The U.S. housing housing demand has always been centered around the people. As time goes on and as population increases, more people need houses. 2012 was a great time to buy a home because the ticket price was cheap, significantly reduced due to the 2008 great recession. It was a buyers market then and people that had purchased it them are reaping the benefits of appreciation on their homes and more equity today.

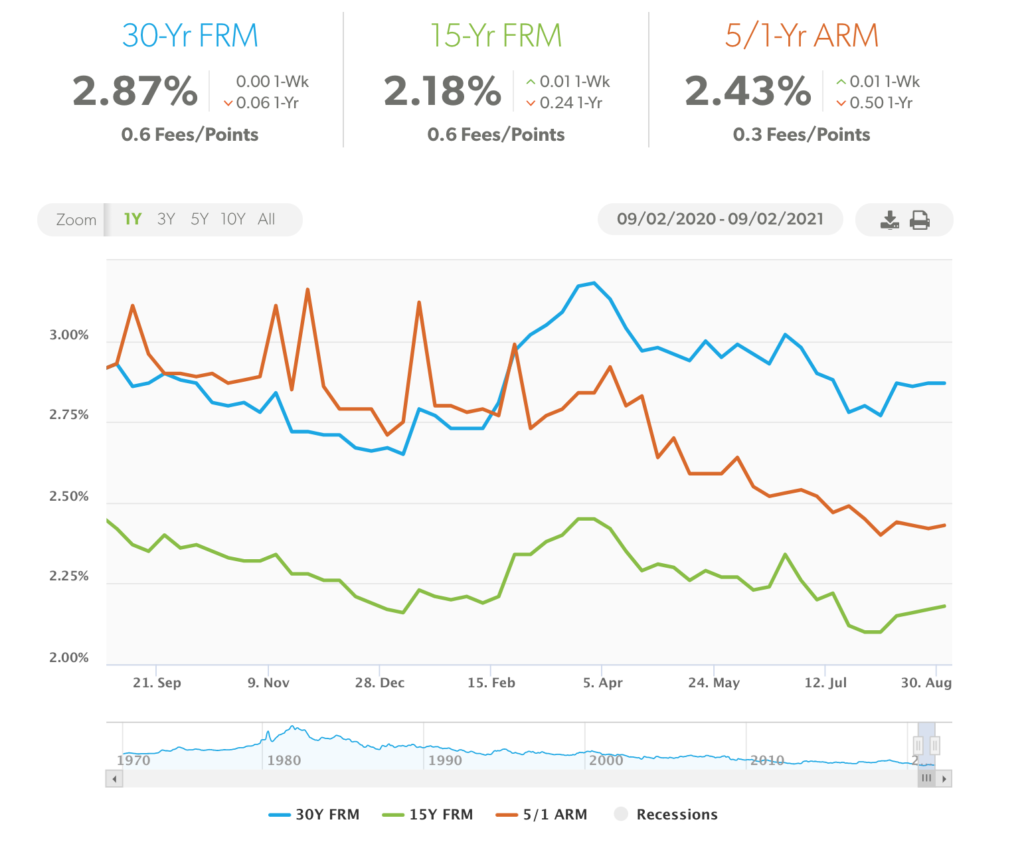

Mortgage Rates for a 30 year mortgage in 2012-2015 was around 3.5% to 5%. Today’s rate (Sept 2021) you’ll fine rates below 3% (2.87% national average). The lowest it’s ever been in history. However, in today’s real estate market (2021), buyers will surly pay the price and then some. Since the pandemic, home prices have rapidly increased, the highest it’s ever been. This is due to many factors:

- People want larger homes and moving out of small apartments / condos, remote work has allowed people to work further and live outside of 18 / 24 hour cities in more suburban areas.

- Supply is really low, new home development slowed in 2012 given there were so many houses on sale due to the low demand and foreclosures of existing homes. It’s starting to increase, but not enough to reach the appetites of home buyers

- Interest rates are at an all time low, due to the Federal Reserve buying mortgage-back securities and bonds, trying to reduce the burden off the economy until there’s growth. While interest rates are low, generally that means prices are high.

- It’s a sellers market: given all this information above, there’s more buyers and less sellers. So homes are selling fast, are most likely overbid. In the bay area alone where I live, homes are being bid at 20-30% above listing price.

It’s a sweet deal for the seller, provided they have another place to live, but for buyers, it’s the question if you can afford a home now, or should you wait. There are pros and cons to either – but regardless on your decision, it’s generally helpful to have the information you need to determine if your personal finances can support if you can buy a home.

