REITs vs Stocks daily update – Oct 21, 2021

The stock market fluctuated through the day, but ended up just a bit higher – still it’s at it’s all time high (article). Snapchat stock sank 20% after missing Q3 earnings, but most corporate earnings have returned positive.

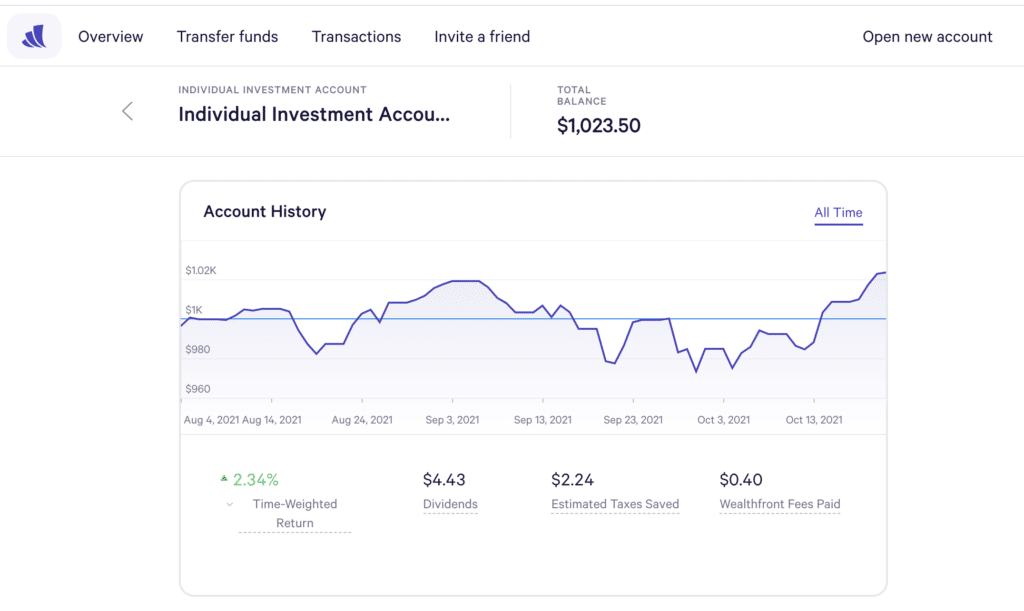

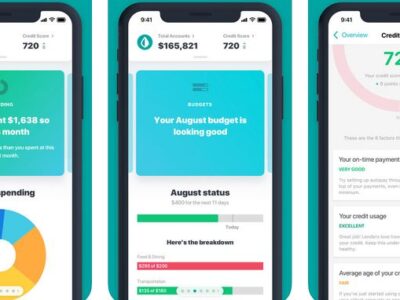

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks had a small gain. This puts our investment above the initial investment of $1000, currently at $1023.50.

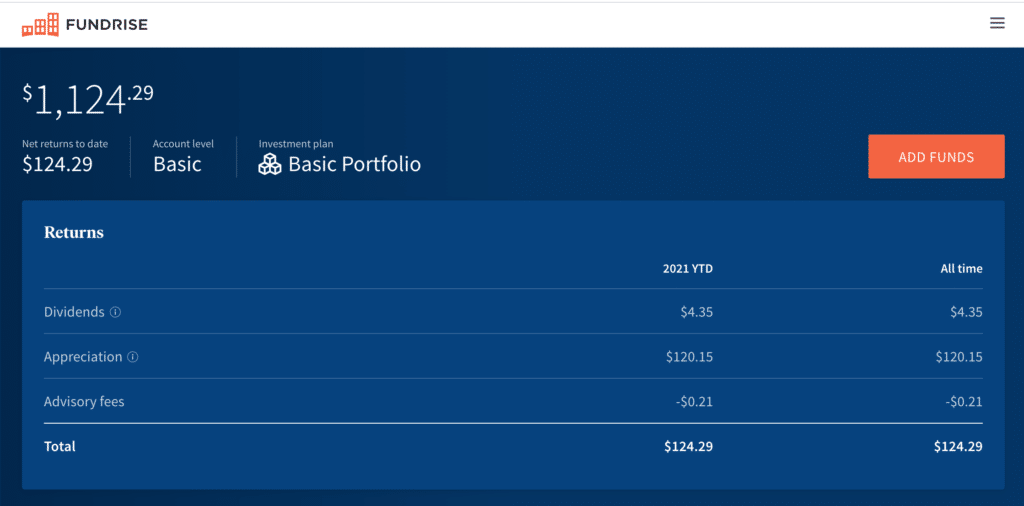

Today’s outcome is Stocks win over REITs, although minimal as there was a small 4 cent growth for Fundrise, Wealthfront had a daily gain of 96 cents. Still, the running total balance of REITs is $1,124.29, which is a a substantial gap over stock market, $1023.50.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $1023.50 (Net returns to date: $23.50 gain)

