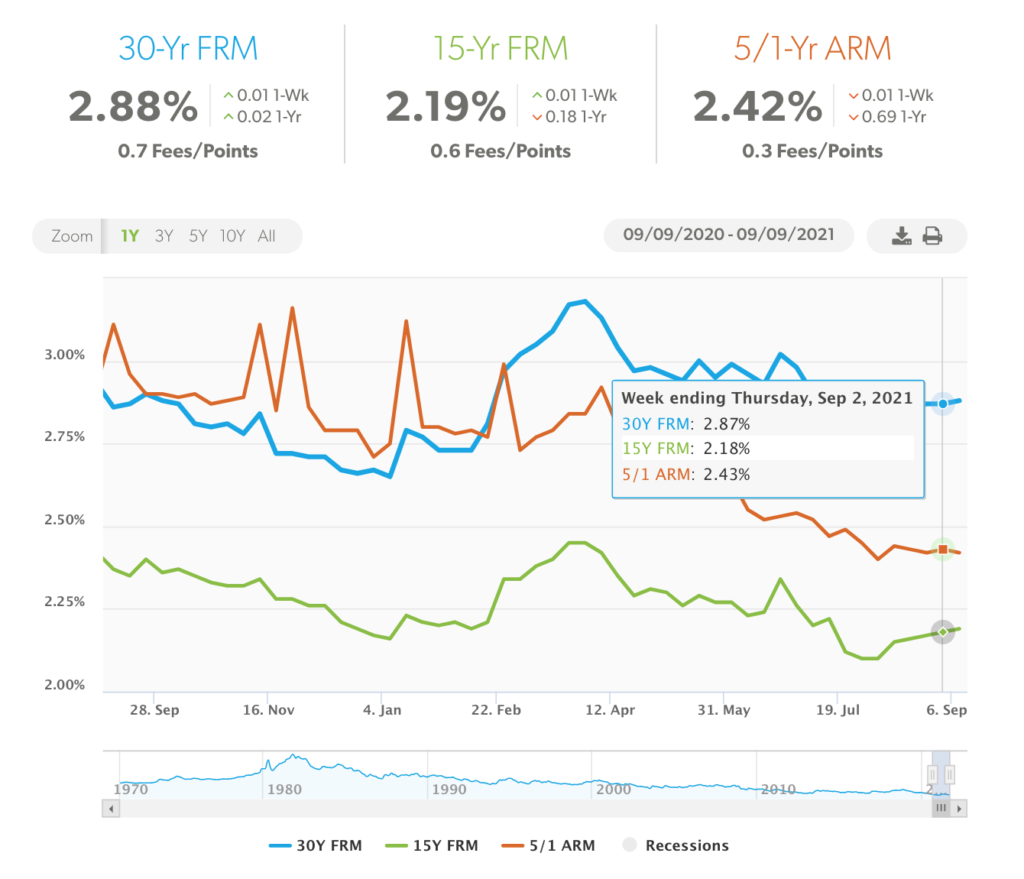

Current Mortgage Rates still flat and very low – week of Sept 9th

Mortgage Rates Remain Relatively Flat for the week of September 9, 2021, up 0.01% from last week Sept 2. The current mortgage rate is 2.88% for a 30 years mortgage which still at historical lows since the Fed has been buying back bonds and mortgages. The average rate for the 15-year fixed-rate mortgage is 2.19% and the average rate on the 5/1 adjustable-rate mortgage (ARM) is 2.42%.

The economy continues to grow, it has lost momentum over the last two months due to the Delta virus, the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence.

See this article for more details on how mortgage rates are determined

So mortgage rates dropped early this summer and have stayed steady despite increases in inflation, although speculation is that it will increase end of this year and more significantly next year, 2022.

With the low rates at this moment, right now is great for the possible home buyer that wants to lock in rates at an all time low and find the home they want to purchase even with the lower supply – although the low rate window is closing, but doesn’t seem to be affecting overall prices which has skyrocketed this year.