A closer look at the first 2 weeks of Fundrise & REIT daily update – August 7, 2021

The weekends usually don’t have stock growth for me to compare as the trading floor is closed, but Real Estate Investment Trusts still seem to have daily updates.

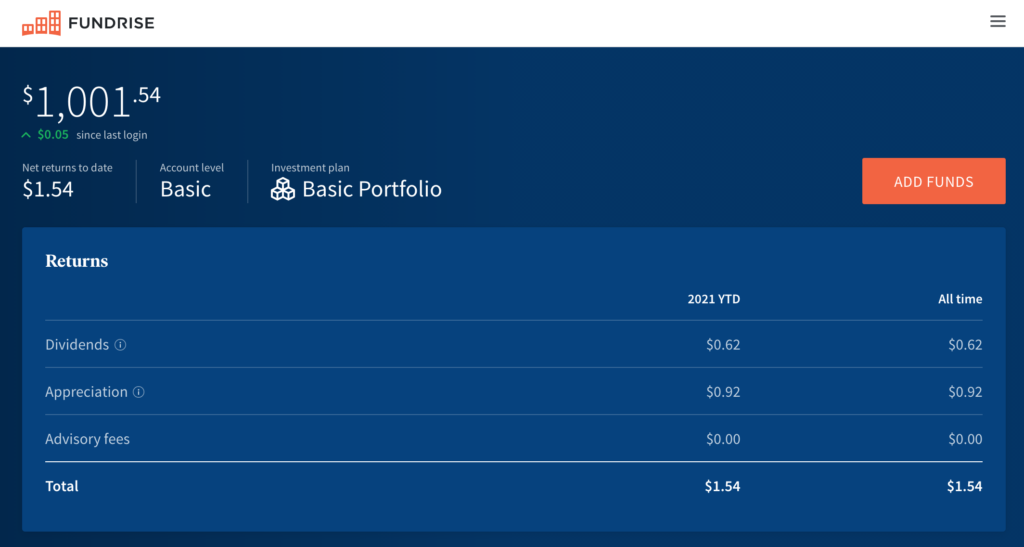

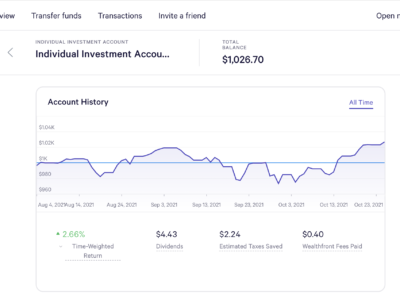

Today’s balance: $1001.54 (Net returns to date: $1.54)

Day change: $0.05 (5 cent growth) since yesterday ($1001.49)

Historical info: $1000 on July 27, 2021 (initial investment)

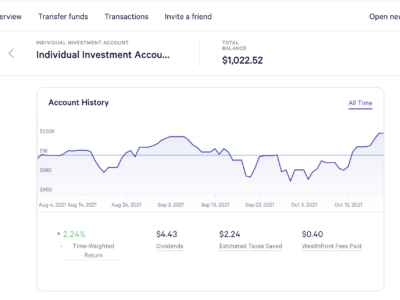

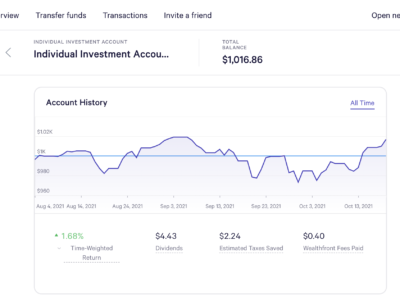

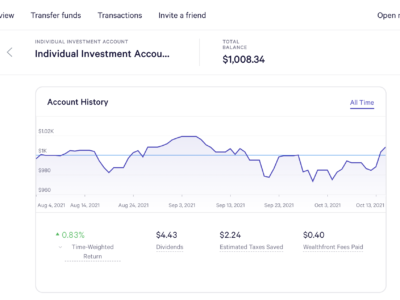

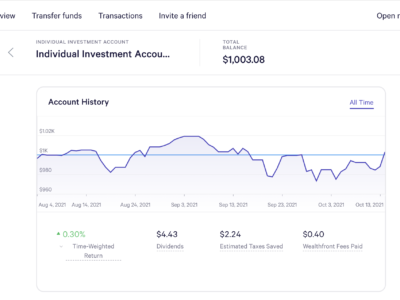

Let’s also take a deeper look at the Fundrise account specifics. We’re able to see historical account value, hopefully in a few years we’ll see more substantial growth, but there is a steady positive slope. The gains have only been a few cents per day.

