REITs vs Stocks daily update – Oct 19, 2021

The stock market had it’s 5th straight day of positive earnings (article). This uplift was due to reported earnings of many companies including Proctor& Gamble, Netflix, and United Airlines. Still, supply chain issues have hit many industries and are one of the top concerns of this time period.

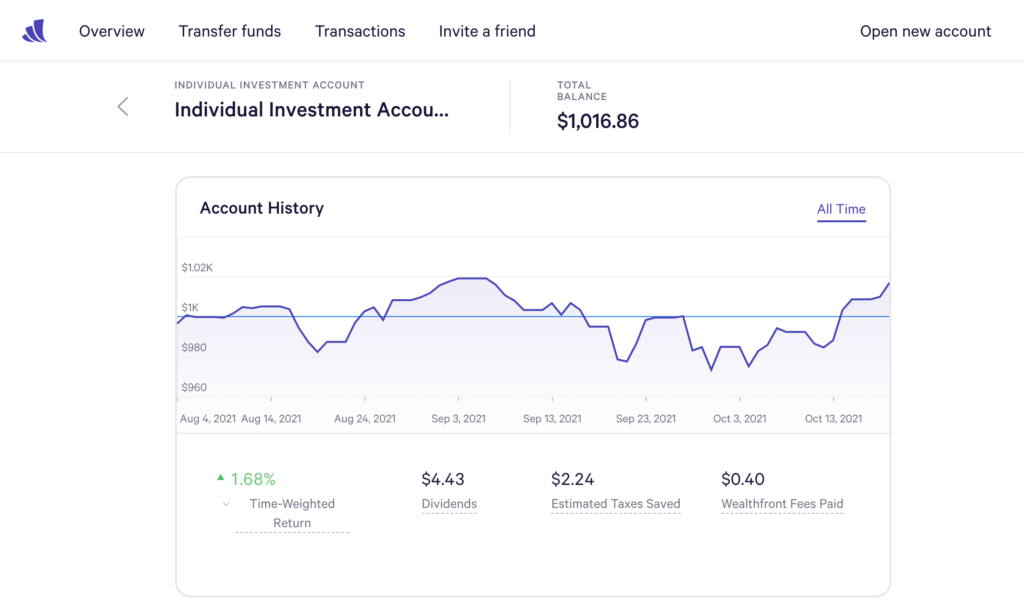

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks continue to have positive gain following the stock market. This puts our investment above the initial investment of $1000, currently at $1016.86.

Today’s outcome is Stocks win over REITs, while a small growth of 4 cents for Fundrise, Wealthfront had a higher daily gain of $7.26 daily increase. Still, the running total balance of REITs is $1,123.29, which is a a substantial gap over stock market, $1016.86.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $1016.86 (Net returns to date: $16.86 gain)

Day change: $7.26 increase since yesterday (Oct 18, 2021) – $1009.60

Historical info: Invested $1000 on August 2, 2021

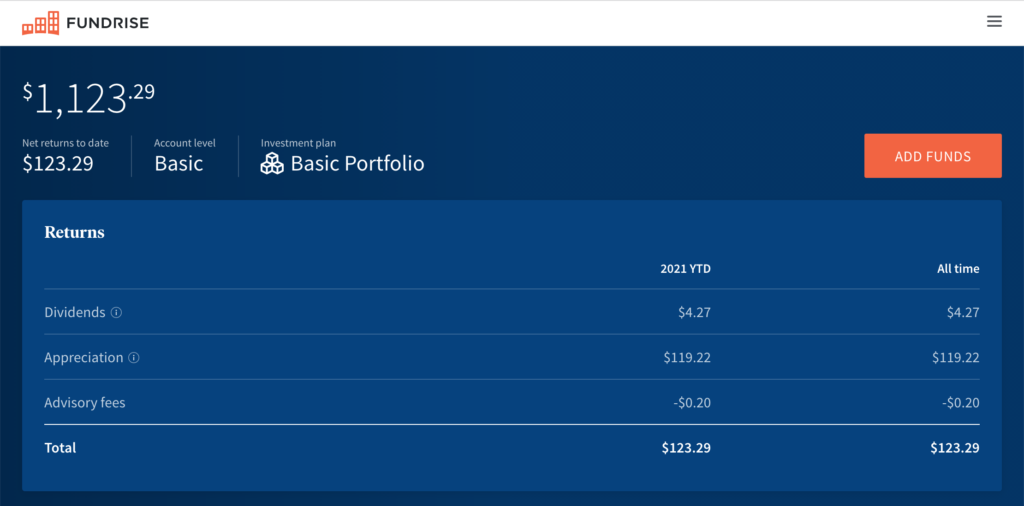

REITs – Fundrise

Today’s balance: $1,123.29 (Net returns to date: $123.29 gain)

