REITs vs Stocks daily update – August 23, 2021

Today ended the day with an increase in the US stock market and the second day of recovered gains after a full week of continued losses in the Stock Market. Why did this happen? The US regulators and FDA gave full approval for the Pfizer vaccine (article) . This positive external event caused confidence in the Market as it assumes means a better future given what the pandemic closures have caused. Generally speaking, confidence is often boosts the stock market forward. Fingers crossed this is sustainable. Now let’s see what all this news has in store for our edition of Stocks vs REITs.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

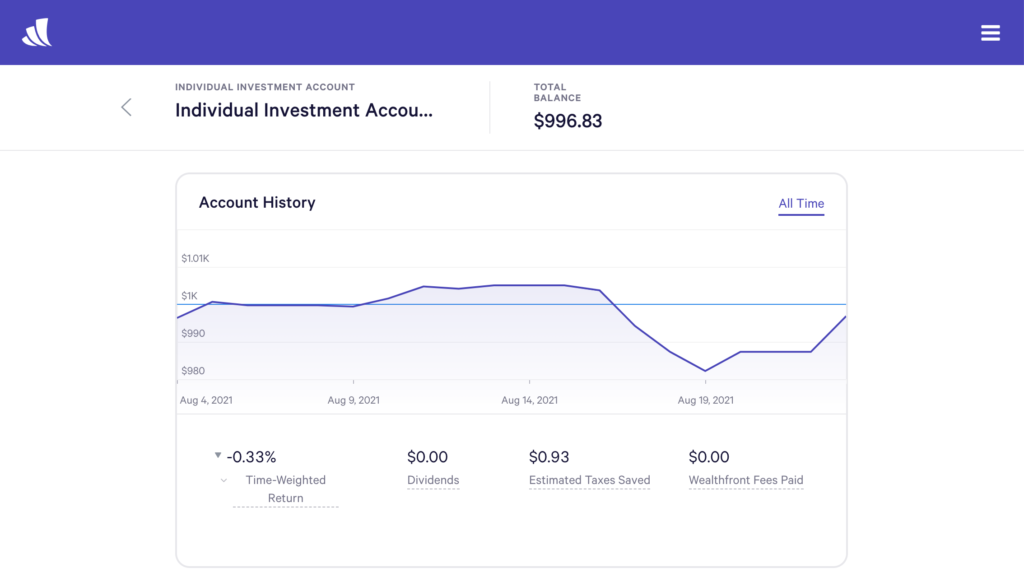

Stock Investment – Wealthfront

Today’s balance: $996.83 (Net returns to date: $3.17 loss)

Day change: $9.56 increase since yesterday – $987.27. This was a strong day for the stock market, one of the highest increases.

Historical info: Invested $1000 on August 2, 2021

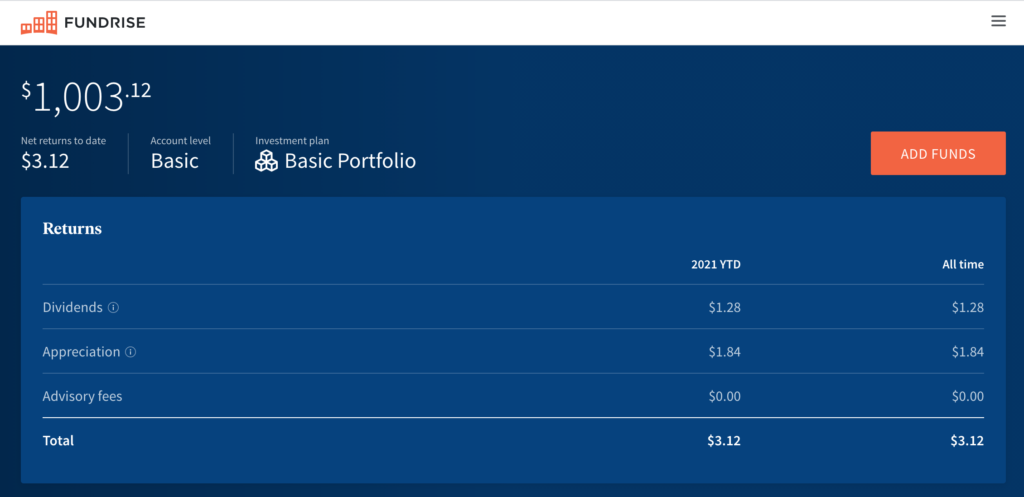

REITs – Fundrise

Today’s balance: $1003.12 (Net returns to date: $3.12 gain)

Day change: $0.09 (Small growth) since yesterday ($1003.03)

Historical info: $1000 on July 27, 2021 (initial investment)

Despite a strong increase of $9.56 to stocks this monday, stocks still have a net loss of $3.17. REITs have another small growth, this time at 9 cents.

Today, REITS continue to win. Despite the recent Stock market gains in the last 2 days, the week before was in red so it’s still in recovery.

A deeper look in the table below shows US stocks still emerge higher. Emerging market stocks are still the bottle neck yet again. And dividend stocks had a phenomenal day at a 1.2% growth matching US stock growth.