If you’re planning or deciding if you’re ready to buy a home, here are 5 tools you should use to determine if it’s good invest based on your investment.

Tool #1: Determine your mortgage rate and how much you can afford.

As of Sept 2021, Mortgage Rates continue to stay flat at its lowest rate in history. The incentive to buy a home has never been so high because at these low rates, you pay the least amount of interest. By the end of this year and into 2022, you’ll start to see interest rates beginning to increase due to economic recovery and growth since the pandemic (No more closures, yay!). It’s also due to the FED deciding to reduce their buy backs of those bonds and securities I mentioned. Once that starts, you’ll see interest rates shoot back up. Regardless of if you are buying a home now or 10 years in the future, it’s important to know what the current mortgage rates are for the U.S. By going to the Freddie Mac website on Mortgage rates, you can see a more generalized mortgage rate of the times.

Obviously, when you buy a home and pick your lender, the rates will be personalized based on your credit score and relationship with that lender, but this is more than enough to give you a ballpark idea if you plan on purchasing a home now. More on how rates are determined in my article, “How are mortgage rates determined?”

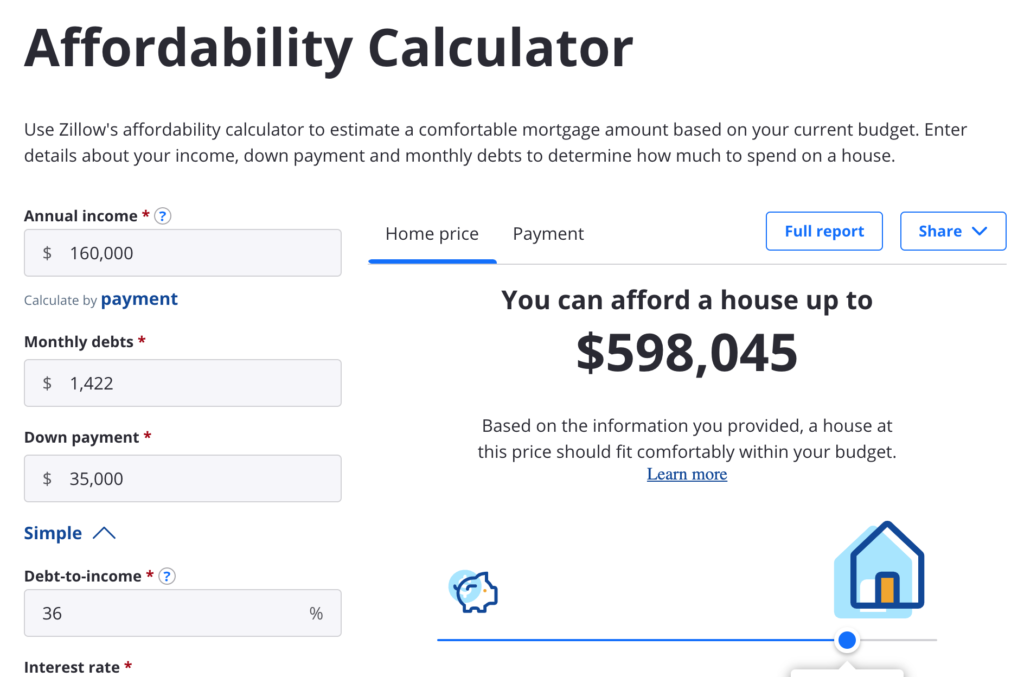

Tool #2: Use an affordability calculator

Understanding how much you can afford is important. I use Zillow’s affordability calculator.

One of the most important things to do is see how much house you can afford based on your income. Generally, you’ll fill out your gross income here, determine monthly debts (utilities, credit card payments, other loan payments like car or student loan debt, but skip the rent payment you currently have as you’ll be replacing that with a mortgage payment. You generally want to keep your debt-to-income below 33%. If you can get a house at 25% of your debt-to-income, even better. Lastly, to properly calculate how much you can afford you’ll want to provide the interest rate you’ll be paying over the life of the loan. You can use the generalized rate from Tool #1, unless you already have a rate from your lender like from your pre-approval letter.

