REITs vs Stocks daily update – September 24, 2021

Stock market was great for a 3rd straight day. The Dow Jones industrial average and S&P 500 ticked up today, despite the politicians still deciding about the US Debt ceiling and the uncertainty from China Evergrande group. This increase in the market has helped our Wealthfront stocks (article).

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks are just a tad bit below our initial investment of 1000, currently at $999.75. REITs win over Stocks today, despite a small 6 cent increase, the running total balance of $1007.68, still much higher than stocks.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

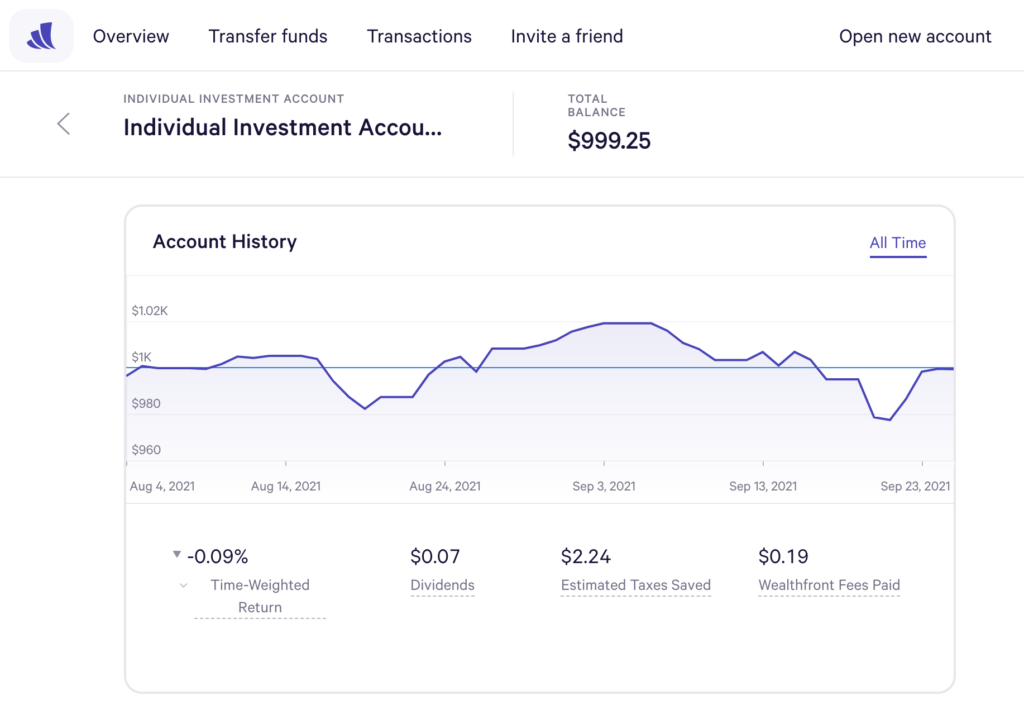

Stock Investment – Wealthfront

Today’s balance: $999.25 (Net returns to date: $0.75 losses)

