REITs vs Stocks daily update – Oct 25, 2021

The stock market began the week at an all-time high, as they awaited big tech earnings for Q3. Tesla hit 1 trillion dollars market capitalization, climbing over $115.18 increase (12.66%) today per share now at $1,024.86. The 3 indexes are in the positive, Dow and S&P 500 set record and closing highs and Nasdaq gained.

Inflation pressures due to supply chain constraints are still top concern as Federal Reserve Chair Jerome Powell spoke about the topic, stating he expected this to last long than previously expected, well into next year.

The rest of this week will be all on the earnings reports and performance of the big tech companies, Google, Apple, Facebook, Amazon. So far, about 23% of the S&P500 companies have reported earnings results and the boost in the stock market or declines will be based on these companies for the next few weeks (article).

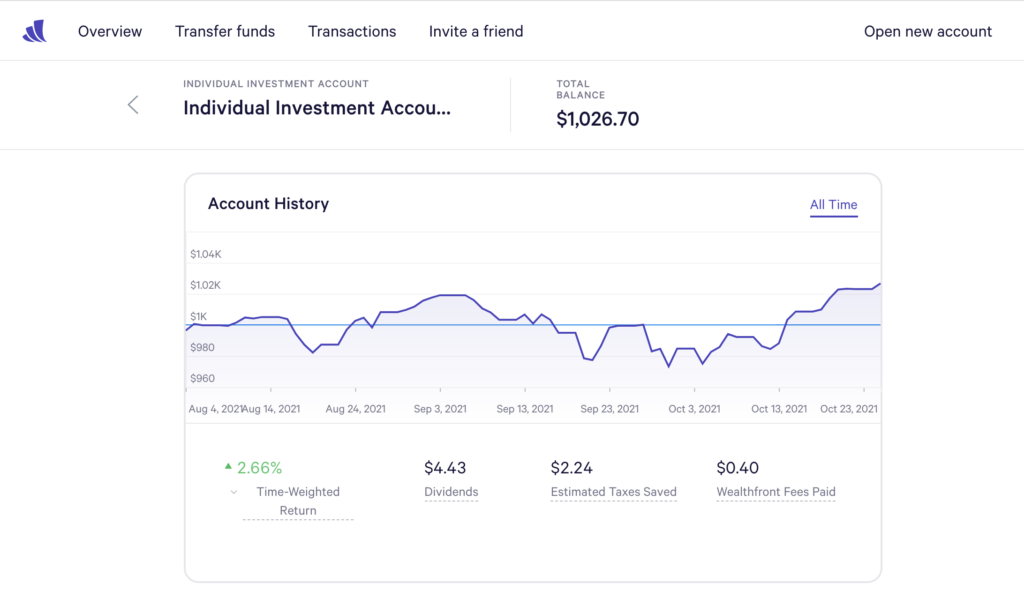

How this affects our $1000 investment in Wealthfront – our Wealthfront stocks increased with the stock market and above the initial investment of $1000, currently at $1026.70.

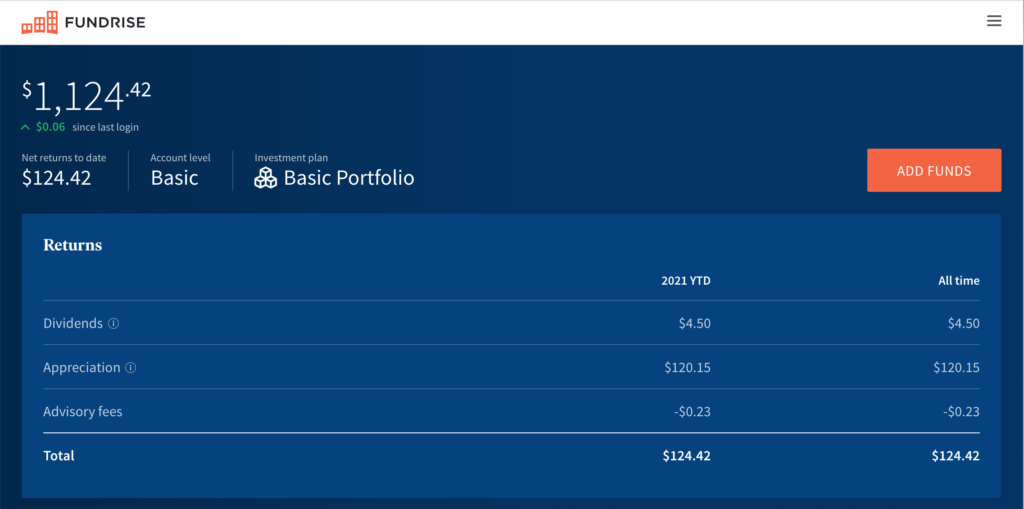

Today’s outcome is Stocks win over REITs, there was a minimal 6 cent growth for Fundrise, while Wealthfront had a dailey increase of $3.82. The gap between REITS and Stocks is significant as the total balance of REITs is $1,124.42 over stock market, $1026.70.

