REITs vs Stocks daily update – September 17, 2021

A few things have been occurring this week in the world – and the stock market ends the week rather choppy, it started off low and continue to decline as we end the mid week of September. The S&P 500 was down 0.9% at 4,432 (article). The market including Dow Jones and Nasdaq dips in reaction to the Whitehouse warning about recession, while wanting to raise the debt ceiling (article) and there are concerns about the second straight week of losses (article). The Pfizer booster shot was not approved by FDA, and mostly likely to want more data before allowing the general U.S population to get it unless folks are immunocompromised. Fed reserve will meet next week to discuss what they’ll do about their policies and the potential to raise inflation and reducing the quantitative easing.

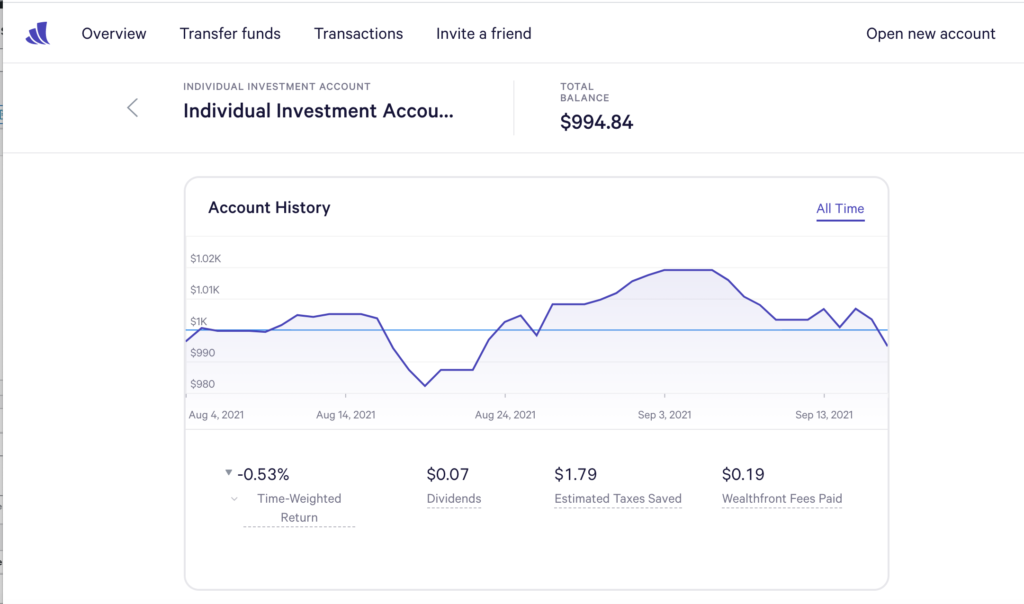

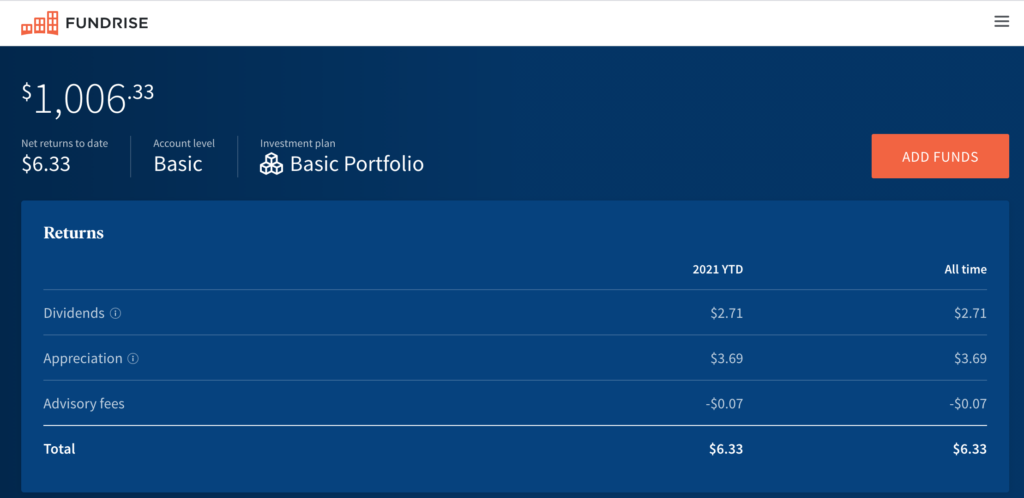

How this affects our $1000 investment in Wealthfront –today, we are saw more substantial $8.42 decrease from yesterday. That puts Wealthfront stocks below our initial investment at $994.84. REITs win over stocks today and overall. REITs had no increase, but a running total balance of $1006.33, nearly $10 dollars over stocks.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $994.84 (Net returns to date: $5.16 losses)