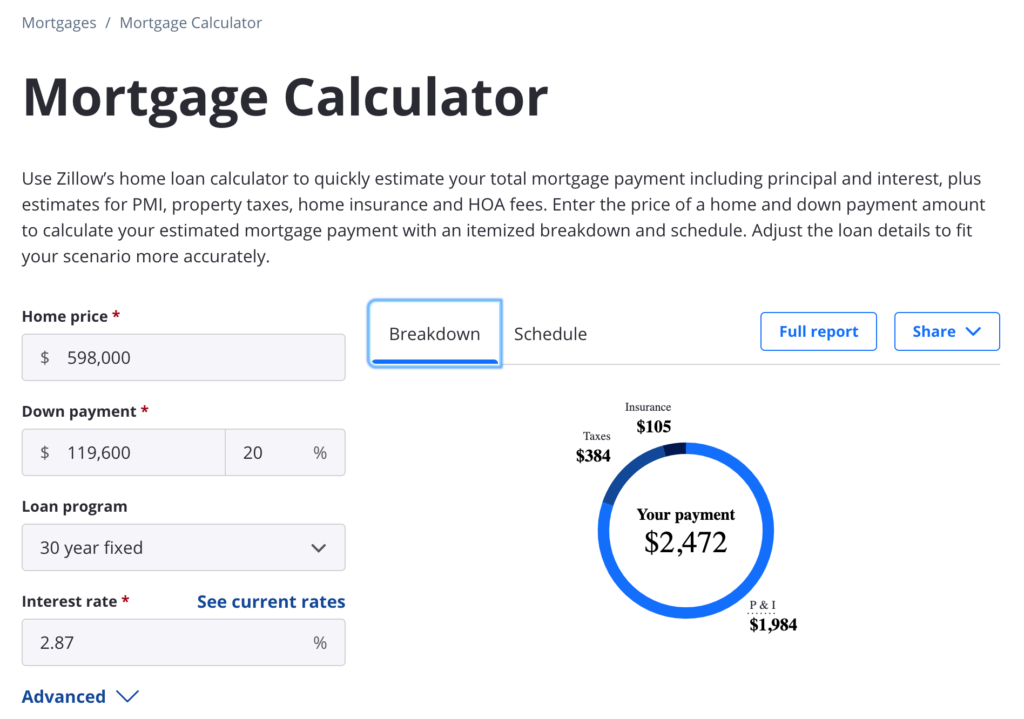

Tool #3: Use a Mortgage calculator

Understanding how much your monthly is going to be is important. I use Zillow’s mortgage calculator

One you know how much you can afford in a home, it’s often a good idea to see how much your mortgage would be per month. You can either use the home price you are most comfortable with from Tool# 2. You can also use this tool to plug in listing prices for homes you are shopping for. This lets you see if you’re stretching yourself, or if you can manage the monthly payment with any other financial goals you have.

You’ll enter the home price, the downpayment you want, generally good to put a 20% downpayment to avoid the private mortgage insurance (PMI) that you don’t want to pay. Keep in mind that a mortgage includes Principle & Interest (P&I) which represents the bulk of your monthly mortgage payment, but you’ll also have homeowners insurance, property taxes, and an HOA depending on the home. If you provide a downpayment of less than 20%, then you’ll also have to pay PMI.

The mortgage calculator will let you know what your monthly payment will be so you can properly estimate if you can afford a home based on the price.

Another good thing to do after you have a mortgage breakdown, is potentially outlining all of your monthly costs and see if you can muster the payments based on what you take home from your paychecks. I typically use a spreadsheet to determine this.

