REITs vs Stocks daily update – September 8, 2021

Today, there’s overall concern about the global stock market. Those concerns has caused yet another drop in our Weathfront index fund investments:

- Buffet’s global market indicator is high at 142% (article)

- Large financial institutions like Morgan Stanley predict a 15% fall by year end (article)

- Pressures from the FED to raise interest rates and the downstream effects on the stock market (article)

- Geopolitical worries that continue from recent weeks as well as Congress and Democratic desire to introduce a 3.5 trillion dollar reconciliation package to send back into the economy

All of these add up to a big worry and negative sentiment on the market and the stability of stocks. As we’ve seen in other weeks, it’s gone down and back up, but we’ll see how this one stands. I’m mentioned this as it affects both our stocks and REIT investments that we’ve done and following external events help us build knowledge and trends directly on our money.

Today our stock investment decreased significantly, a second day of losses at $5.19, while REITs had no growth. Fortunately, we’re still above our $1000 dollar investment from early August at $1,010.61. Given the losses in the stock market, I would normally give this one to my Fundrise REITs, but it has no growth today. Have to say, I’m declaring no winner today!

TLDR; What’s this all about? I invested $1000 in both REITs (Real Estate Investment Trust) and the Stock Market, and now it’s a challenge to seeing which one will perform better in the next 5 years. You can read the start here.

Here’s the numbers today:

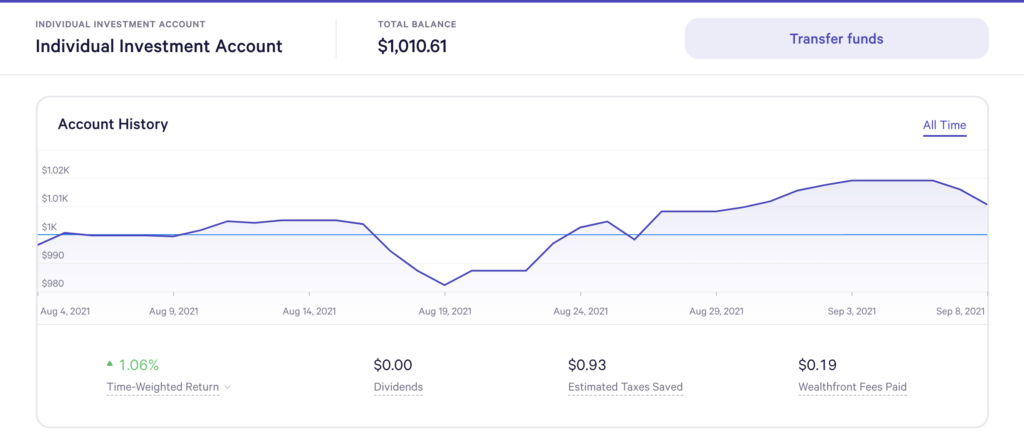

Stock Investment – Wealthfront

Today’s balance: $1,010.61 (Net returns to date: $10.61 gains)

