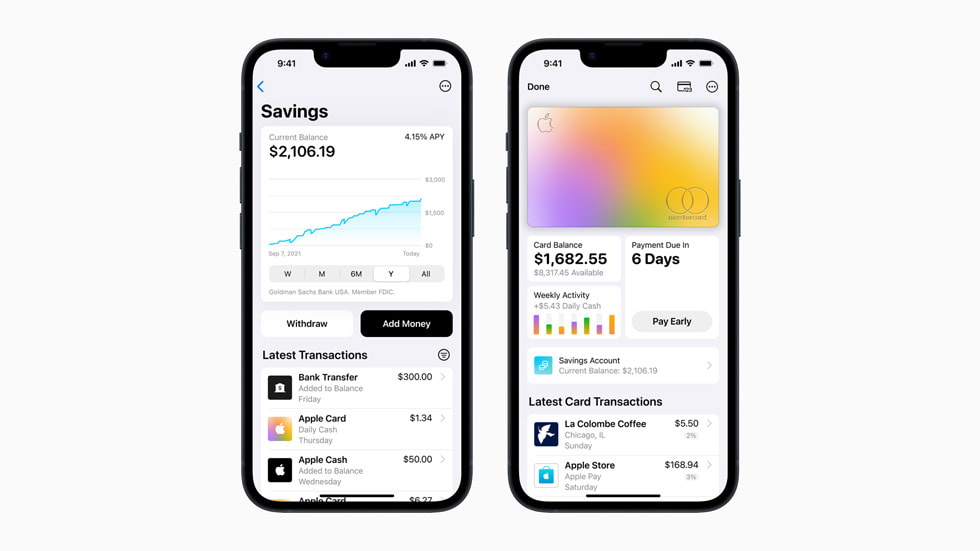

Apple Savings Account is a virtual savings account for Apple Card users offered in partnership with Goldman Sachs Bank. It offers a competitive interest rate of 4.15% annual percentage yield (APY), which is higher than many traditional savings accounts.

The annual percentage yield (APY) for traditional savings accounts can vary widely depending on the bank or financial institution and the current interest rate environment. However, in general, traditional savings accounts tend to offer lower APYs than high-yield savings accounts or other types of investment vehicles. As of April 2023, some traditional savings accounts offer APYs ranging from 0.01% to 0.50%, though this can change over time.

Apple has launched a new savings account for Apple Card users, offering a 4.15% annual percentage yield (APY), no fees and no minimum deposit or balance requirements.

It also offers some extra benefits to Apple Card users, such as automatic deposits of Daily Cash earned with the Apple Card and the ability to make an instant transfer to your Apple Wallet. The account can be managed through the Wallet app on your iPhone.

There are other high-yield savings account options with higher interest rates also exist, such as UFB Direct’s Premier Savings account offering a 4.81% APY, Bread Savings’ account with a 4.50% APY, and Lending Club’s high-yield savings account earning a 4.25% APY. Financial experts suggest finding the best option for your savings goals and financial situation.

Apple has a history of disrupting industries and offering innovative products and services, and its partnership with Goldman Sachs gives it the financial backing and expertise needed to potentially succeed in the savings account market.

Overall, while it’s still early days for Apple’s savings account, there is potential for it to be successful if it continues to offer attractive rates and features while also providing a seamless and convenient user experience. It certainly generated a lot of buzz and attention due to its competitive interest rate.