Day change: $0.96 increase since yesterday – $998.29

Historical info: Invested $1000 on August 2, 2021

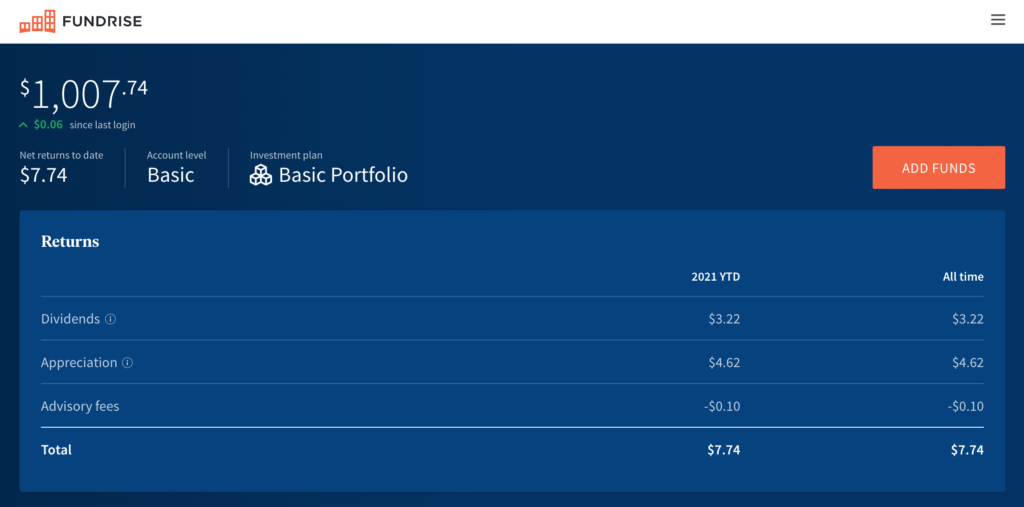

REITs – Fundrise

Today’s balance: $1007.74 (Net returns to date: $7.74 gain)

Day change: $0.06 (6 cent growth for REITs today) since yesterday – $1007.68

Historical info: $1000 on July 27, 2021 (initial investment)

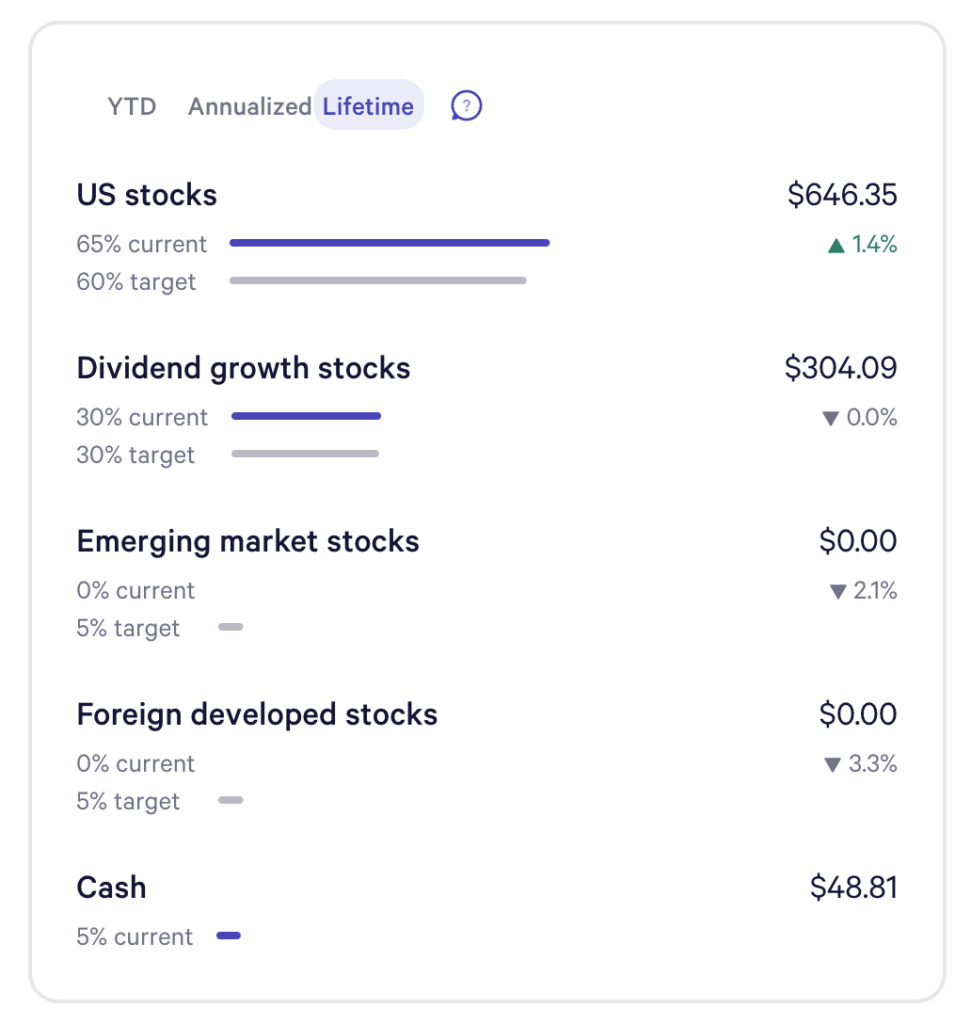

Wealthfront Funds snapshot:

Our lifetime earnings above is getting better – US stocks now moved into 1.4% positive, while Foreign developed stocks still see no improvement showing a 3.3% decrease overall.