How to edit your portfolio in your Wealthfront investment account

I gave a in-depth analysis of my observation in my daily funds over the last month. And learned a few things about how Weathfront allocations funds when you designate a high risk portfolio (9.5 of 10 risk portfolio) expected for long-term growth of 30+ years. My analysis compared the 5 Wealthfront index funds that were given to me automatically when I answered questions to determine my risk tolerance. You can read about that in this post here.

Looking at the 5 funds given, I’ve decided to reallocate funds in my Wealthfront investment account, mostly to focus less on the under performing onces and to put more of my investments in the ones I believe will perform better.

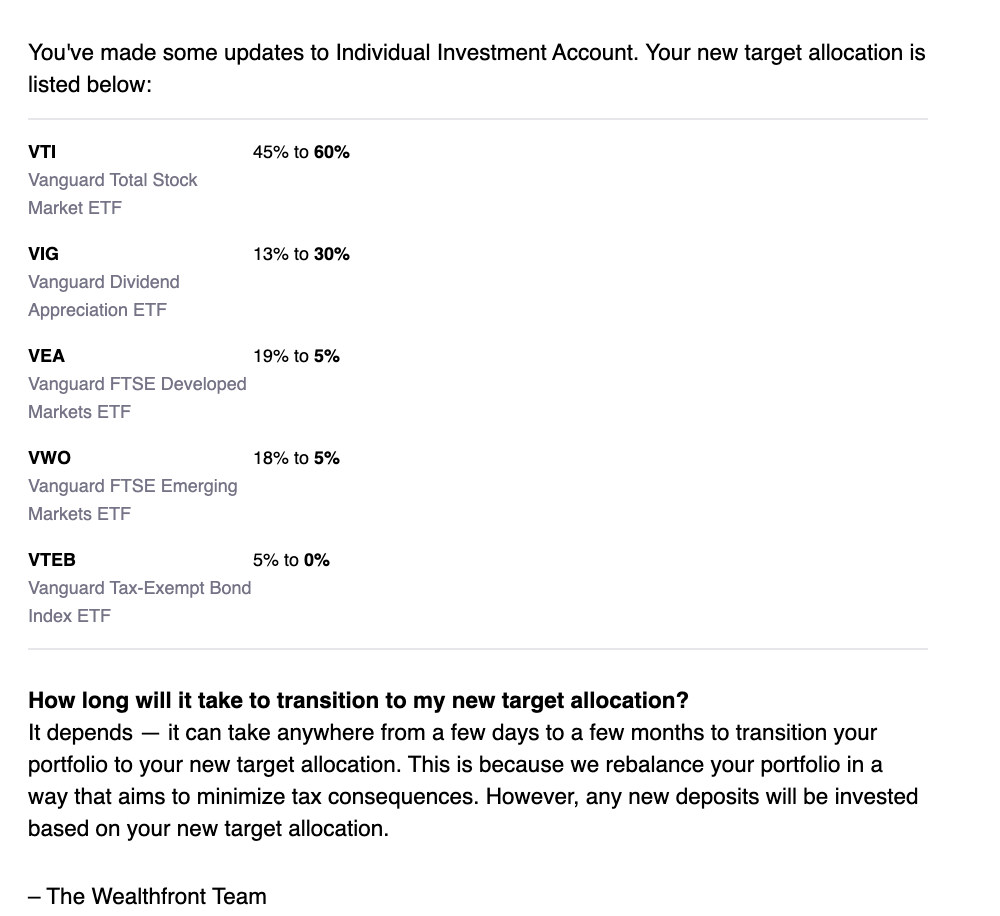

- VTI – Vanguard Total Stock Market ETF (US Stocks) –

- 45% current allocation → 60% new allocation

- VEA – Vanguard FTSE Developed Markets ETF (Foreign developed stocks) –

- 19% current allocation → 5% new allocation

- VWO – Vanguard FTSE Emerging Markets ETF (Emerging market stocks) –

- 18% current allocation → 5% new allocation

- VIG – Vanguard Dividend Appreciation ETF (Dividend growth stocks) –

- 13% current allocation → 30% new allocation

- VTEB – Vanguard Tax-Exempt Bond Index ETC (Municipal bonds) –

- 5% current allocation → 0% new allocation

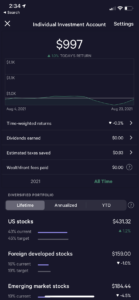

This above is what I’ve decided to adjust my portfolio to. I’m not adding any new funds right now, but I’m shifting the percentages around to focus my ~$1000 on the ones that are doing better. Since yesterday (Aug 23), both VTI and VIG has had a daily increase of 1.2% and based on my analysis, this has performed better than the rest over the last month.

As suspected, Wealthfront is very easy to use, the moment you decide to make a change, it can all be done right from your mobile app.

Here’s how you can adjust your Portfolio in Wealthfront

Step 1 – Get into Edit Mode) After logging into your app and navigating to your investment accounts, you’ll be able to see your newest investment account balance affected by the market. Go ahead and scroll down to see your current list of funds, and press “Edit Portfolio” when ready

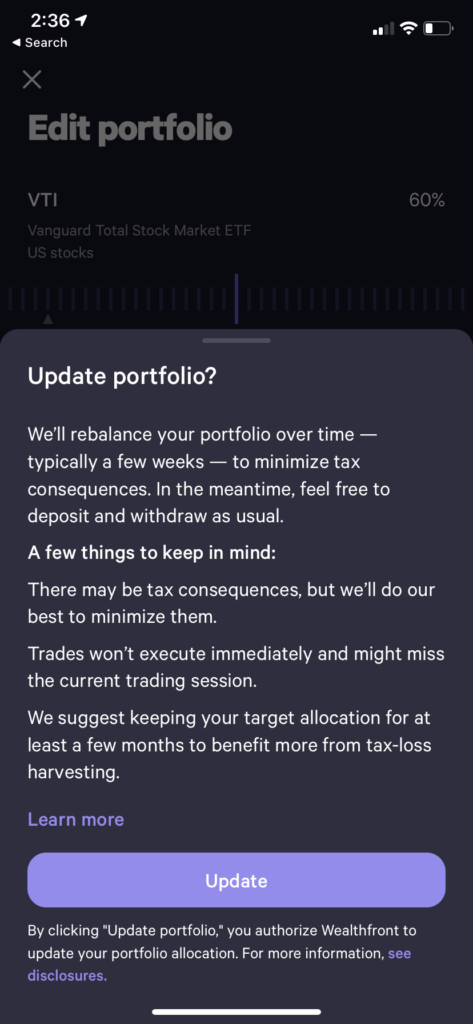

Step 2 – Adjust your portfolio by dragging) Next, pull the lever from each fund to reflect the new percentage you want to have for the fund. For VTI – it’s currently at a 45% allocation and I’m planning on bringing it to 60% while reducing other funds. The goal here is to make sure it meets 100% total. When you are done, click continue,

Please note: These are my personal choices, but feel free to adjust to your own decisions. I want to note that I am choosing to invest this $1000 based on my own choices and you should do the same to your own investments, and not follow my choices. I am reducing underperforming funds to 0% or 5% and increase the better ones.

Step 3 – Confirm changes) You’ll then see a window asking to confirm the update.

Notice you get dropped back to the original screen and not much has changed except the target percentages.

Step 4 –Sit back and monitor) Over the next few weeks to months, you’ll those assets shift. Wealthfront mentions this will take time to make sure the taxes are reduced and minimized and that will happen automatically.

This below is the email I got once I made those changes.