6 Tips for Investing in Your 30s

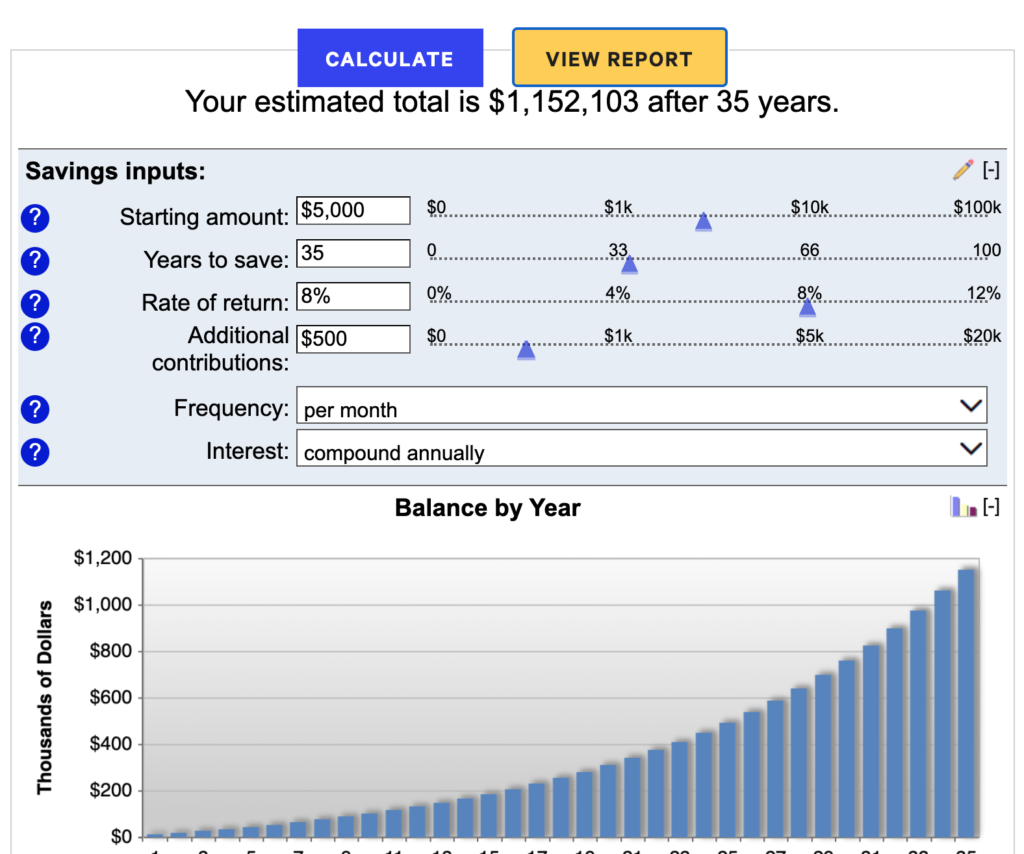

I wish I understood earlier in my 30s what investing could do for me. I would say what really makes you see it when you use a Compound Interest Calculator. There are many out of, but here’s one from Bankrate.

If I could tell you that you could turn $200,000 into 1 million dollars, what would you say? For me, it’s a no brainer, absolutely, but how?

There is an opportunity to invest small chunks of money and turn it into millions.