Day change: $8.42 decrease since yesterday – $1,003.26

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1006.33 (Net returns to date: $6.33 gain)

Day change: $0 (0 cent growth for REITs today) since yesterday – $1006.33

Historical info: $1000 on July 27, 2021 (initial investment)

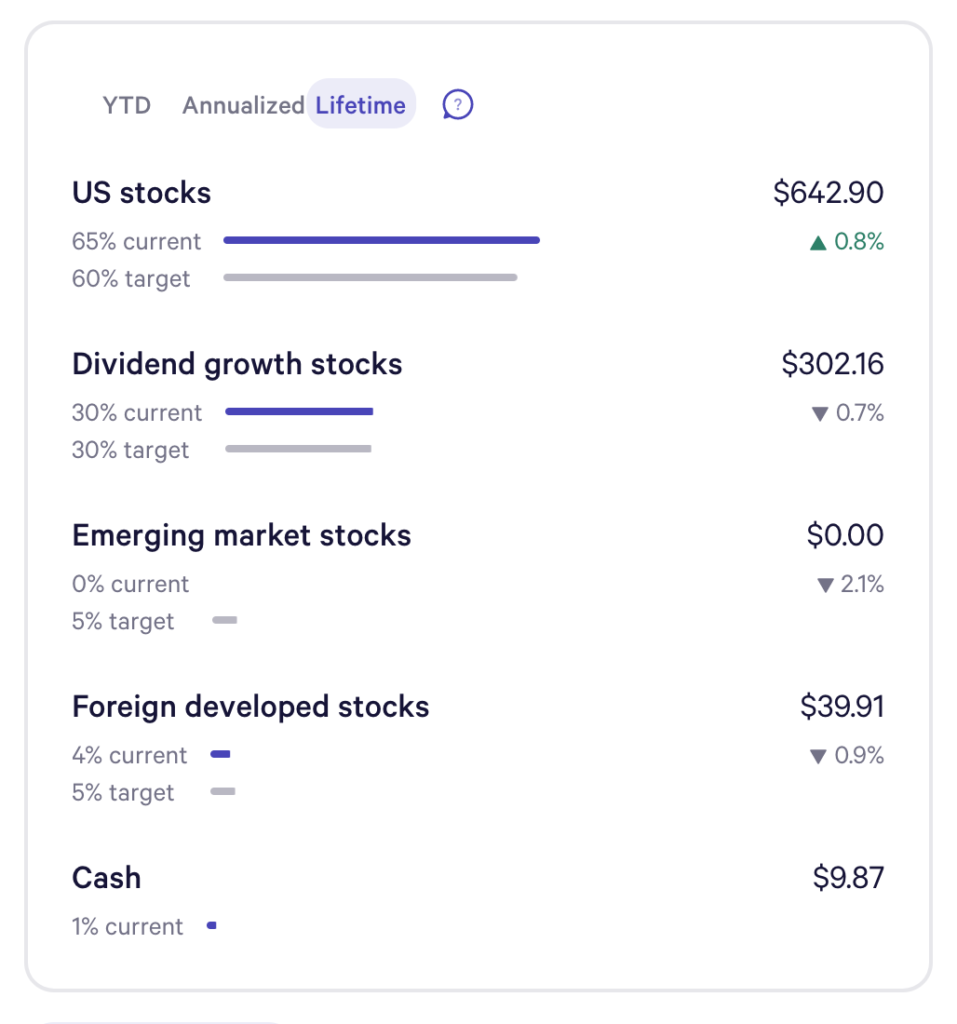

Wealthfront Funds snapshot:

Lifetime earnings for most of these funds are down , but it’s only been a 2 month investment. Obviously although things are down – it’s very early to know what the lifetime gains of would be in 10+ years.

By next week, we’ll find out about the latest policy announcements from the Federal Reserve that is expected to be out on Wednesday. There’s still talks about a correction, but others mention it just could be dips from the time of year as September historically has shown losses (article) So many channels are saying that it can go in either direction.

I’ve often wrote about long-term investment tips and how to be resilient in these more unknown times. If you are a long-term investor and have a long time horizon on when you’ll need to tap into your investments, then these movements in the world might just be noise and won’t affect your investment strategy.