3 reasons to use a savings calculator to plan for your financial future

Planning for your financial future – most would say it’s important, although it’s hard to know how to plan it for besides earning an income. That’s why projecting how your personal finances could grow in the future will help you understand what you want to do, but also how to do it.

The first step is using a calculator. I’m not recommending a traditional calculator, but one that looks specifically at compound interest of saving your money over time.

A savings calculator is a great tool for the following 3 reasons:

1. Motivate

It will excite and begin to explain why you need to start saving. You’d never imagine how much money you could make, but also how it works for you over 5, 10, 15, 20+ years.

2. Plan

Seeing what you can generate from saving and investing that money helps you decide many things in life including raises, how much you need, how much do I need to ask for from my employer. After all, we work to live and build the lifestyle we want and to support our families. The calculator helps you plan and deciding on longer term goals like buying a house, saving for a big trip, buying a car. It allows you to see how much time you need to put it in for your money to begin to work for you.

3. Make changes

The calculator projects the “what if” scenarios. So you can begin to see what you already contribute today, and what you might want to contribute to get to that goal, whether it’s more or less per month. You might decide to put more in, as increasing your contributions is important to help you meet any future goals while keeping enough for you to spend on today. Generally, I’ll plug in a few scenarios and that helps me determine how much more or less I plan to save. And by saving, what I mean is how much extra disposable income I decide take from my paycheck and add into my investment accounts.

Which one do I use:

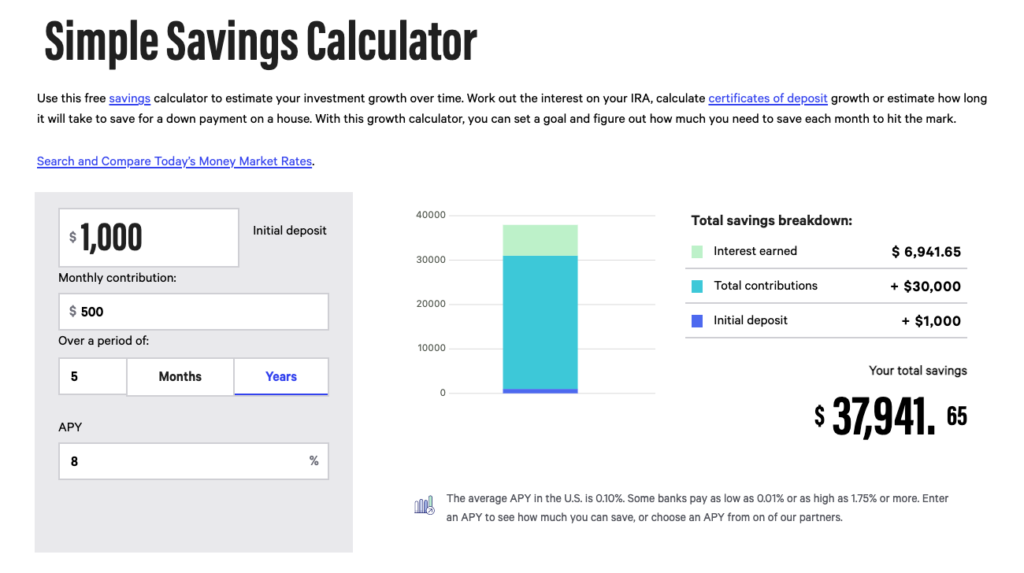

I’ve been using Simple Savings Calculator by BankRate: https://www.bankrate.com/calculators/savings/simple-savings-calculator.aspx

This calculator lets you see how your investments will grow over time. You get to see how compound interest works based on what you have now, how much you contribute per month or per year, and the APY interest rate based on where your money currently sits, how much it’ll become.

It’s a really simple calculator that outputs a chart and your total savings. You only enter 3 variables and you can quickly see how much you put it, how much interest you earned, and your initial deposit.

What I like about this particular calculator is it helps me quickly visualize the breakdown. I can see the total, but also how much my money has worked for me – looking at the “interest earned” in the light green color.

By using a savings calculator – you can see how much your money could make when you starting saving instead of spending it. I use a personal savings calculator to help me figure out the basics of interest and investments. I’ll look at it once a week or month depending on what my goals are and how close I am to it.

It’s personally helped motivate me, plan my financial future and answer the “what if”, and allowed me to make the changes today to get there: