REITs vs Stocks daily update – Oct 22, 2021

The stock market closing the week and today with mixed results, but nothing substantial in terms of a decline – news about the asset purchase tapering and interest rates increase from the Federal Reserve had kept investors weary. Supply chain issues and rising increase of interest rates are making investors worry, issues that will probably continue well into next year (article).

On the real estate front, since interest rates are rising across the economy, Mortgage rates continue to climb, currently at 3.09% for a 30-year fixed mortgage according to Freddie Mac. The rise is due to the trajectory of both the economy and the pandemic.

As the availability of existing homes are improving, prices remain high due to homebuyer demand and limitations on housing starts and permits resulting from the ongoing labor and material shortages. Experts predict the housing market to remain strong as we head into the end of the year.

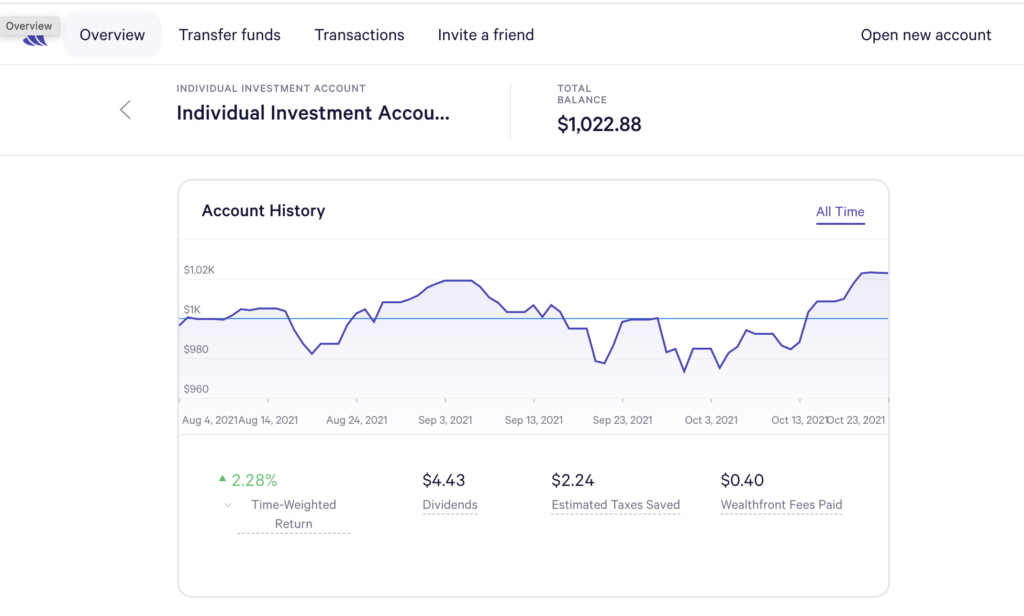

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks had a small decline, but our investment is above the initial investment of $1000, currently at $1022.88.

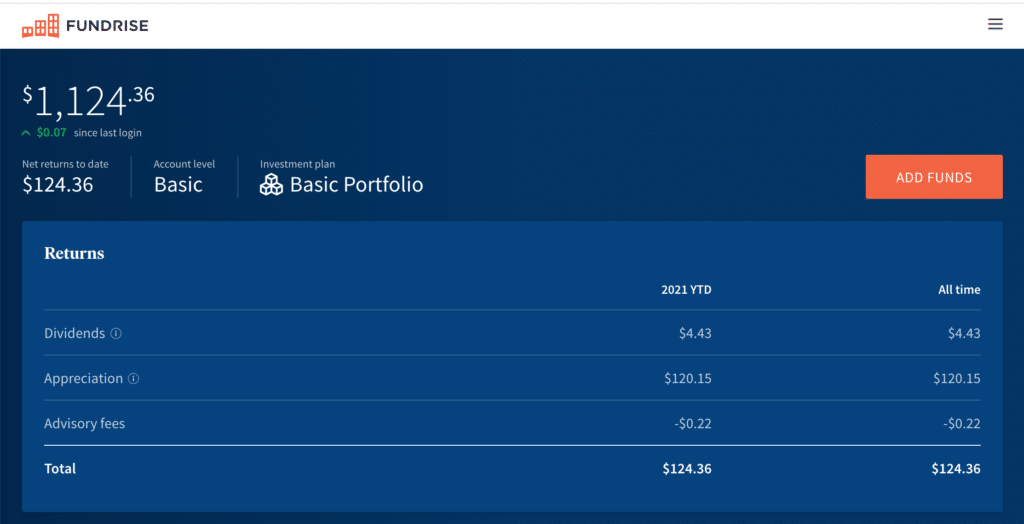

Today’s outcome is REITS win over Stocks, although minimal as there was a small 7 cent growth for Fundrise, Wealthfront decreased 62 cents. The gap between REITS and Stocks is significant as the total balance of REITs is $1,124.36 over stock market, $1022.88.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $1022.88 (Net returns to date: $22.88 gain)

