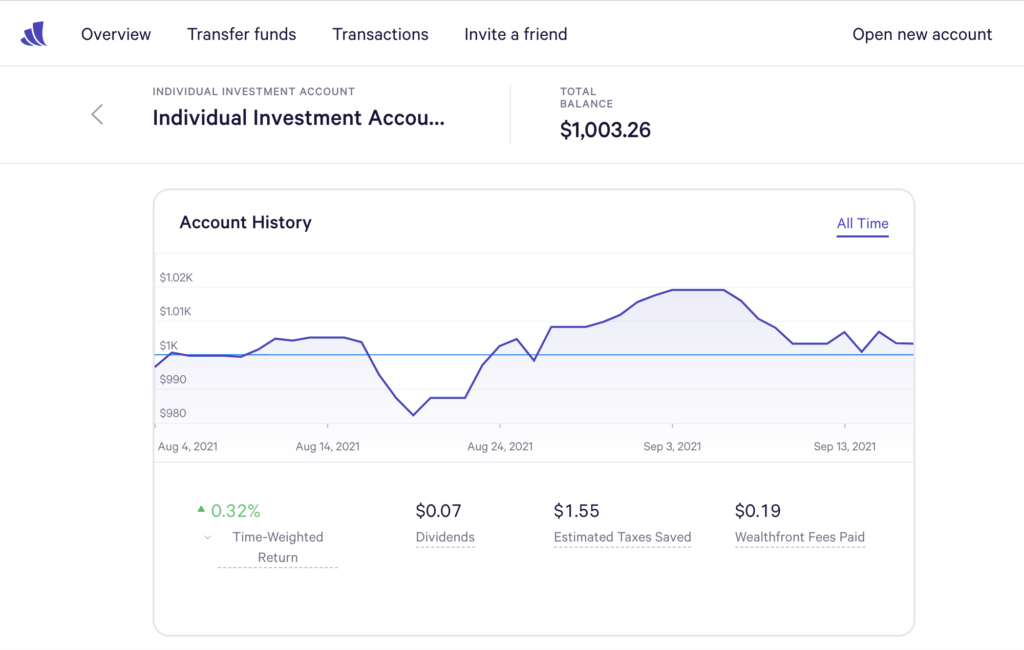

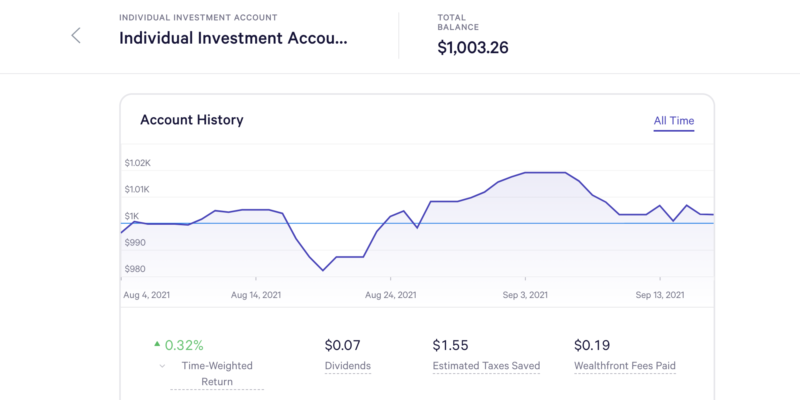

Stock Investment – Wealthfront

Today’s balance: $1,003.26 (Net returns to date: $3.26 gains)

