REITs vs Stocks daily update – September 2, 2021

Stocks increased today $2.07, while REITs had a growth of 97 cents. Although stocks double the growth today, I was excited about REITs since this is the largest gain it’s had since it’s been a consistent few cent gain. This one jump almost by a dollar within one day. Both Wealthfront stock and REITs had positive gains, but with the overall stock market gains, our Wealthfront Stock has been well above REITs by more than ten dollars, $1,017.45 vs $1005.50. Stocks win over REITs today! Despite tech stocks which took a small stumble today, the S&P 500 hit another high (article).

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

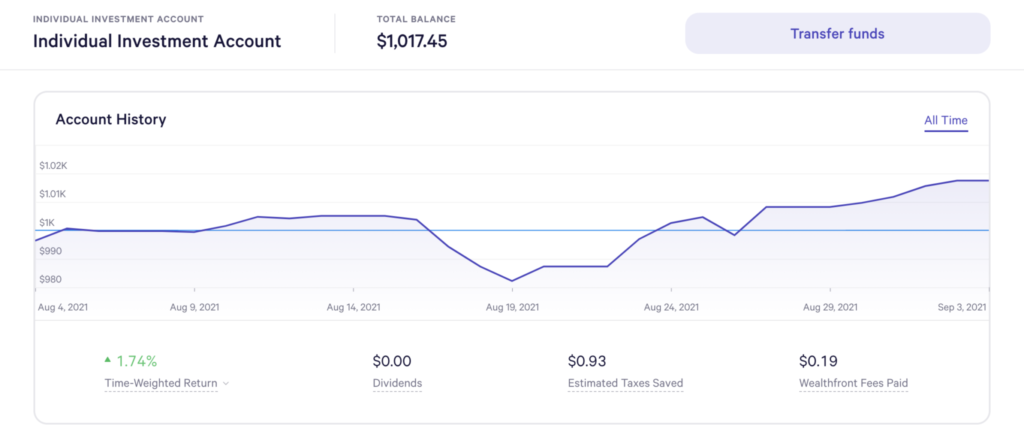

Stock Investment – Wealthfront

Today’s balance: $1,017.45 (Net returns to date: $17.45 gains)

Day change: $2.07 increase since yesterday earnings – $1,015.38

Historical info: Invested $1000 on August 2, 2021

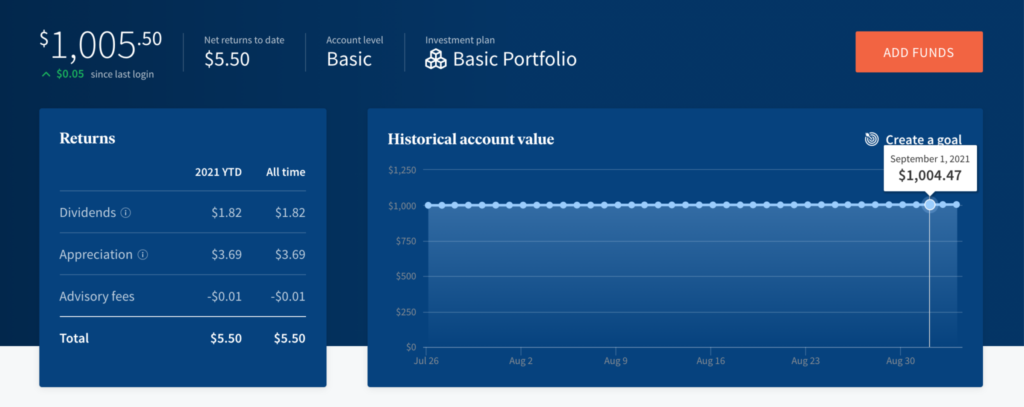

REITs – Fundrise

Today’s balance: $1005.50 (Net returns to date: $5.50 gain)

Day change: $0.97 (largest growth for REITs yet) since yesterday’s earnings ($1004.53)

Historical info: $1000 on July 27, 2021 (initial investment)

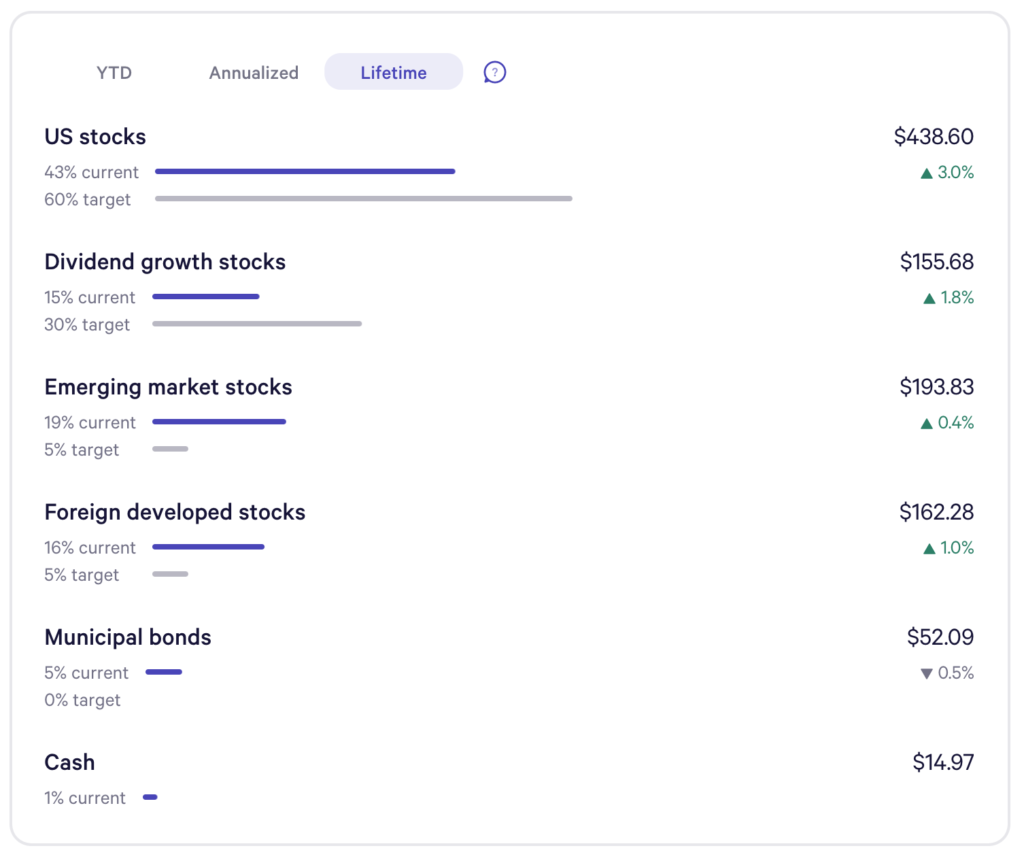

Wealthfront Funds snapshot:

US stocks and Dividend growth are high performers with 3.0% lifetime increase for US stocks. Emerging market stocks the lowest, but still positive at 0.4%. In general, it doesn’t looks like bonds have been performant at all.