REITs vs Stocks daily update – September 15, 2021

Today, the stock market had a healthy recovery and gains. Energy and industrial sectors help fuel the S&P 500’s gains. (article). It’s really the first positive signs since the last 6 days of heavy losses in the stock market. External events again influencing the stock market, crude oil prices go higher, Pfizer Booster shot data comes in stating that after 4 months, it is still 84% effective, from the 96% effective after the 2nd dose. This data is serving as guidance for when the 3rd booster shot should be administered, still waiting on the FDA meeting on Friday (article). Overall, the stock market seems to be highly

Other events uncorrelated to the stock market:

- Gavin Newsom, California Democratic Governor survived the recall election

- Biden planning to meet US Employees about requiring vaccinations to everyone

- SpaceX is about to make history to send the first-every civilian crew to space

How this affects our $1000 investment in Wealthfront – yesterday, all our gains were wiped out, but today, we are seeing gains of $5.75 increase from yesterday. That puts us at $1006.48 – our gains in stocks helped push just right above REITs at 1006.21. Stocks win today over REITs since no growth was shown for REITs and with one day gains put stocks just above.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

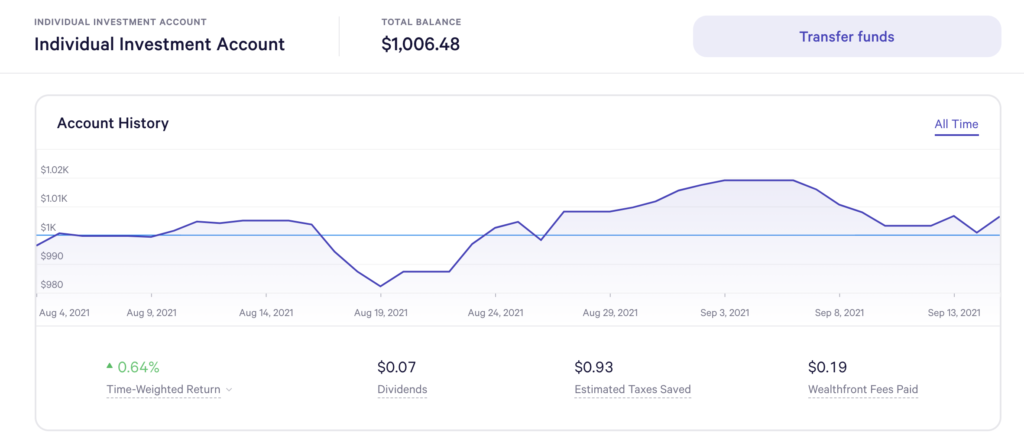

Stock Investment – Wealthfront

Today’s balance: $1,006.48 (Net returns to date: $6.48 gains)

Day change: $5.75 increase since yesterday – $1,000.73

Historical info: Invested $1000 on August 2, 2021

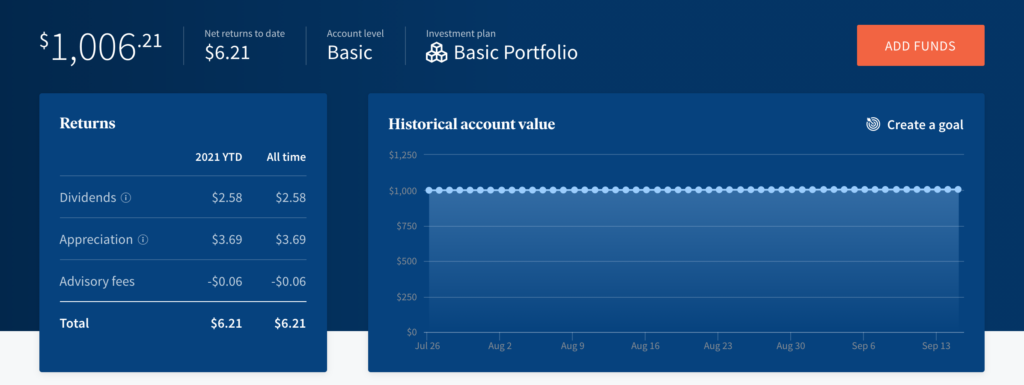

REITs – Fundrise

Today’s balance: $1006.21 (Net returns to date: $6.21 gain)

Day change: $0.00 (No growth for REITs today) since yesterday – $1006.21

Historical info: $1000 on July 27, 2021 (initial investment)

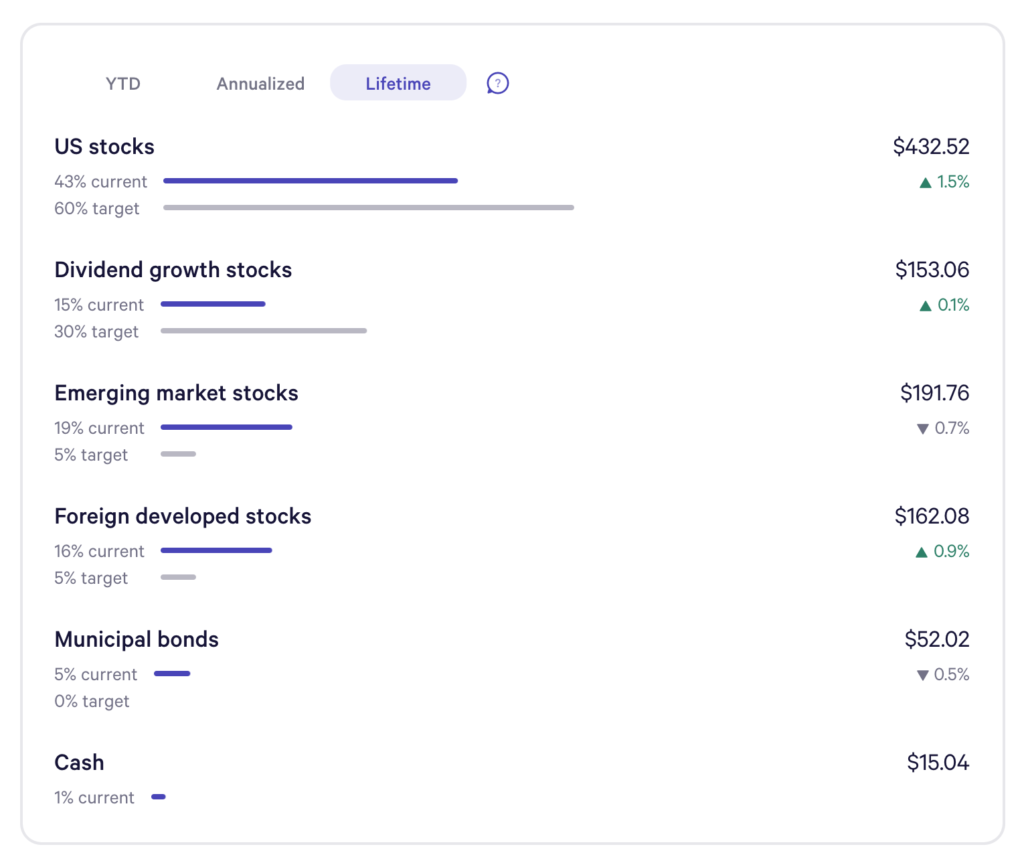

Wealthfront Funds snapshot:

We’re seeing a healthy push towards total positive gains: US stocks, Dividend growth stocks, and Foreign developed stocks still maintain lifetime growth, much better from yesterday. The global stock market has been pretty volatile in the month of September, still to what where we end up. Overall, folks are predicting a small crash, in times like this, it’s really an investing opportunity if things continue to drop.