Day change: $3.22 decrease since yesterday – $1,006.48

Historical info: Invested $1000 on August 2, 2021

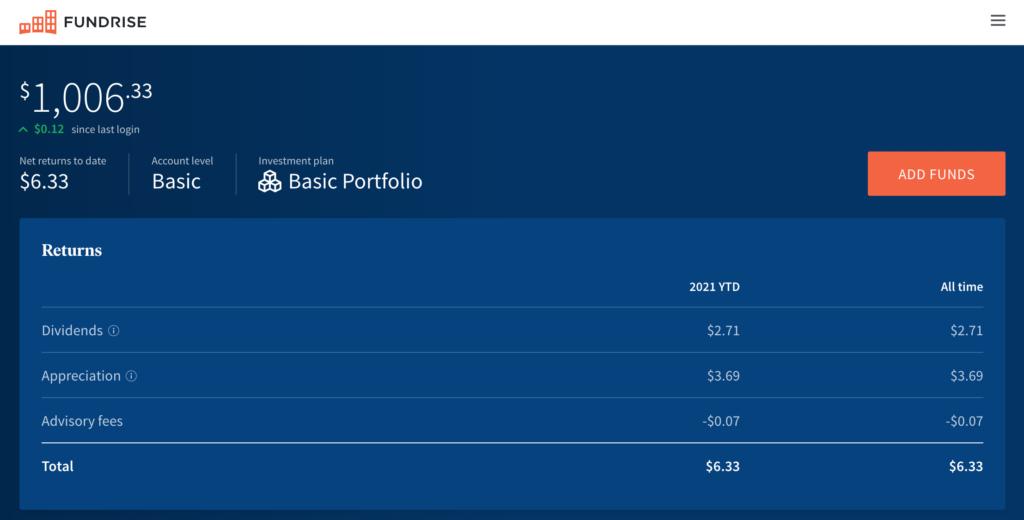

REITs – Fundrise

Today’s balance: $1006.33 (Net returns to date: $6.33 gain)

Day change: $0.11 (11 cent growth for REITs today) since yesterday – $1006.21

Historical info: $1000 on July 27, 2021 (initial investment)

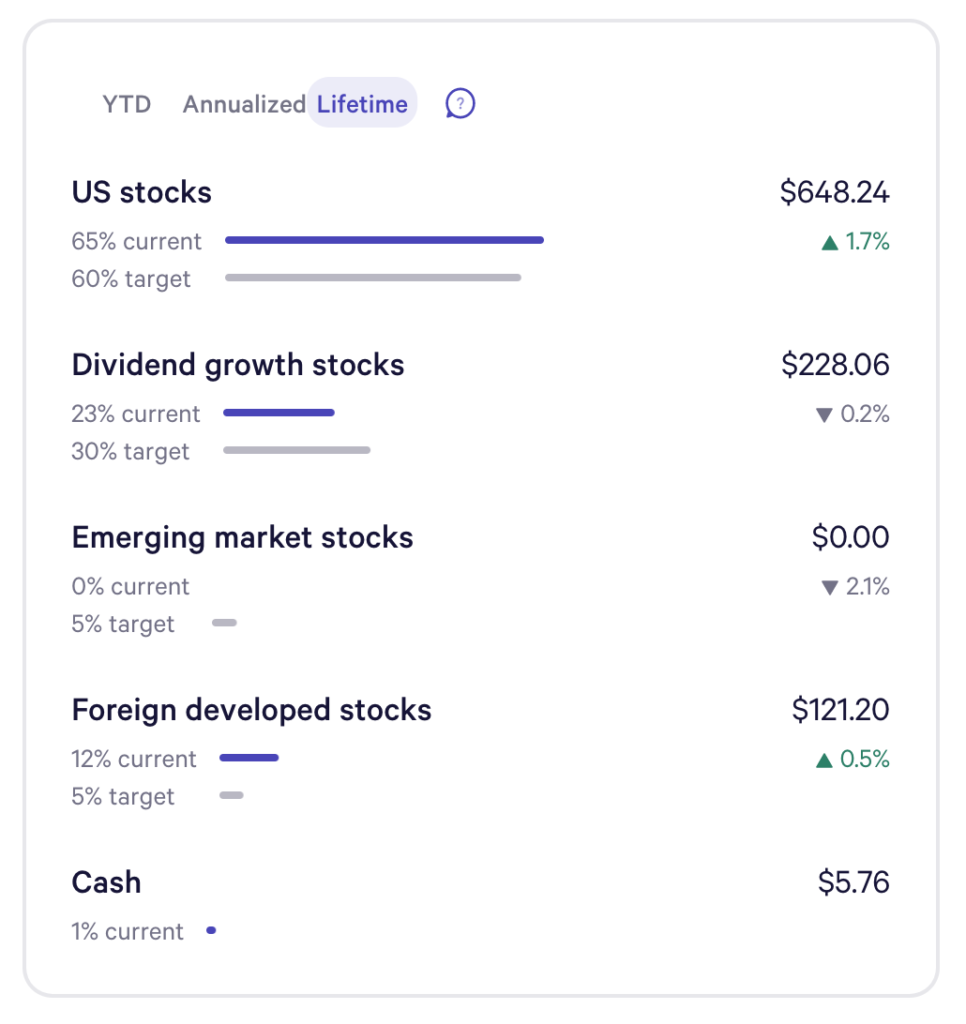

Wealthfront Funds snapshot:

Looking deeper at Wealthfront individual funds we have, lifetime earnings from US stocks are still up (1.7%), including Foreign developed stocks. Everything else is down from all the consecutive losses we’ve had this month of September.