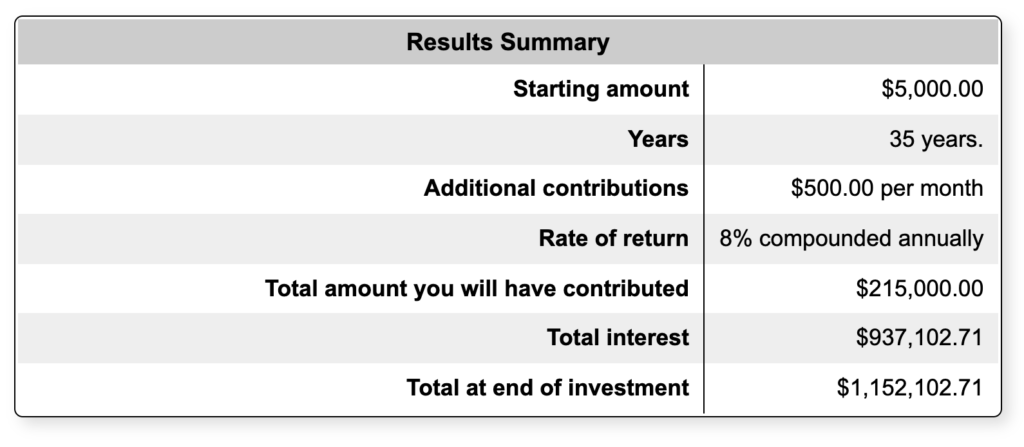

In your 30s, you have another 35 years before retirement. The example here is a vivid one, put $5000 in an investment account @ 8 percent interest, contribute $500 per month consistently and your savings could be worth $1,152,102.71 after 35 years. I’ll repeat….

Your savings could be worth $1,152,102.71 after 35 years

Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Even small deposits to a savings account can add up over time.

In your 30s, things get really serious and more complex than your 20s. You begin to have or think about tie-ing the knot if you haven’t start a family, build a career and start to earn more. And our decisions to save and invest for retirement and your future can really impact it as seen in the example above.

Here are 7 tips to get on track for investing in your 30s:

Tip # 1. Just don’t WAIT

The best advice for anyone in their 30s is don’t wait – it’s never to late to invest, but the sooner you do it, the more you get. Take advantage of every penny and the financial support you have from your company. Pull 10-20% from your paycheck and invest it. Keeping doing that til it hurts, meaning, enough so you start to figure out your budget and expenses and what’s disposable income for you.

Tip # 2. Max your 401(k) – tap in to your employer’s free money

Starting out is hard, but hopefully by your 30s, you’ll start to have an income and promotions where you had a bit more money to do whatever you want. But before you do what ever you want – max our your 401k. Today you have send your pre-tax salary, and send it to your 401k. And companies also like to match contribute (meaning they’re giving your free money), but to take it up a knotch – in your 30s, you should also try to get to a point where you can max that 401k. (The 2021 max contribution rate is $19,500)apital Management.

Tip # 3. Reduce investment fees

In your 30s, you should start to building a substantial investment fund beyond your 401k. You might have setup an individual brokerage account outside of your retirement accounts. Maybe you bought more trendy stocks like FAANG companies ones, or other company stocks like TELSA. Or you might have index funds or mutual funds. It’s a good tip that while you invest, you should try to find lower expense ration fees on your investments. Check your current funds and check the tradeoffs of some fees or another. You can use BankRates Mutual Funds fees calculator to check.

Tip # 4. Create a diversified portfolio.

Reducing risk is one thing to always keep an eye out for. The saying that you shouldn’t put all your eggs in one basket. So as you begin to develop your investment acumen, try add some dollars into foreign stocks or real estate investment trusts. This will protect your from unforeseen events – Real Estate Investment Trusts have gradual gains and decent dividend payoffs over time – and it protects you from putting all your eggs in the stock market.

Tip # 5. Avoid the hot stock of the moment.

There’s always some new things in the hot seat that everyone talks about. Bitcoin is that today, Dogecoin, NFTs, sometimes it’s a stock like GameStop, etc. I’d recommend keep most of your investments in low-cost index funds or ETFs and make a diversified portfolio through that. If you really want to try the trend, put some play money in it, and make sure it’s less than 5% of your portfolio.

Tip # 6. Invest your time.

Put time to understand your finances and where you money is going. Get expert advise from a financial advisor, often times, your bank would provide one for your. These people will give you advice, but also pointers on how you can increase your financial acumen and knowledge so you can manage your own money and avoid the rash decisions. Also invest in the time for yourself – to learn more in areas you care about. Self Education is one of the best things – and in today’s world, it’s free with Google.