Day change: $0.04 increase (4 cent increase for REITs) since yesterday (Oct 18, 2021) – $1,123.25

Historical info: $1000 on July 27, 2021 (initial investment)

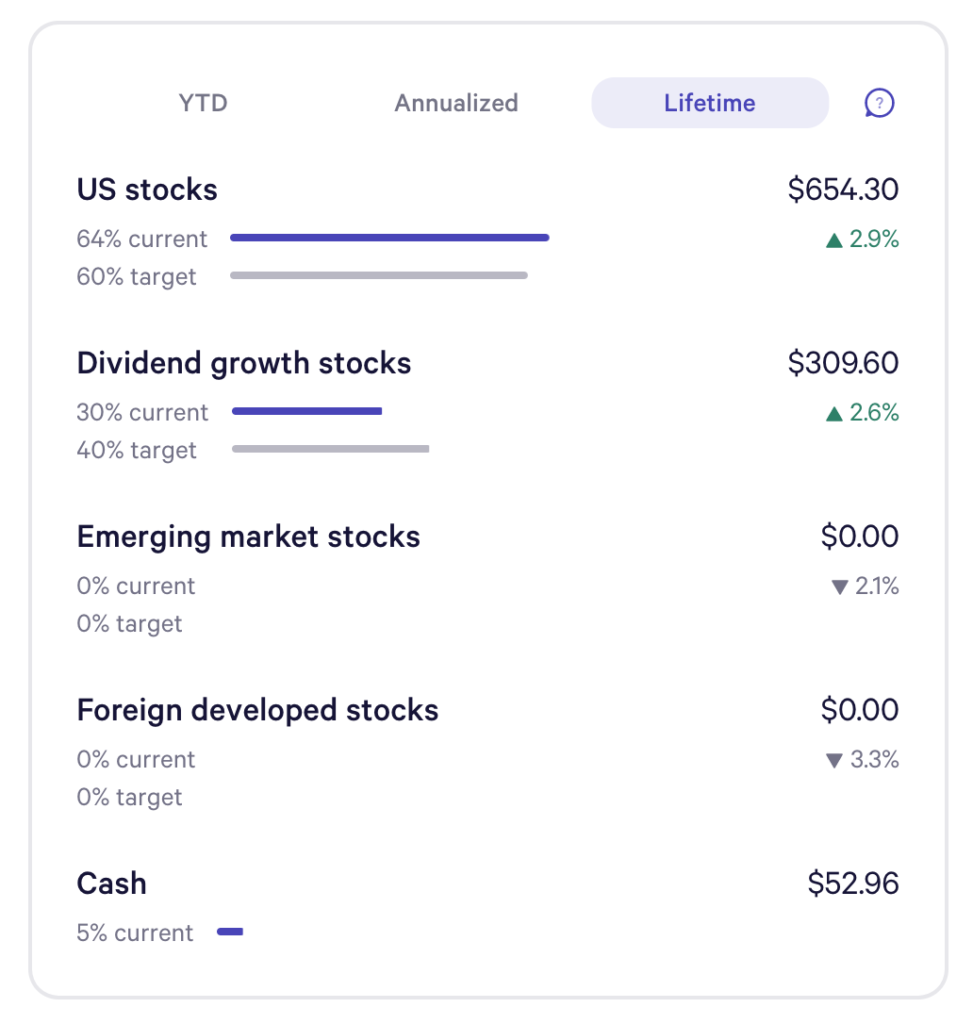

Wealthfront Funds snapshot:

Most funds are we’re investing in are US stocks and Dividend Growth stocks and they’re both showing positive growth. 2.9% for US stocks and Dividend growth jumping up to 2.6%.