How to starting investing with Stocks – My story on how I got started

I’ve been investing stocks on various trading platforms – Vanguard was the first one I ever used, but I’ve also tried other ones to learn about the intricacies of each platform, from Charles Schwab, Robin Hood, Acorns. I’ll write a bit more about each one soon enough as I think it’s important to compare from a simple investor like me.

My first investment account was my Roth IRA that my brother opened up for me when I turned 18 and moved to college. I put a few hundred bucks in it, but college was tough – my finances were all over the place and I racked up some credit card debt while studying. Needless to say, I never contributed to it til a few years into my career. I would say I started actively added to my retirement in my late 20s when I started getting traction with my career.

I started using Vanguard when I signed up for my company 401k. After getting comfortable contributing to my retirement account, I decided to open a taxable brokerage account. This was when I had to choose and read up on which stocks I wanted to put my disposable income in which differs from the company 401k where it’s a targeted retirement income that adjusts risk levels based on your age and how close you are to retirement. There’s no visibility in specific funds or control on how you want to invest.

Moving to a taxable brokerage account, you have to choose everything yourself. It required reading up on basic investing terms and understanding how to buy. I decided to invest in VTSAX (Vanguard Total Stock Market Index Fund) which is a low cost mutual fund that tracks the performance of the US stock market. I don’t do day trading and mostly depend on time so I felt that this was better for me than an ETF like VTI.

Question 1: Why invest in the stock market and not put your money in savings?

Some of you may be wondering why I decided to put my money in stocks and not a traditional savings account. Well, when I was little, savings accounts were great, interest rates were around 3-4% interest, shocking how times change where it’s only about a fraction of a percent (0.25%). For years, I left my money in a savings account and suffered from no growth, and worse, being affected my inflation. And the stock market does grow at a steady 7% since inception, recent years 10%+ although I’m not sure how much that will last.

Question 2: When was I ready to invest in a brokerage account?

I feel I was late to the game here too, as you can never be too early. I always shield away from stocks as mentioned here due to the culture and the family values I was brought up in. It was seen as a sign of gambling. After I got more settled in my job and after a few years of contributing to my 401k and collecting the company match, I started getting close to max contribution which today is about $19,500 of pre-tax 401k contribution. I think at that point, I put the rest in savings. I think at this point, I felt more confident to take a bit more risk, and test waters in stock investing. For me, it was a calculated risk that I was comfortable in doing – that’s when I decided to open a Vanguard Brokerage account and send a few thousand to see and understand how my money changed.

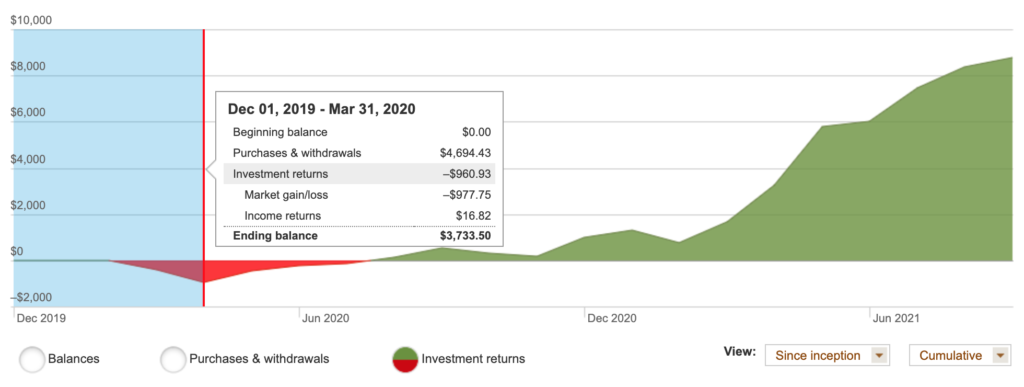

Over the course of ~2 years, my personal assets on Vanguard has seen solid growth, although I had a big scare during the pandemic. Below you can see I only invested a few thousand (~$4,694.43), but with the drops in March 2020 due to closures and the pandemic, the market dropped significantly and I lost roughly 1/5 of my funds (-$977.75).

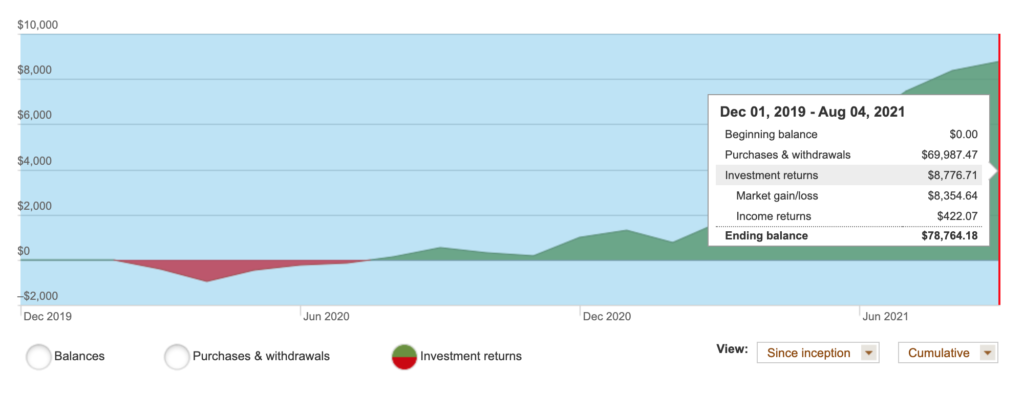

Fast forward to August 2021 – I’ve had a lot of gains. The growth is actually due to me establishing a consistent contribution per monthly paycheck and sending a majority of my savings to this stock fund. But my investment returns have been pretty good for the course of 1.5 years ($8,776.81 in gains) with me contributing $69,987.47 in total since that drop.

For those F.I.R.E. individuals, this really isn’t a lot of money, but it’s been pretty good gains for someone that’s late to the game in my mid-30s. For the folks that aren’t familiar, F.I.R.E. is a movement which stands for “Financial Independence Retire Early.” I only heard of it a few years ago, a bit late to the game, but I seek inspiration and decided to act in the last few years to eventually retire hopefully before 60.

Question 3: Why am I putting so much of my money in stock?

For me, seeing my money grow and do some work for me than traditional ways of collecting a paycheck makes me happy to see. It’s a risk as we’ve seen in March 2020, but since I’m still considered “young”, but not that young, I still have roughly 30 years to see growth, declines, and more growth.

This is basically my passive income stream and it’s part of my long-term strategy for financial independence. Let’s hope I’m not too late for that – but as Aya Laraya said…“When you invest, you are buying a day that you don’t have to work.”

I’m willing to take it one day at a time…