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

Stock Investment – Wealthfront

Today’s balance: $1026.70 (Net returns to date: $26.70 gain)

Day change: $3.82 increase since Friday of last week (Oct 25, 2021) – $1022.88

Historical info: Invested $1000 on August 2, 2021

REITs – Fundrise

Today’s balance: $1,124.42 (Net returns to date: $124.42 gain)

Day change: $0.06 increase (6 cent increase for REITs) since Friday of last week (Oct 25, 2021) –$1,124.36

Historical info: $1000 on July 27, 2021 (initial investment)

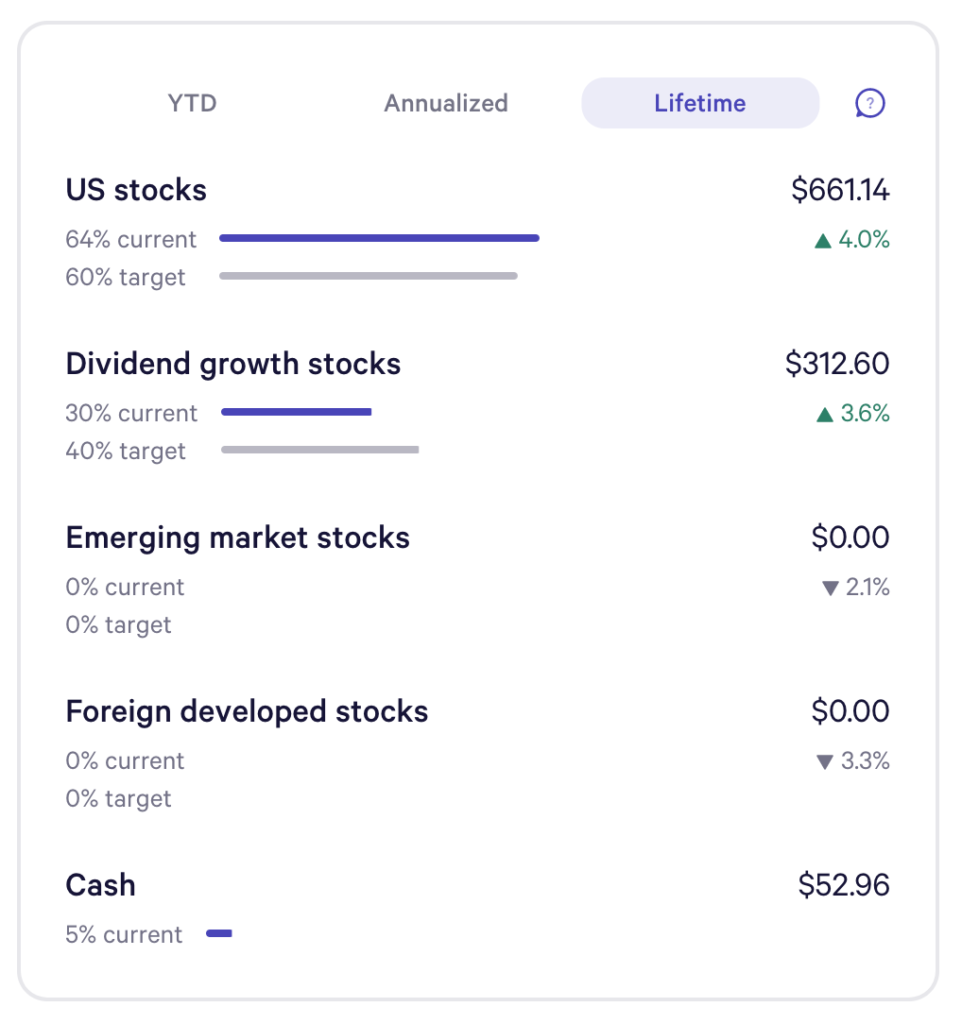

Wealthfront Funds snapshot:

US stocks hit an all-time high with my fund growth at 4% in lifetime earnings since we opened this Wealthfront account in late July. Dividend growth grew to 3.6%, up 0.2% from Friday of last week. We’re seeing positive growth across all fronts.