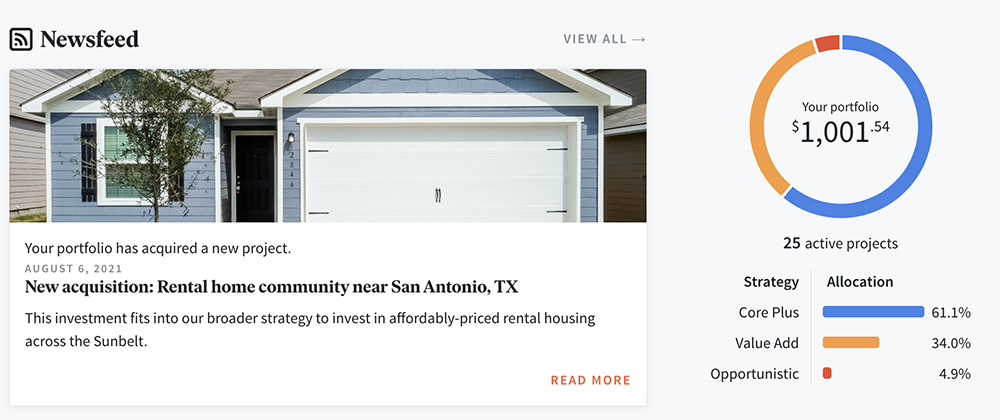

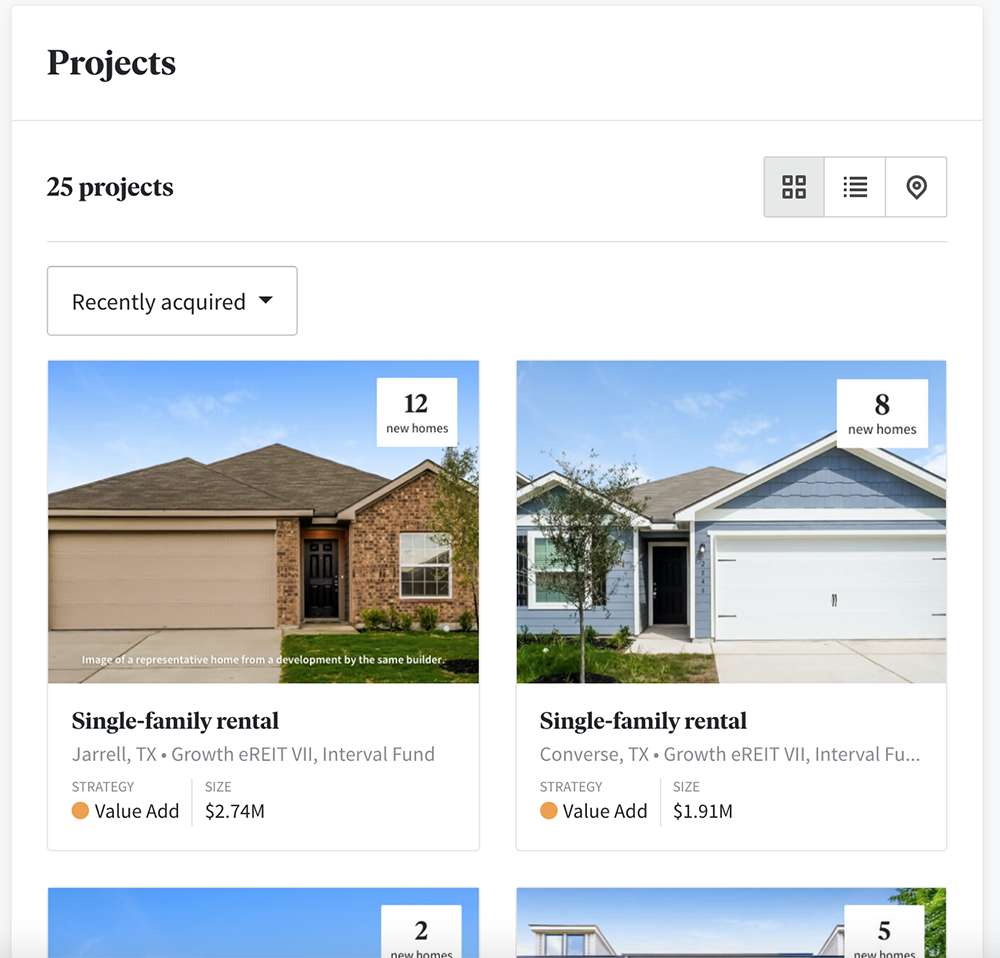

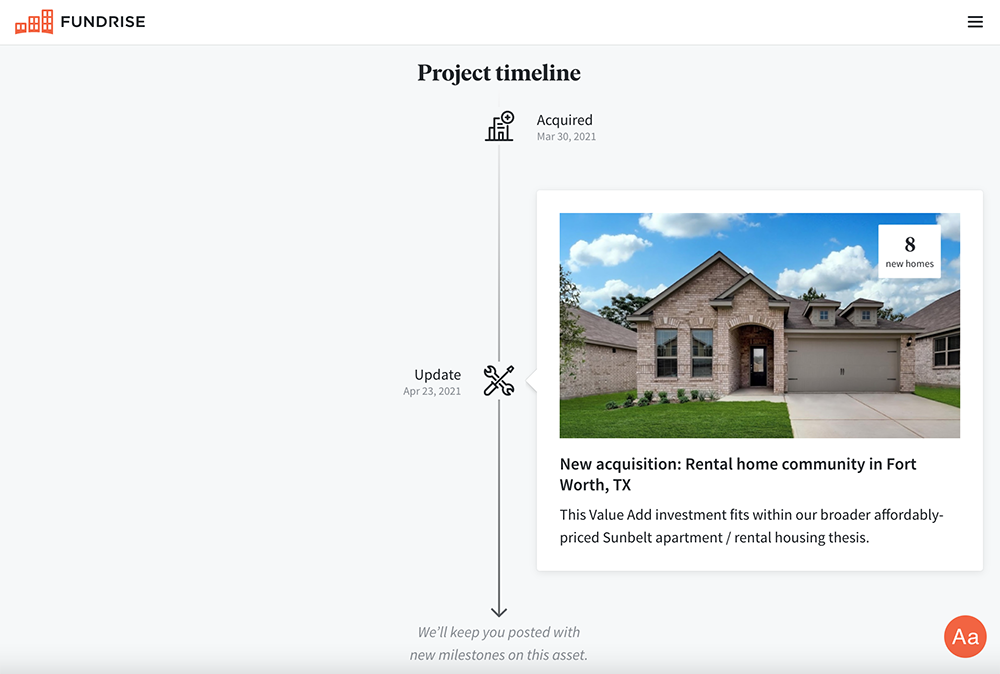

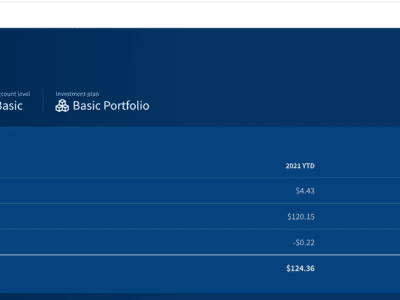

What’s more interesting that Fundrise provides us is a deeper look of what the $1000.54 portfolio is made of. It shows what property is being bought. Quite recently, the portfolio that they’ve provided me mostly adds new property rentals and houses. Seen below is one from San Antonio, TX while it shows the allocation of funds to the right. Core Plus, Value, Add, and Opportunistic doesn’t mean much to me at the moment. The majority of this portfolio is in an Interval fund stated to be in a ramping up stage. This stage is primarily on raising capital and acquiring projects. I guess that means there won’t be much returns for quite awhile as properties seem to be constantly acquired and still need to be leased out or constructed.

