REITs vs Stocks daily update – August 27, 2021

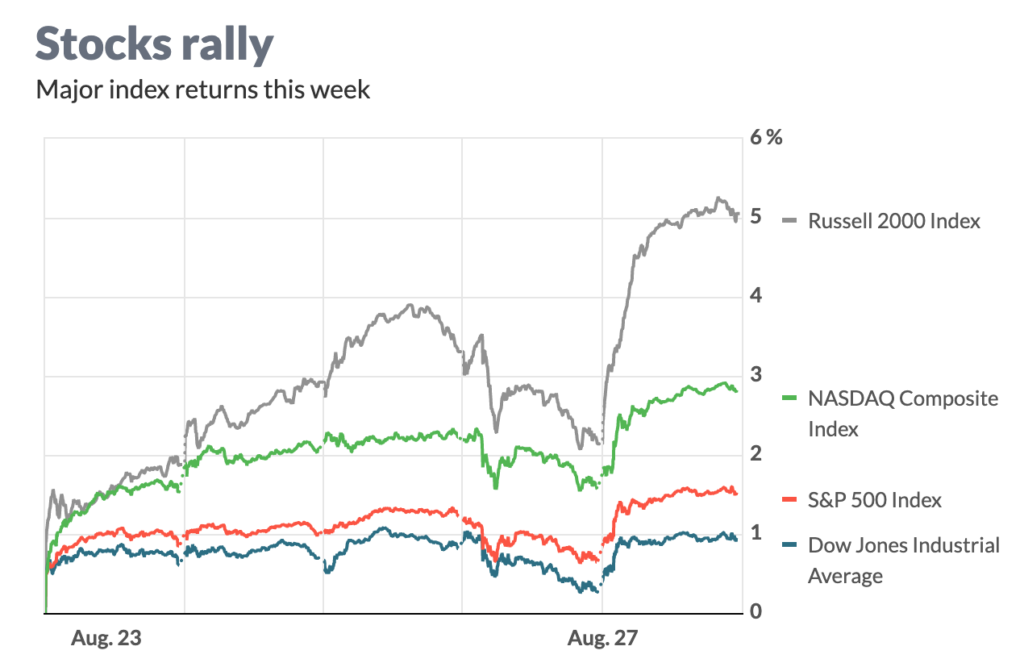

The stock market gains yet again – another Nasdaq and S&P500 record. The speech from the federal reserve chairman, Jerome Powell drove the stock market up to end the week. (article)

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

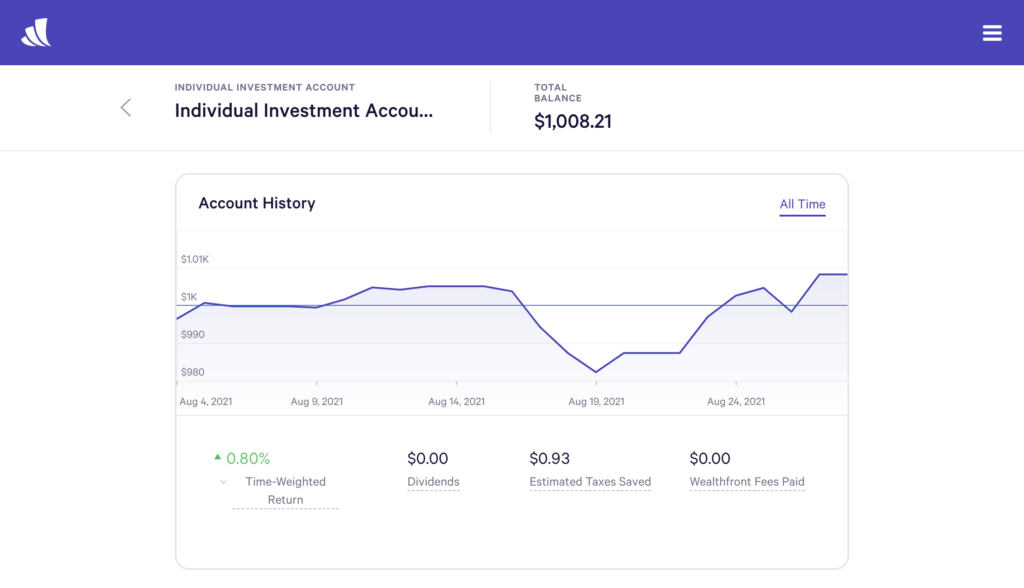

Stock Investment – Wealthfront

Today’s balance: $1,008.21 (Net returns to date: $8.21 gains)

Day change: $3.49 increase since August 25 (2 days ago) – $1,004.49.

Historical info: Invested $1000 on August 2, 2021

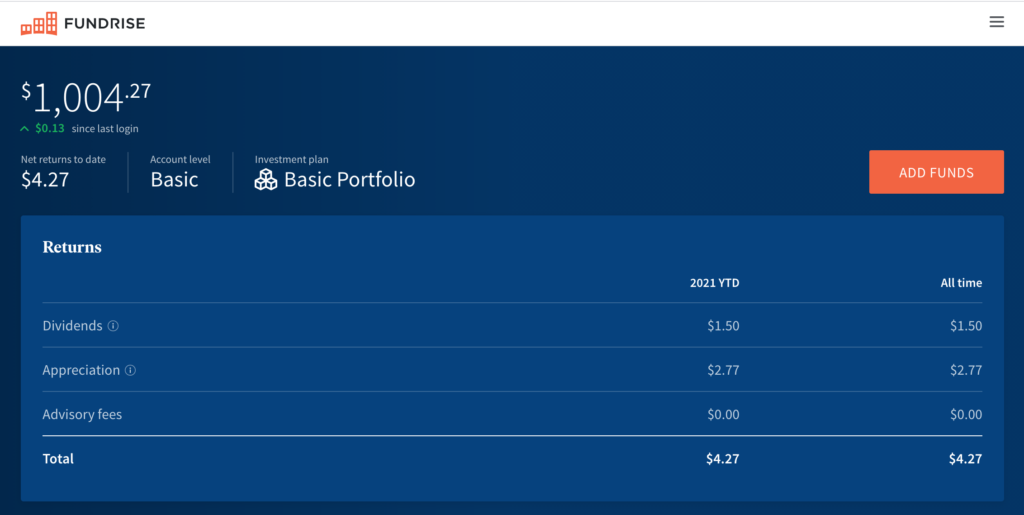

REITs – Fundrise

Today’s balance: $1004.27 (Net returns to date: $4.27 gain)

