Student loans – how can I pay them off? And can I do it faster?

Student loans are tricky for young Americans. Even today, it’s the highest amount of debt I carry. When I went to school, I had to pay for college myself and the only way to do that for me was to take out student loans. I went to both undergrad and graduate school – one was a public university in the same state I grew up in so it was a bit cheaper than going out-of-state. And after, I went to a for-profit graduate school, that was due to me transitioning to another field of study from what I did for my bachelors degree. I came out with over $100,000+ of student loan debt in total. What was worst was that my interest rates for the grad plus loans were very high, about 7.9% which represented the majority of my student loan debt. The first few months I graduated from school, I started accrue-ing an unforeseen amount of interest and it was staggering. It took me 3 months to find a job after graduating and while I was interviewing, my loan balance was increasing. The moment I got my first job, I was putting $1000/month; but student loan debt was stilling growing rapidly. Isn’t that scary?

Why was this happening? What do I do…I thought to myself – it was the interest that was hurting me and there was nothing I could do about it.

As mentioned, the majority of my loans was 7.9% interest. What scared me was even the average annual return of stocks from 1957 through 2018 is roughly 8%. So even if I had the money to invest, even if it resulted in really great gains, it will never really cover my student loan.

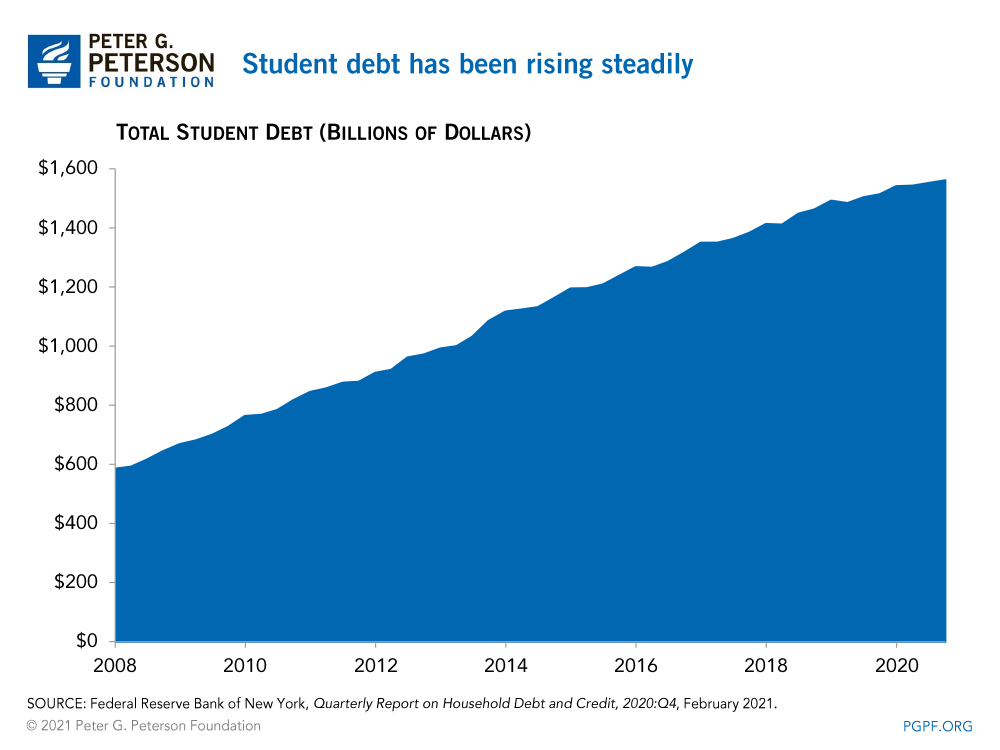

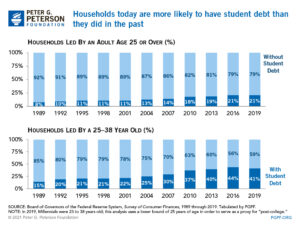

Today, the amount of student debt in 2020 totaled nearly $1.6 trillion, more than twice the amount outstanding in 2008 ($600 billion) – most loans being issued by the Federal Government. They’ve made student loans easy to get and different than other loan evaluations which consider various mechanisms to determine risk. I could hardly keep up with payments, let alone pay these student loans off quickly. Student debt is becoming more common, and quite different than what it use to be for those people that went to college decades ago.

What’s sad is it’s presented to you as one of the only ways to pay for school besides scholarships and grants – and given I was presented the options to take loans right after high school where I was pretty young trying to focus on what I’d lean in college; there was no way I’d understand the affects of taking on debt many years later.

In fact, the average loan debt for a bachelor’s degree among the class of 2019 was $28,950, according to the most recent data available from The Institute for College Access & Success. (Reference). And I had plenty more than this amount.

So what did I do when I dug myself into this hole…what really saved me in the end was refinancing, but it was something I couldn’t do right away. I just graduated from grad school and needed a rainy day fund. Generally speaking, best to have 6 to 12 months. I spent the first year paying my loans with whatever paycheck money I had after saving about 10% for my rainy day fund. Below is what I learned about pay-off strategies, which are more common sense – but not obvious to me at the time. So I’m hoping anyone in a similar situation will find it useful.

Payoff strategies for tackling loans

1. Use interest reduction techniques if it fits: When you use the Federal loan websites used to pay off your student loans, you may have the option to have an automatic payment method which will reduce interest by a small amount. This depends on the company servicing your loan. About 0.25% off when I was doing it, which is marginal – I was using myfedloan.org. At first I thought this was good, since I was lowing my interest a bit, but not really wise on my part. Much later, I started to understand how the applied my monthly payment. That leads to the next strategy…

2. Target the high interest loans: What I learned is I shouldn’t pay the monthly balance automatically and have them apply my payment as it’s distributed equally to the bunch of loans, but what I learned instead is that I should manually look at each loan individually and pay off the highest interest ones. This will count towards the minimum monthly payment that is required from the company servicing your loans.

3. Apply extra payments directly to the principle balance: Often times, I had extra money to pay off my loans due to some good months of a higher paycheck or a bonus. I made the mistake a few times to apply the payment and let the loan service company distribute it, but I learned what’s best is to apply it to the loans you want directly target, the higher interest loans. Once you cover the monthly minimum and monthly interest, it’s easier to target the principle balance directly.

These techniques were basic and helped, but the interest was still an issue that was preventing me from getting ahead. I was always playing catch up and couldn’t pursue investing strategies. I had to fix that first so after I got enough money as a safety net and made sure my job was more secure, I started researching private banks that would refinance my loan.

Refinance your loans

When I started making a steady paycheck where I could guarantee some security, I began looking at several banks and read reviews – SoFi was one of them, mainstream banks like Bank of America and WellsFargo were others. But it’s really came down with the relationship I would have with the bank. I was worried about banks that sell off your loan after a few years and you end up with a loan servicer or credit union that you don’t want. I discovered First Republic Student Loan Refinancing and it was 1.95% over 5 years, or 2.95% over 10 years. They had a good reputation and really have a white glove service approach to banking. With their rates , the lower the years means, the high the monthly payments. I calculated how much extra I could pay off per month and ended up choosing to refinance all of my high interest loans from 7.9% to 2.95%. This really saved me – I was able to see my loans stabilize, and my monthly payoffs were hitting the principle balance in ways that allowed me to see forward progress, a small loan balance. This also allowed me to start investing, and get the 8-10% stock market growth potential that’s been occurring these last few years while keeping my debt stabilized.

This was really the beginning of a healthy financial trajectory that would pave the way for where I am now, active in my investments. I still have less than 4 years of loan payments left, but my net worth is positive and and assets growing.