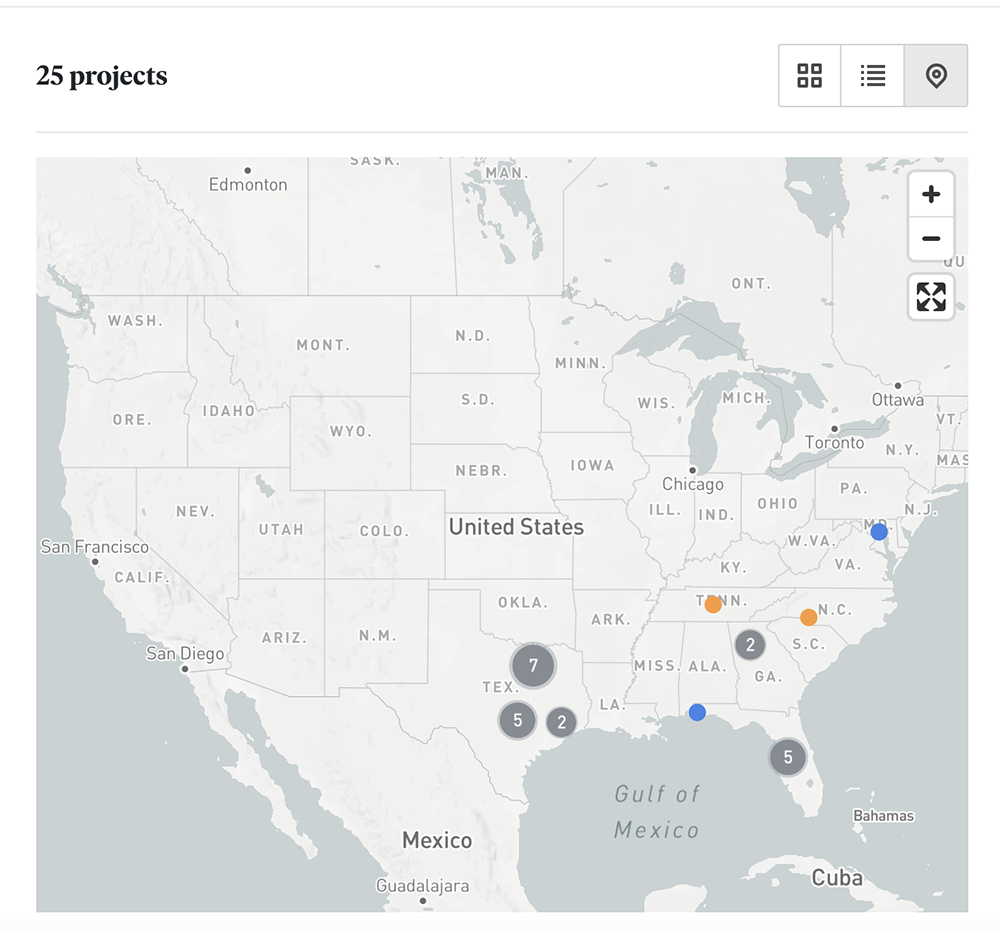

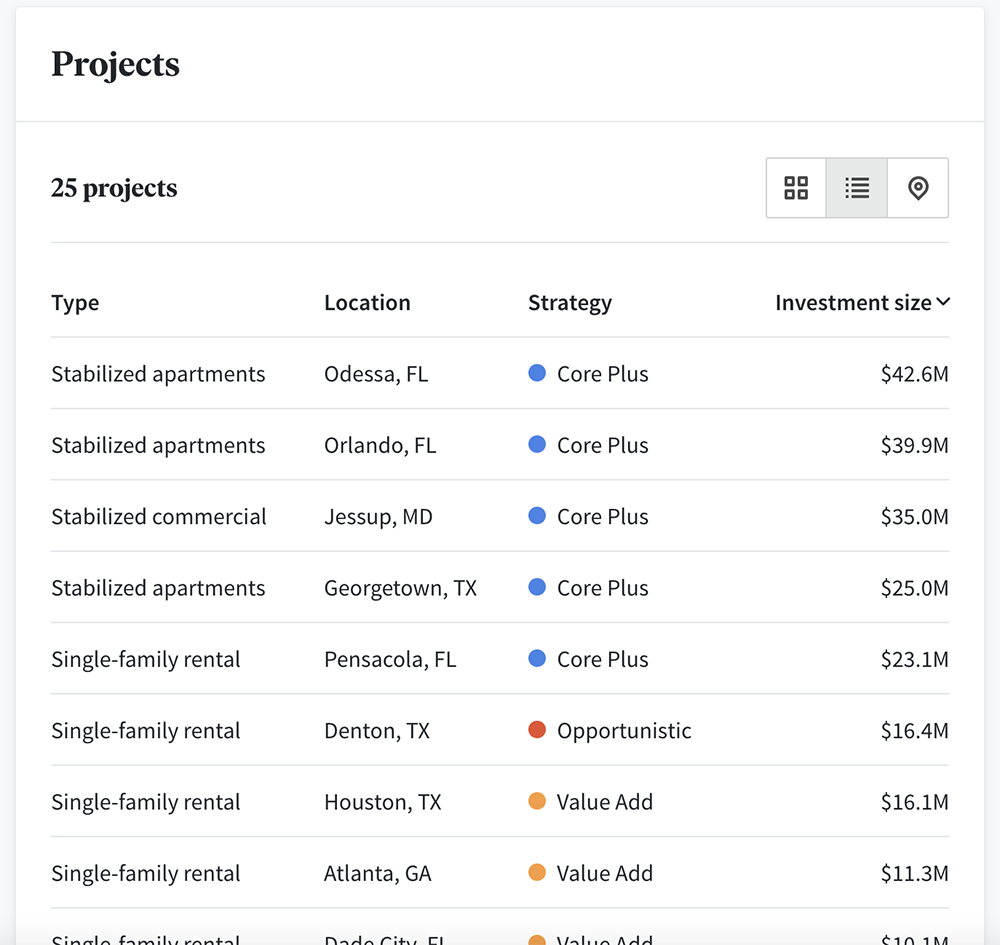

A mixed portfolio of 25 projects seem to be focused in the south east area of the United States with heavy investments in cities of Texas and Florida, and some in North Carolina and Tennessee.

You can see the investment size of each project are well over 10+ million each, which means my $1000 is a very small sum of that, but at least it gives me a seat at the table.

Overall, the transparency of seeing where my money is going is nice – although to be completely honest, it feels a bit artificial for now as most of the activity is acquisitions and little activity in the timeline itself. More to come I’m sure as this fund and account ages.