Day change: $0.13 (small growth) since yesterday ($1004.14)

Historical info: $1000 on July 27, 2021 (initial investment)

Stocks increased $4.49 in the last 2 days, while REITs had small growth of 13 cents. But with the stock market gains, our Wealthfront Stock has now surpassed REITs by a few dollars, $1008.21 vs $1004.27. Both are performing better than a traditional savings would be.

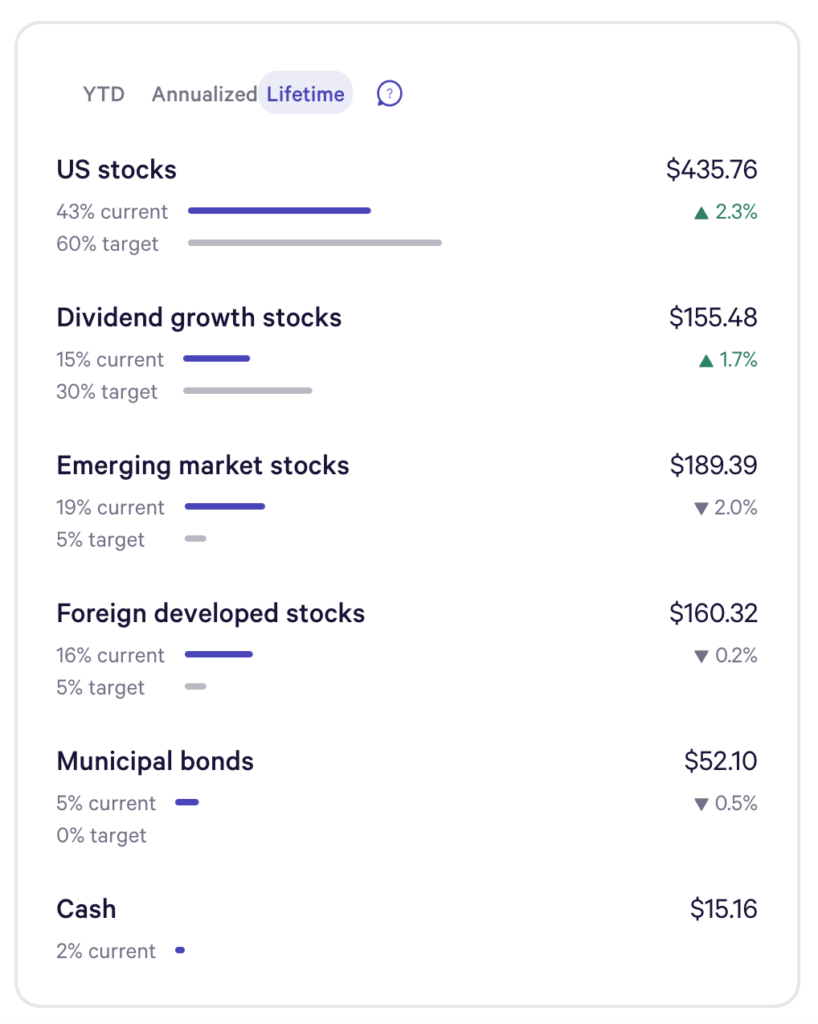

Another snapshot below of our specific Wealthfront funds – US stocks and Dividend growth are high performers with 2.3% daily increase for US stocks. Emerging market stocks again, continue to decline at 2.0%.

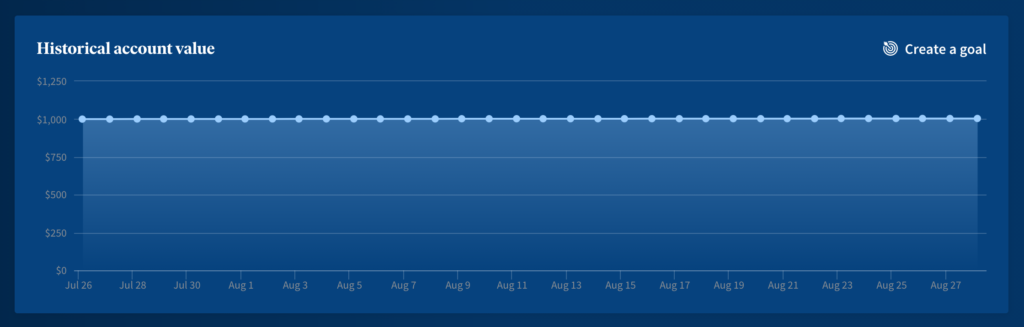

It’s been almost a month since investing in both Real Estate Investment Trusts, and Wealthfront Stock funds. In this reflection, this is what we’re able to see in terms of the graphs.

REITs looks like it’s a flatline, but the slope is tiny, it’s slowly increasing in several cents per day.

Stock funds from Wealthfront have been fluctuating quite a bit, even dropping below my initial $1000 investment. Thankfully, the overall stock market recovered putting up in the best position we’ve seen since investing. Not bad for 1 month of investments. We’ll probably see a more interesting month as we get closer to the end of the year.