REITs vs Stocks – The showdown to watch (over the next few years)

A few weeks ago, I invested in REITs (Real Estate Investment Trust) using a platform called Fundrise. It’s been interesting to observe the day-by-day even though marginal gains. Since it’s still early days of using small amount of funds to invest in Real Estate, I thought it would be interesting to add another comparison. I put $1000 in real estate, let’s put $1000 in the stock market. And see the gains and losses per day. After a few years, we might see some more interesting trends.

If interested, you can read about that article here (skip down below to see what I’m going to use for my stock market fund):

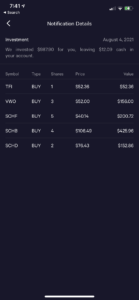

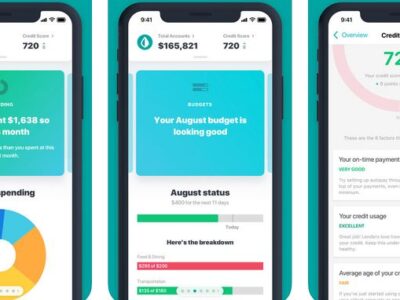

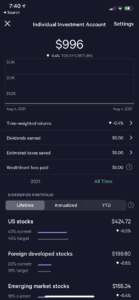

So for the $1000, I decided to open a Wealthfront account. I’ve heard great things about this from friends, but I really wanted to try it myself. I’ll write another post soon comparing all the investment accounts I’ve had, in the meantime, Wealthfront is great because it’s also an automated personal investment platform that chooses stocks for you – except that you get to choose your risk tolerance, and it shows you what funds they’re adding for you. I hear it also rebalances over time, but I’ll let you know when that happens. Here’s a few mobile shots of what I’m seeing:

.

So the $1000 that I gave to Wealthfront to invest, they distributed into several ETF funds based on the risk level I chose. I answered a few questions and it chose a 9.5 of 10 risk portfolio, that’s designed to maximize my returns while keeping it diversified. What did it choose:

VTI – Vanguard Total Stock Market ETF (US Stocks) – 45%

VEA – Vanguard FTSE Developed Markets ETF (Foreign developed stocks) – 19%

VWO – Vanguard FTSE Emerging Markets ETF (Emerging market stocks) – 18%

VIG – Vanguard Dividend Appreciation ETF (Dividend growth stocks) – 13%

VTEB – Vanguard Tax-Exempt Bond Index ETC (Municipal bonds) – 5%

Out of my thousand however, they invested $987.90 and left $12.09 in cash. I guess they couldn’t buy any more funds for 12 bucks.

I like the transparency in what they’re doing so I can follow and learn over time. Now that we’re invested, we can now compare REITs vs Stocks. If you are looking at the screenshots, you can already see what happened today.

REITs vs Stocks – August 5, 2021

Stocks – Wealth-front Individual Investment Account

Today’s balance: $996 (Net returns to date: ~0.04% loss of $4.00)

Historical info: Invested $1000 on August 2, 2021

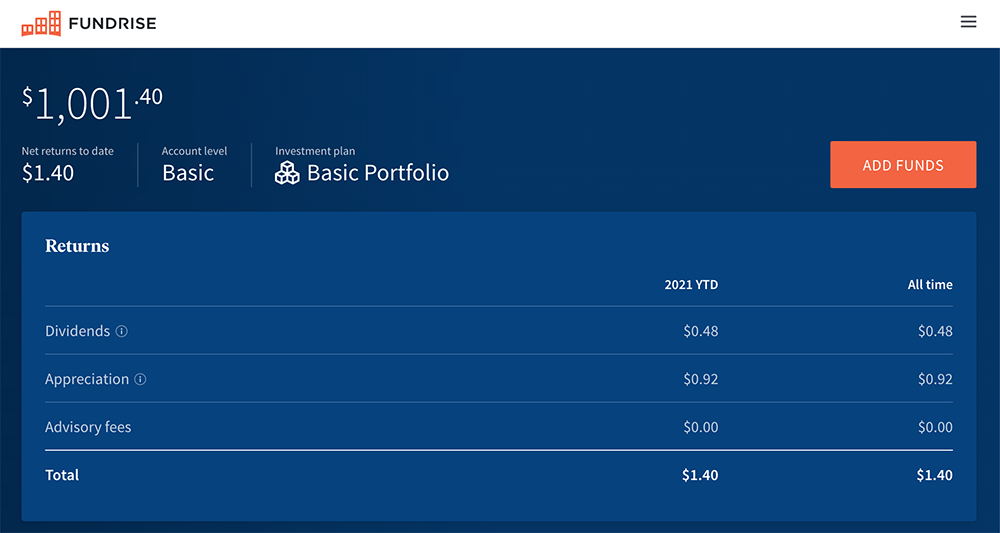

REITs – Fundrise

Today’s balance: $1001.40 (Net returns to date: $1.40)

Day change: $0.04 (4 cent growth) since yesterday ($1001.36)

Historical info: $1000 on July 27, 2021 (15 days since initial since initial investment)

Comments: For today, Real Estate wins. Overall, my REITs are $5.40 cents above my initial stock investment from Wealthfront.

Why I lose $4.00 in stocks? The majority of these stocks, particularly VTI mirrors US stock performance / S&P 500. Overall, stocks were down today, “The S&P 500 fell as General Motors Co. and CVS Health Corp. declined after earnings” as mentioned from a Boomberg article.