Investing in stocks you believe in & give it time – the sooner the better

It was 2015. It was a nice sunny day and we went to the office cafeteria to get lunch. After we paid for our meals, we sat down and my boss asked me if I invest in stocks. I told her no, then she asked why I wasn’t investing.

I told her I didn’t know how. She asked me then what I do with my money. I told her I save it in my savings account. She then told me I’m wasting my money, you lose more of it to inflation. I paused for a second, I had just started the job less than 2 weeks ago and she was getting really deep in my personal finances.

I just didn’t know how to invest and I was scared. I had tried it before and failed, but I didn’t tell her that. Back in 2015, I had nothing open in terms of taxable brokerage accounts. I had a Roth IRA that I barely contributed to – that my brother opened for me in college and that was it. I was a contract employee (temp job) – so there really wasn’t 401k, but an hourly wage that I stashed in savings.

She encouraged me (more like told me) that I should invest my money and I should learn. Just put some extra money “disposable income” into things I believe in. Doesn’t have to be a lot, just enough that it’ll change my behavior. That I’ll look at it everyday.

At the time, I didn’t consider index funds as something to invest in, this was something I learned a few years later. She targets individual stocks. My boss was smart – she got in early a decade ago, bought a house and invested the rest of her salary in stocks. She kept about 20% of her income in CDs as safety to protect her assets from inflation, then invested the rest outside of her mortgage. Fast forward to today, she owns multiple properties, in great financial position with her investments, and can mitigate risk by shifting her assets around.

Maybe I’ll get there one day, but it was my calling that I should at least try to educate myself in the world of investing. So decided to take her advice, but not at first…

I watched the stocks in the sense that I opened the stocks app on my iPhone and just chose stocks to watch everyday. I did it for a week, then I did it every other day. I wasn’t building the habits to read the company and care about it. As she told me, “You really have to have your skin in the game.”

So some time later, I mustered the courage and bought 10 shares of Square (SQ) stocks. Priced at the time @ $10.48 cents. It was over $100.

I was scared, that’s a lot of money to lose and at the time I considered it pure gambling. Like Casino-like gambling where you see your money disappear in an instant. In the past, my first and only investment in 2014 was Castlight Health, I invested in to when it was ~$21/share and sharply declining, now it’s $1.98. I lost a good amount of money there which is why I was afraid to invest when my boss asked me why I didn’t. I had chosen it back then because I thought healthcare was important without really understanding the industry and randomly chose an up and coming IPO in health. I wasn’t educating myself about the industry. Part of me believes I chose Square because I also believed in it, that I read up on the company, the types of product they have, and I saw in around in everywhere I went, coffee shops, food trucks, and I couldn’t see small businesses going without this Point of Sale product that was changing the industry. Obviously there are lots of competitors today like Clover, and others, but Square was relevant and a great user experience. Anyways, back to the story – I chose a stock was now watching it like my boss was telling me to.

She checked up on me a few months later and ask what I bought. I told her I bought 10 shares of Square. She told me, “That’s it – I usually get $5 to $10 thousand dollars worth of stocks”. Needless to say we were two different investors.

About two years later in 2017, Square stocks were at ~$30 and I sold about 8 of them. I felt great, I made my money back (~$100) and then some (~$140). She had messaged me a year after that and told me I picked a good one, SQ is at ~$50 (that was 2018). I was sad cause it kept climbing – luckily I still had 2 shares left.

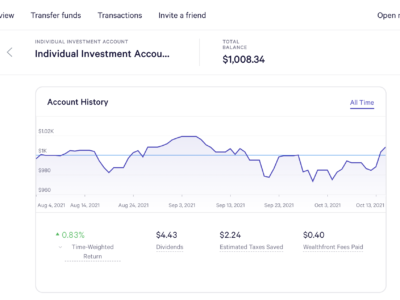

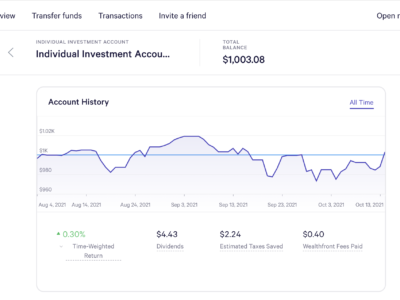

Today, it’s 2021 and I still have those shares – two of them (Since I bought 10 and sold 8). Today, August 6, 2021 it’s priced at $274.90. So I have $549.80.

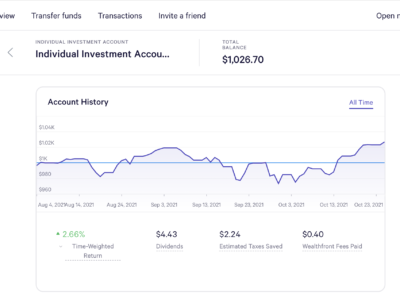

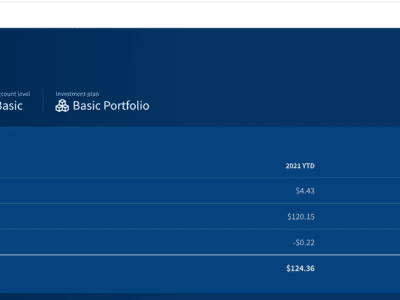

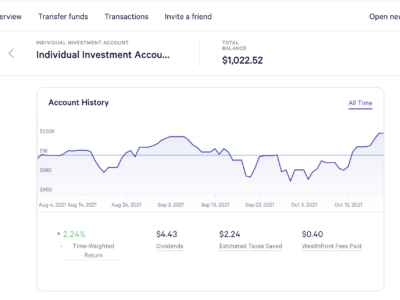

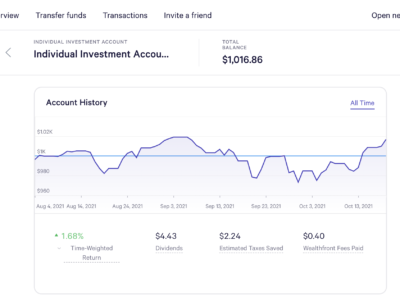

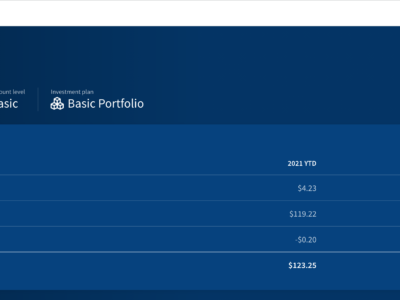

Stocks go up and fall – but generally the long-term pays off with compound interest. You can see in the screenshots above the climb over several years, but day to day, it fluctuates significantly.

And that feeling, of being sad. It’s really nothing to be sad about, even though I was. I learned a lot in the 2.5 years of watching it everyday and deciding what I should do, how I should react when I see market fluctuations day-by-day. I learned about my emotions, the excitement, the fear, the indecisiveness in me. Sometimes I wished I invested more, like the $5 to $10k that my boss told me to (I really didn’t have that much extra money at the time), or if I waited a bit longer to sell, or I wish I had all the 10 shares fo Square stock today. It doesn’t matter now because the decision is done and made. I’m still net positive in my investment, but there was so much I learned about myself and the stock market. And I’m an active investor now.

Looking back to 2015 though – there was a lot more she said, around buying a house too. Ohhh I wish I acting sooner and listened to her, but I wasn’t as wise then. There are always lessons to learn, but taking that leap and trying to the best of your comfort zone and financial capacity is important. I also learned a lot about people and made a great friend…I’m thankful she became my boss 7 years ago.