Day change: $0.62 decrease since yesterday (Oct 21, 2021) – $1023.50

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,124.36 (Net returns to date: $124.36 gain)

Day change: $0.07 increase (7 cent increase for REITs) since yesterday (Oct 20, 2021) –$1,124.29

Historical info: $1000 on July 27, 2021 (initial investment)

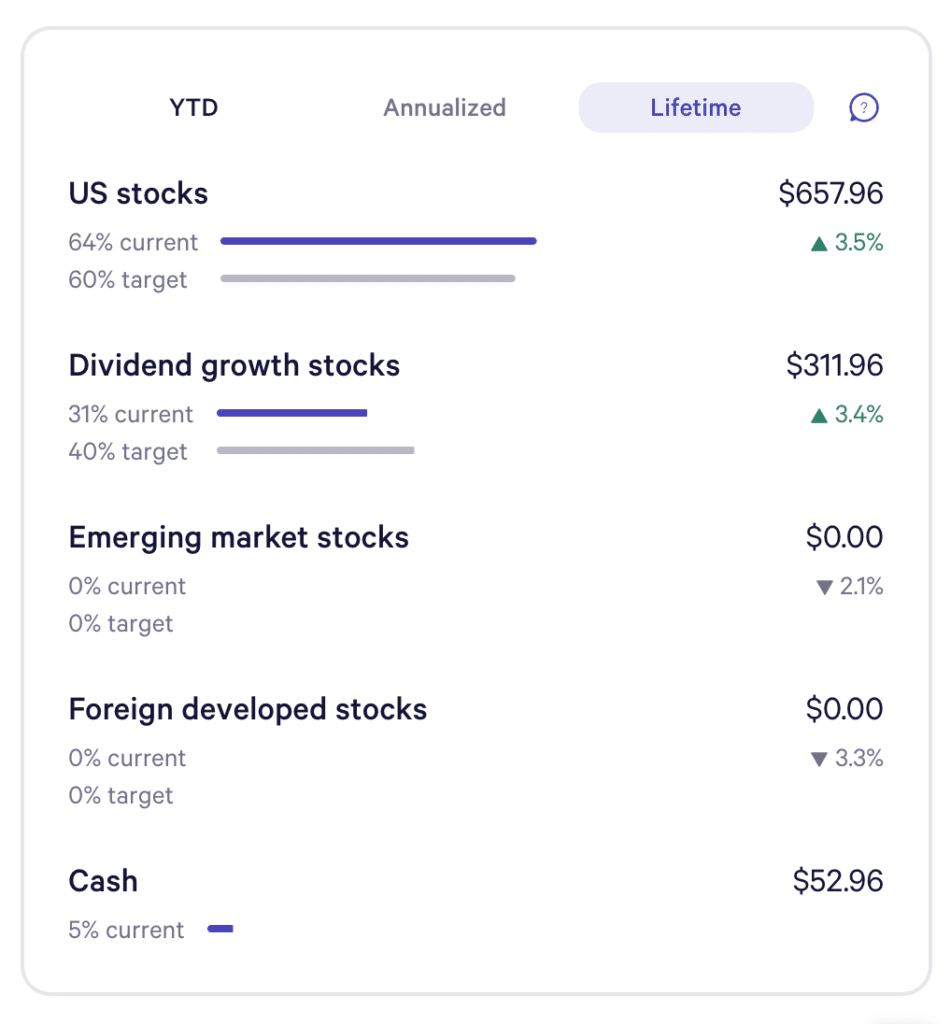

Wealthfront Funds snapshot:

US stocks dropped to 3.5% growth rate (from 3.7%) in lifetime earnings since we opened this Wealthfront account in late July. Dividend growth grew to 3.4%, up 0,3% from yesterday, but still positive growth across all fronts.