How are mortgage rates determined?

When you’re shopping for a home, often times you’ll need to compare lenders rates based on the type of loan you want. But the one question is, when a lender tells you they can get you 2.875% which is a pretty good rate, what does that mean and how does it compare. You’ll often need to shop for rates from different lenders and compare them to each other.

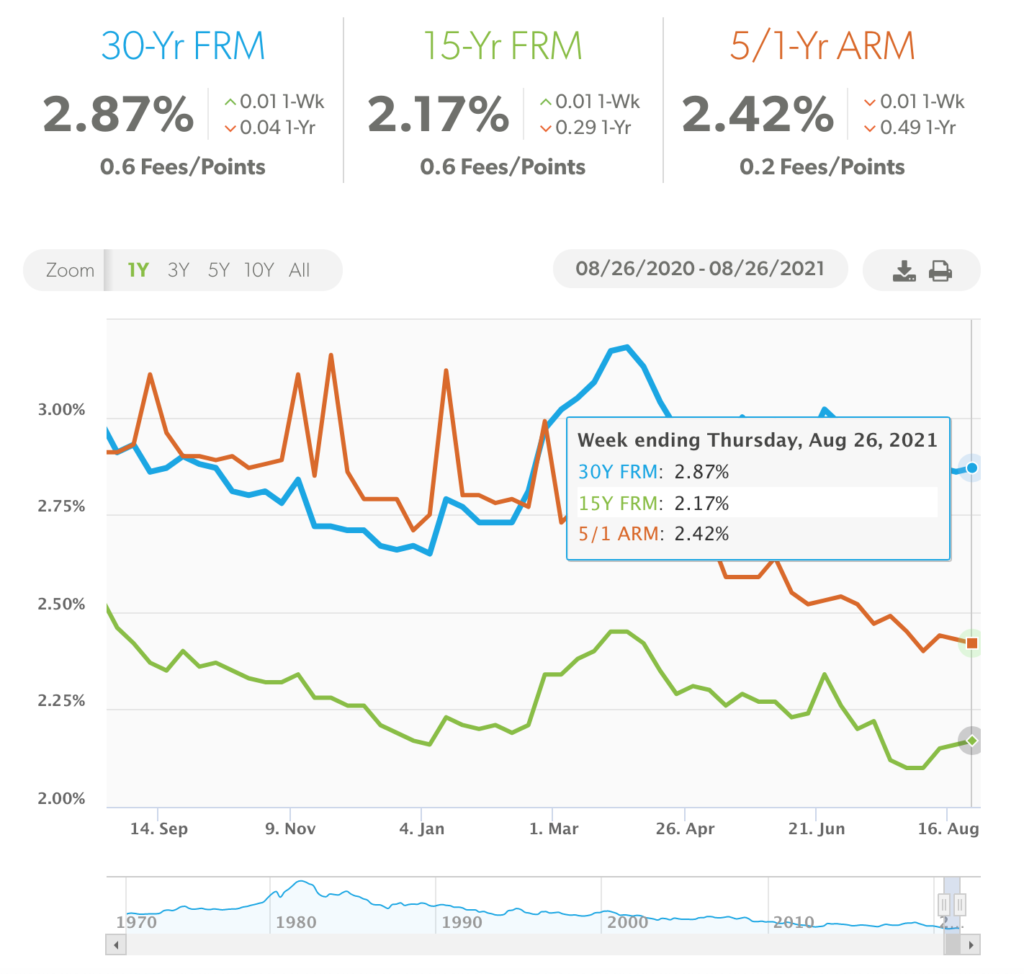

Another important aspect of knowing how the mortgage rates are changing and what’s determining them. One way to check is the FreddieMac website about Mortgage rates.

Here you’ll be able to view a graph that compares between the 3 common mortgages types: 30 year Fixed Rate Mortgage, 15 year Fixed Rate Mortgage, and 5-1 Year Arm.

How are mortgage rates determined?

Mortgage rates are largely determined by the economy. Rates are higher when the US economy is flourishing and lower when it’s struggling.

As of this week, August 26, 2021, Mortgage rates are holding steady.The federal reserve bank has been buying nearly 1 trillion dollars of mortgage bonds since last year which has drove rates down to historical lows. This is great because it reduce the amount of interest one would borrow on a house. Sometime later this year and next, the Fed announced they will begin to stop buying it, put the brakes on their quantitative easing as the economy recovers.

Two main economical factors that impact mortgage rates are employment and inflation. When employment numbers and inflation go up, mortgage rates tend to follow suit. Inflation has been low due to the Fed, but with next years plans to increase inflation, you will also see Mortgage rates climbing as well.

Right now, there’s a back and forth between the economic recovery and rising COVID-19 cases in the United States. This has left mortgage rates moving sideways over the last few weeks. Overall, rates continue to be low, with a window of opportunity for those who did not refinance under three percent.

Although lenders take this rate into account – they also personalize rates depending on buyer. So if you are a prospective Home buyers, you will get a unique mortgage rate based on your credit score, debt-to-income ratio, the amount of your downpayment, the type of mortgage, and the mortgage terms (30yr fixed, 15 yr fixed,, 5-1 arm, 7-1, arm, etc)

All and all, now’s a good time to refinance your mortgage due to the low interest rates. Also a great time to buy if you care about the low interest rates, but keep in mind, it’s a sellers market so you might be paying a premium on the home price. So it’s a great time to buy if you can luck out and get a moderately priced home at these historically low mortgage rates.

[…] See this article for more details on how mortgage rates are determined […]