Day change: $5.19 decrease since yesterday – $1,015.80

Historical info: Invested $1000 on August 2, 2021

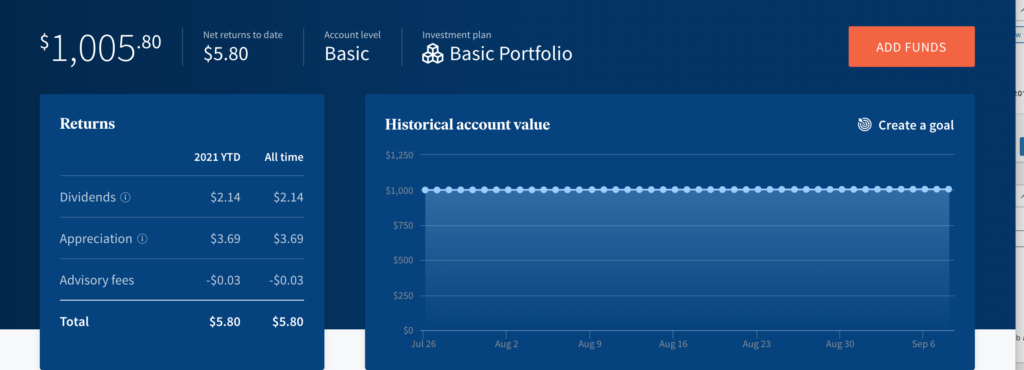

REITs – Fundrise

Today’s balance: $1005.80 (Net returns to date: $5.80 gain)

Day change: $0 (no growth for REITs yet) since yesterday – $1005.80

Historical info: $1000 on July 27, 2021 (initial investment)

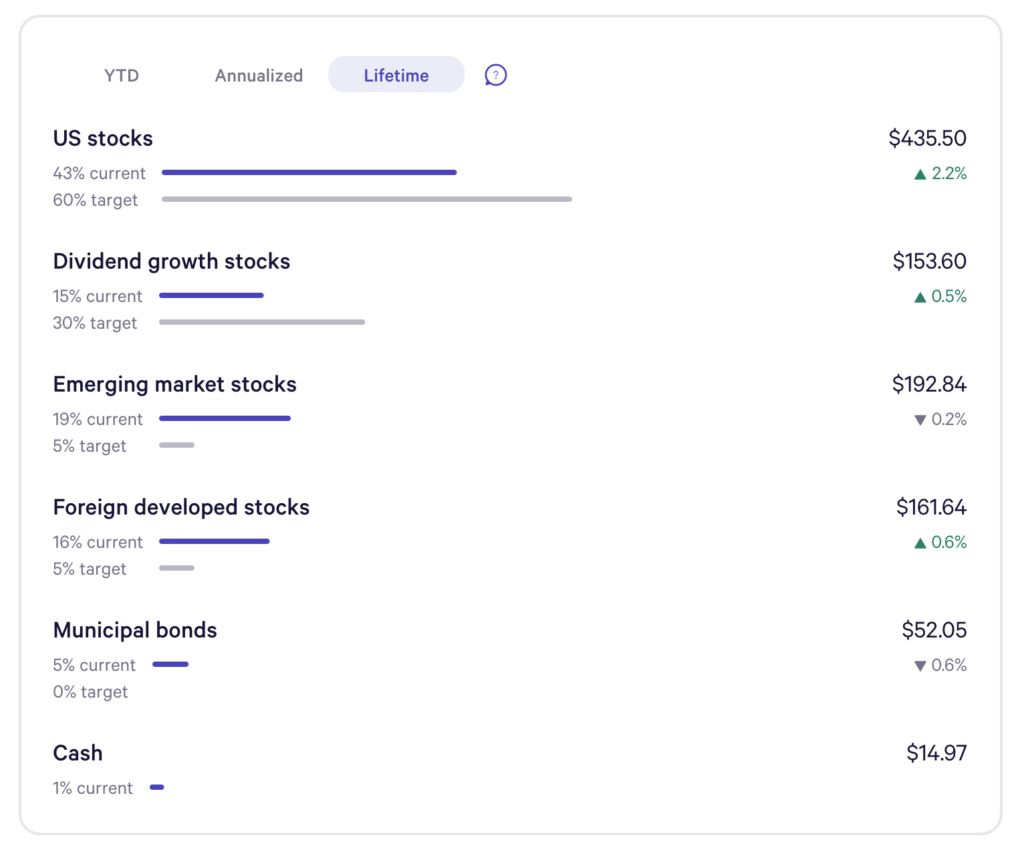

Wealthfront Funds snapshot:

US stocks still have a positive lifetime growth including Dividend growth stocks, but Emerging market stocks were hit and have decreased.

Hopefully these external events both COVID and jobs normalize and bring confidence back to the stock market.