Top 5 best investment accounts for the beginner

When starting out investing, you might not have much to start with or you’re just learning how to begin. In any of those cases, you’ll want to avoid fees and extra costs as you’ll want to put as much money as you can back into your investments.

Here is my favorite investment accounts from the ones I’ve tried – these aren’t ranked by best, but I’m merely explaining what each does:

- Robinhood – Simple user interface – easy to parse information. No fees to make investments and easy to contribute to any type of investments you want. Individual stocks, Index Funds, or even Cryto-currency. I used this to start out buying my first set of shares. It just doesn’t have the control to analyze trends over time, but good to track and have general visualizations of growth.

- Vanguard – Great for auto-investing and self-management. I first started using this because of my job, I was contributing to my 401k and several companies were using this. When I started to invest in my own brokerage account, I open an account because I wanted to soley invest in Vanguard ETFs and mutual funds – they don’t charge commission-fees if you want to buy these vs if you try to buy Vanguard Funds with another platform, they’ll have their own commission-fees. I wanted to reduce the amount of fees I had and I was planning to put a lot of money over the course of several years of recurring investments. It’s not the most intuitive user interface, and takes some time getting use to.

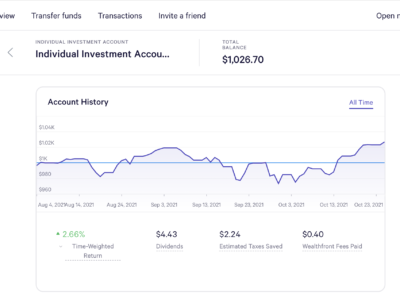

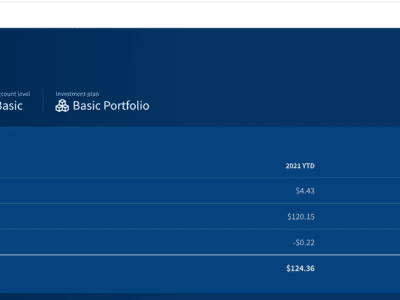

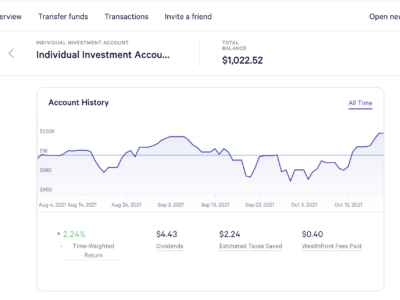

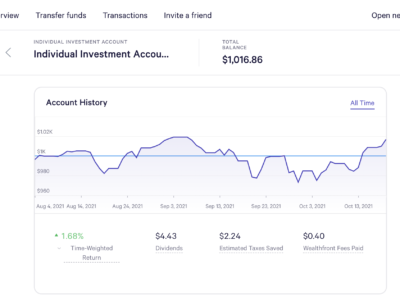

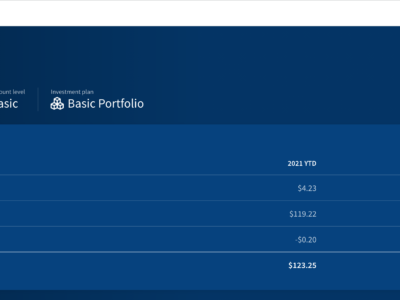

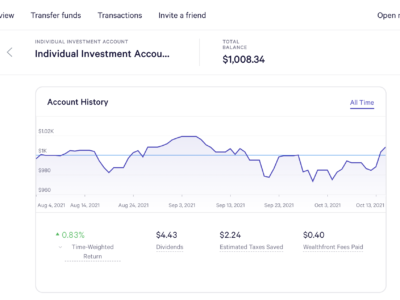

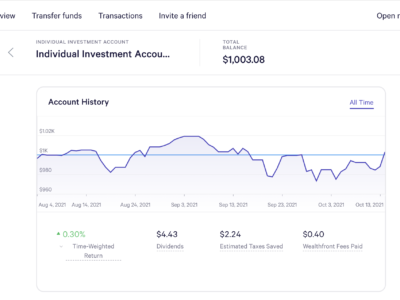

- Wealthfront – Recently opened, I’m learning this one, but it’s a set it and forget it investment tool. Amazing for beginners that want to select their risk profile and have transparency on the types of funds Wealthfront is selecting. At this current moment, they choose only ETFs, so not individual stock funds. The nice thing about it, is it re-balances your investments over time to reduce on fees and lets you customize how much money goes into which ETFs. It’s a very fluid investment account to use.

- Acorns – I tried it out a few years ago because I was interested in micro-investing. You can give any amount to them and you’ll see how it grows, but it does not tell you what it’s investing. It’s more of a black box and the fee was $1 a month to use. Also a beautiful interface that shows projections. When I became a more advanced investor, I wanted more control in what I was putting my money into and Acorns wasn’t great for that. This is great for beginners that don’t want to look at their investments. A set it and forget it approach.

- Charles Schwab – Most intuitive investment account if you want to analyze your investments and trends. So it’s great for investing in large index funds or individual stocks. It shows charts and graphs and easily allows you to drill down to specific accounts. I moved my Roth IRA account here just because it’s easy to get into and transfer payments from my bank account and see how much I’ve contributed. It’s really my go-to investment account for everything I want to do now that I’ve graduated out of being a novice investor. I didn’t start here though and I moved my funds over from Acorns when I wanted to experiment more with self-selected stocks.

As you grow in your investment knowledge and acumen, you might grow out of one platform or another – all of them have their pros and cons as I described – but these are my 5 best stock investment accounts for the beginner.

What's your reaction?

Excited

0

Happy

0

In Love

0

Not Sure

0

Silly

0