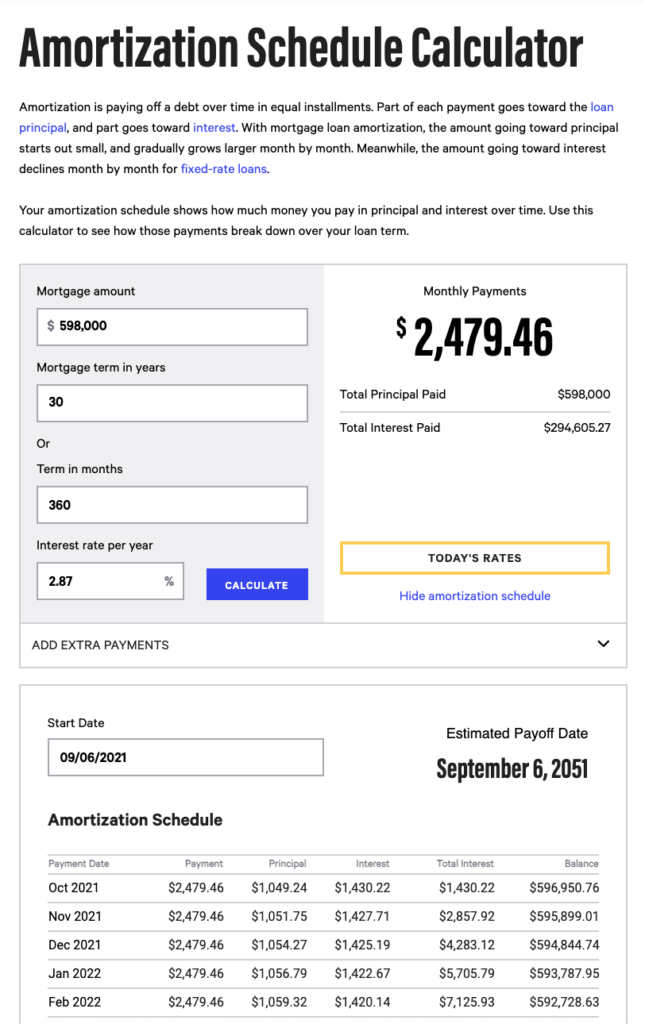

Tool #4: Use an Amortization Schedule calculator

Understanding how much you’ll be paying in interest over the life time of the loan is important. I use Bankrate’s Amortization Schedule calculator.

This tool is great to determine how much interest you’ll be paying over the lifetime of the loan, but also if you add extra payments, how sooner and how that will affect the months and years. The lesson to learn and see in an amortization schedule is that you’ll be paying more interest than principal in the early years of the loan.

Tool #5: Use a Rent vs Buy calculator

Understanding the tradeoffs to renting vs buying is important. I use Zillow’s Rent vs Buy calculator.

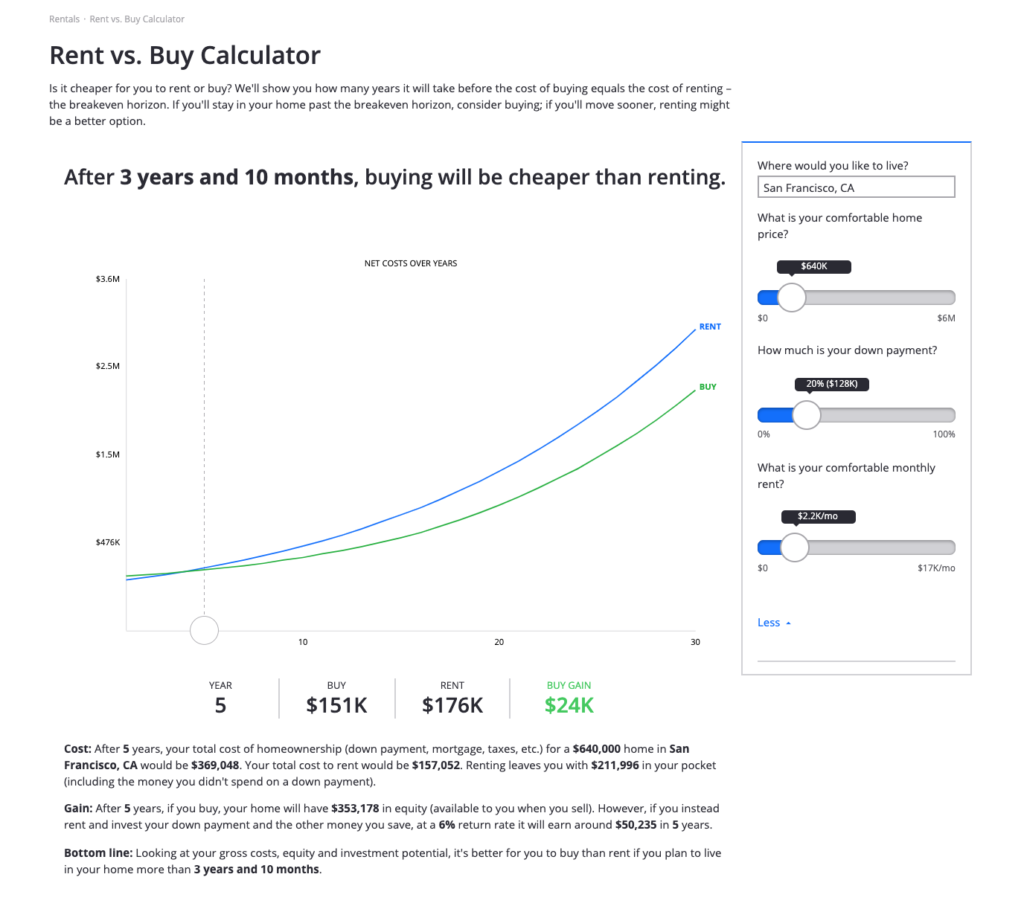

The Rent vs Buy calculator is critical in determining if you should buy a home in your area or not. This one is very helpful for you deciding if you should buy a home now or wait til later.