Day change: $0.98 increase since yesterday (Oct 20, 2021) – $1022.52

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,124.29 (Net returns to date: $124.29 gain)

Day change: $0.04 increase (4 cent increase for REITs) since yesterday (Oct 20, 2021) –$1,124.25

Historical info: $1000 on July 27, 2021 (initial investment)

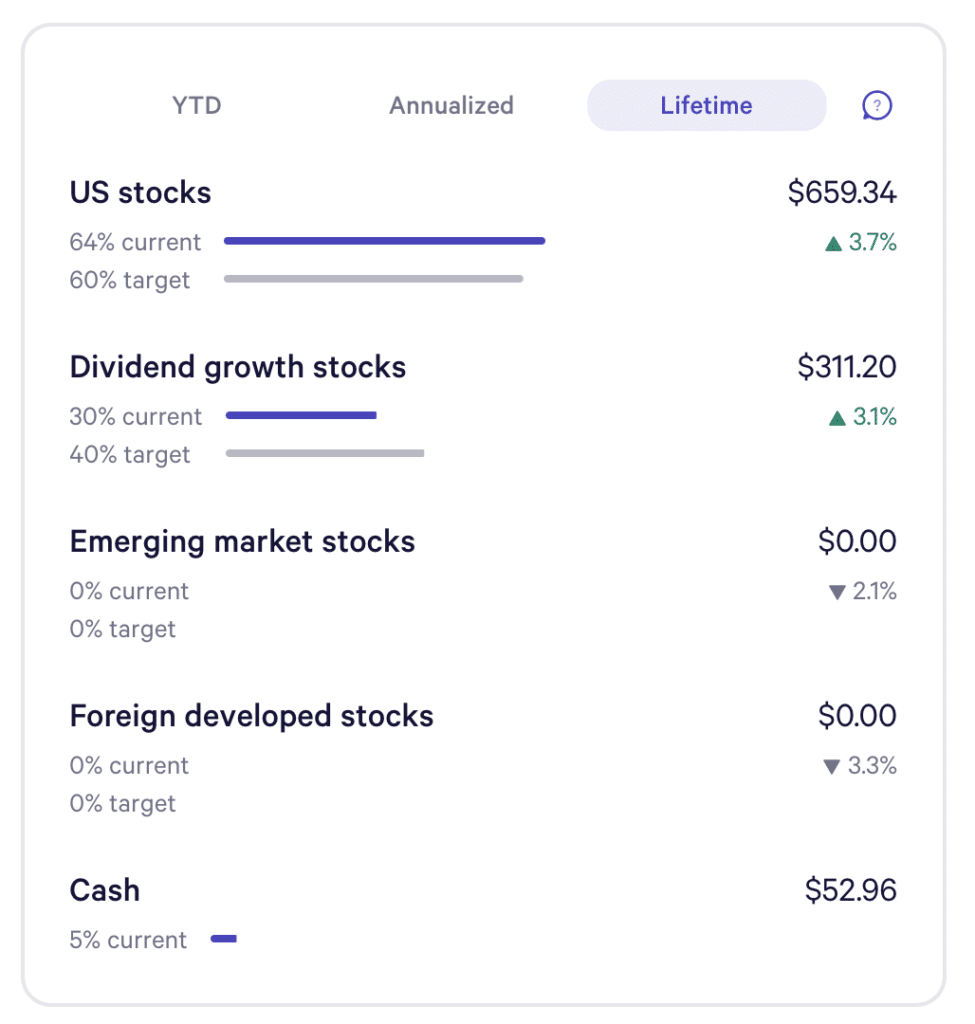

Wealthfront Funds snapshot:

US stocks are at another high with a 3.7% growth rate in lifetime earnings since we opened this Wealthfront account in late July. Dividend growth fell to 3.1% from 3.6%, but still positive growth. A strong recovery since the bad month of September.