Obviously there are other factors to determining if you should buy a home or keep renting like if you plan on moving in less than 2 years, plan on changing jobs, but this calculator helps give you a financial window into the future and the benefits of going down one path or another.

The example below is using the price from a home affordability calculator, how much I pay for rent to determine the cost-benefit of either direction. You can see the conclusion, that after: 3 years, 10 months, it’ll be better to buy than rent. This is where the each curve in the graph crosses each other, where if I plan on staying put in a home beyond 3 years, 10 months, I’ll get the largest amount of return.

This is a fun calculator to use and it’s also fun seeing the notes below the graph:

Cost: After 5 years, your total cost of homeownership (down payment, mortgage, taxes, etc.) for a $640,000 home in San Francisco, CA would be $369,048. Your total cost to rent would be $157,052. Renting leaves you with $211,996 in your pocket (including the money you didn’t spend on a down payment).

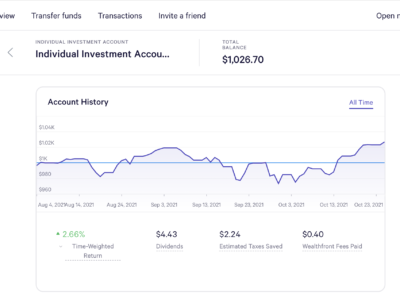

Gain: After 5 years, if you buy, your home will have $353,178 in equity (available to you when you sell). However, if you instead rent and invest your down payment and the other money you save, at a 6% return rate it will earn around $50,235 in 5 years.

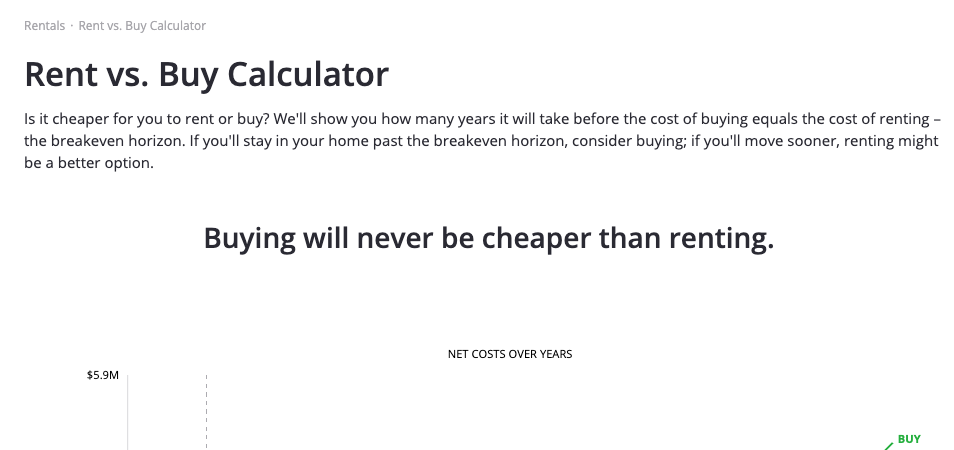

Keep in mind though, sometimes you’ll see some dire outcomes with this calculator…”Buying will never be as cheap as renting”. It might be the conclusion that your area is saturated with over priced homes or your rent is cheap enough or manageable to keep going one direction or another. For the San Francisco Bay Area, this result is common.

All and all, this is one of the more important tools for projection along side the Amortization schedule calculator. Another tip: for the Rent vs. Buy calculator, it’s important to adjust the rate of investment return for the extra money you put into somewhere else. It defaults at a 6% investment return and that assumes you’re putting your money into something that brings money back, example, a stock market return has been 10%+ over the last decade, averaging 7% growth since 1929. If you are savings account only, you’re investing rate should be more like 0-2% depending on how much you get back there.

Obviously this website, Basicworth.com is about personal investment strategies, tips, and ways to improve your wealth – so it’s best to not put everything into your savings account and divert more towards other investments due to rising inflation, but I’ll add more articles on that soon.

Hoping these 5 tools help you determine if you can or should buy a home right now or in the future.